Check Out What Whales Are Doing With FICO

Author: Benzinga Insights | October 31, 2025 03:01pm

High-rolling investors have positioned themselves bearish on Fair Isaac (NYSE:FICO), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FICO often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 12 options trades for Fair Isaac. This is not a typical pattern.

The sentiment among these major traders is split, with 33% bullish and 58% bearish. Among all the options we identified, there was one put, amounting to $25,350, and 11 calls, totaling $511,463.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1300.0 to $1820.0 for Fair Isaac during the past quarter.

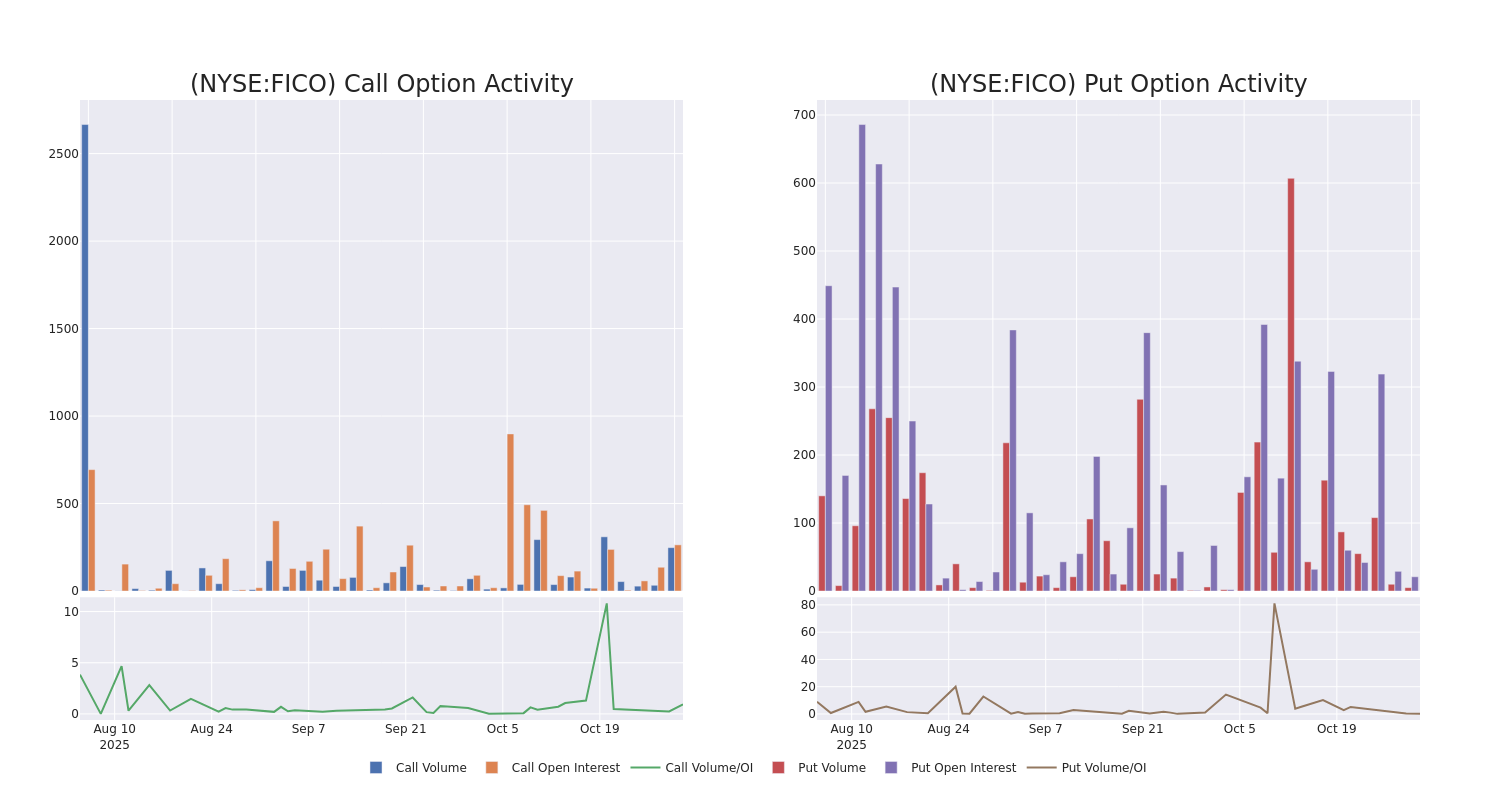

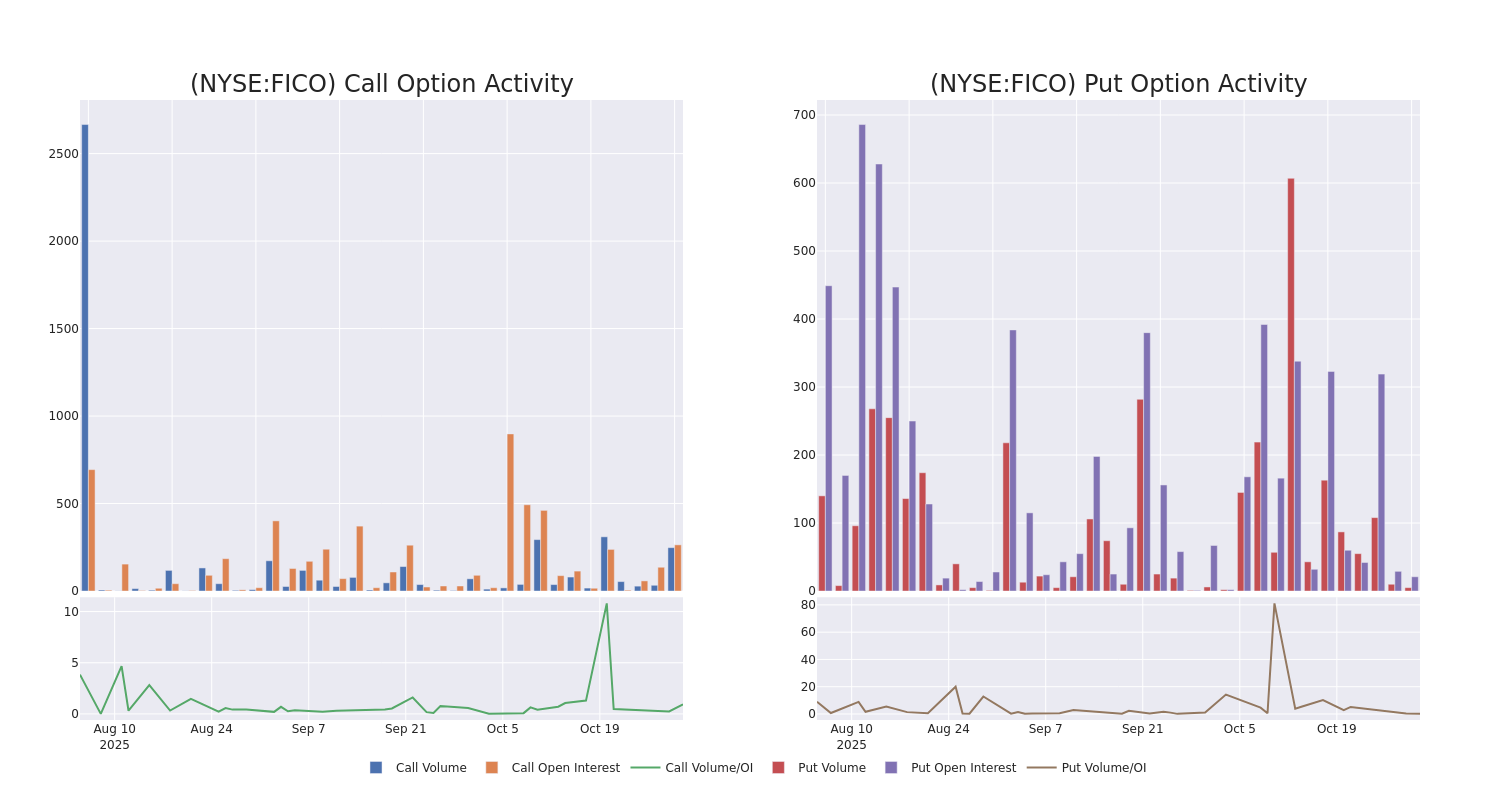

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Fair Isaac's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Fair Isaac's substantial trades, within a strike price spectrum from $1300.0 to $1820.0 over the preceding 30 days.

Fair Isaac Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| FICO |

CALL |

TRADE |

BULLISH |

01/16/26 |

$74.9 |

$58.4 |

$69.7 |

$1720.00 |

$111.5K |

32 |

16 |

| FICO |

CALL |

TRADE |

BEARISH |

01/15/27 |

$401.0 |

$396.0 |

$396.0 |

$1500.00 |

$79.2K |

2 |

2 |

| FICO |

CALL |

TRADE |

BEARISH |

11/20/26 |

$496.0 |

$476.1 |

$482.29 |

$1360.00 |

$48.2K |

6 |

1 |

| FICO |

CALL |

SWEEP |

BULLISH |

12/19/25 |

$79.8 |

$72.6 |

$79.8 |

$1730.00 |

$47.8K |

1 |

11 |

| FICO |

CALL |

TRADE |

BEARISH |

11/21/25 |

$25.2 |

$24.5 |

$24.5 |

$1820.00 |

$44.1K |

213 |

82 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's US-centric credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

After a thorough review of the options trading surrounding Fair Isaac, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Fair Isaac's Current Market Status

- With a trading volume of 196,343, the price of FICO is down by 0.0%, reaching $1585.36.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 5 days from now.

What Analysts Are Saying About Fair Isaac

3 market experts have recently issued ratings for this stock, with a consensus target price of $2250.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Fair Isaac, which currently sits at a price target of $2400.

* An analyst from Needham downgraded its action to Buy with a price target of $1950.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Fair Isaac with a target price of $2400.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Fair Isaac, Benzinga Pro gives you real-time options trades alerts.

Posted In: FICO