Where Terex Stands With Analysts

Author: Benzinga Insights | November 04, 2025 06:44am

Across the recent three months, 4 analysts have shared their insights on Terex (NYSE:TEX), expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

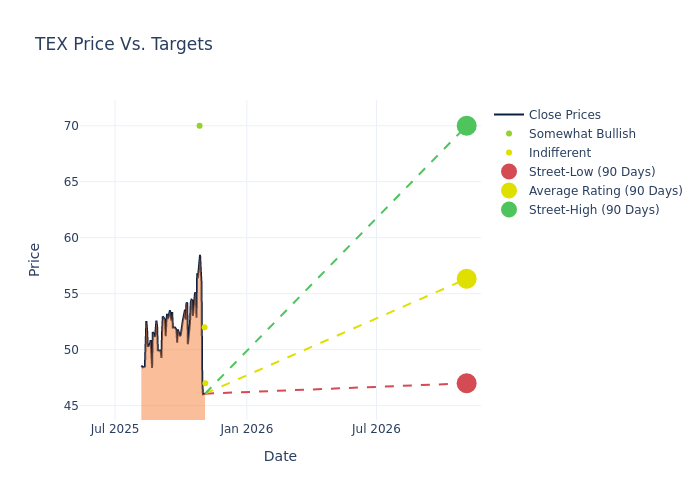

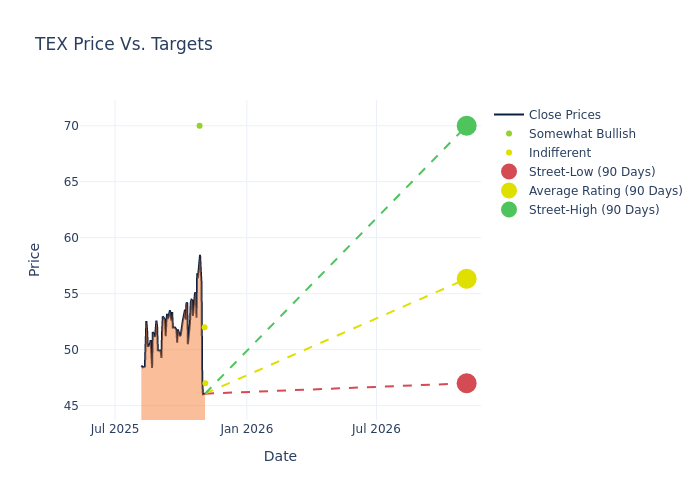

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $56.75, a high estimate of $70.00, and a low estimate of $47.00. This current average reflects an increase of 10.56% from the previous average price target of $51.33.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Terex's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Courtney Yakavonis |

Morgan Stanley |

Raises |

Equal-Weight |

$47.00 |

$41.00 |

| Kyle Menges |

Citigroup |

Lowers |

Neutral |

$52.00 |

$58.00 |

| Tim Thein |

Raymond James |

Announces |

Outperform |

$70.00 |

- |

| Kyle Menges |

Citigroup |

Raises |

Neutral |

$58.00 |

$55.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Terex. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Terex compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Terex's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Terex's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Terex analyst ratings.

About Terex

Terex is a global manufacturer of aerial work platforms, materials processing equipment, and specialty equipment for the waste, recycling, and utility industries. Its current composition is a result of numerous acquisitions over several decades to focus on a smaller group of light construction and other vocational equipment, having divested a handful of underperforming businesses, particularly in cranes and other lifting equipment. These remaining segments see heavy demand in nonresidential construction (aerial work platforms—40% sales), aggregates/mining (materials processing—30% sales), environmental, waste/recycling and utilities (environmental solutions group—30% sales).

Terex's Economic Impact: An Analysis

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Terex showcased positive performance, achieving a revenue growth rate of 14.44% as of 30 September, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Terex's net margin is impressive, surpassing industry averages. With a net margin of 4.69%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Terex's ROE excels beyond industry benchmarks, reaching 3.26%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Terex's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.06% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a high debt-to-equity ratio of 1.29, Terex faces challenges in effectively managing its debt levels, indicating potential financial strain.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TEX