Check Out What Whales Are Doing With META

Author: Benzinga Insights | November 06, 2025 10:01am

Investors with a lot of money to spend have taken a bearish stance on Meta Platforms (NASDAQ:META).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 46 uncommon options trades for Meta Platforms.

This isn't normal.

The overall sentiment of these big-money traders is split between 34% bullish and 50%, bearish.

Out of all of the special options we uncovered, 29 are puts, for a total amount of $1,925,030, and 17 are calls, for a total amount of $1,063,422.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $580.0 and $750.0 for Meta Platforms, spanning the last three months.

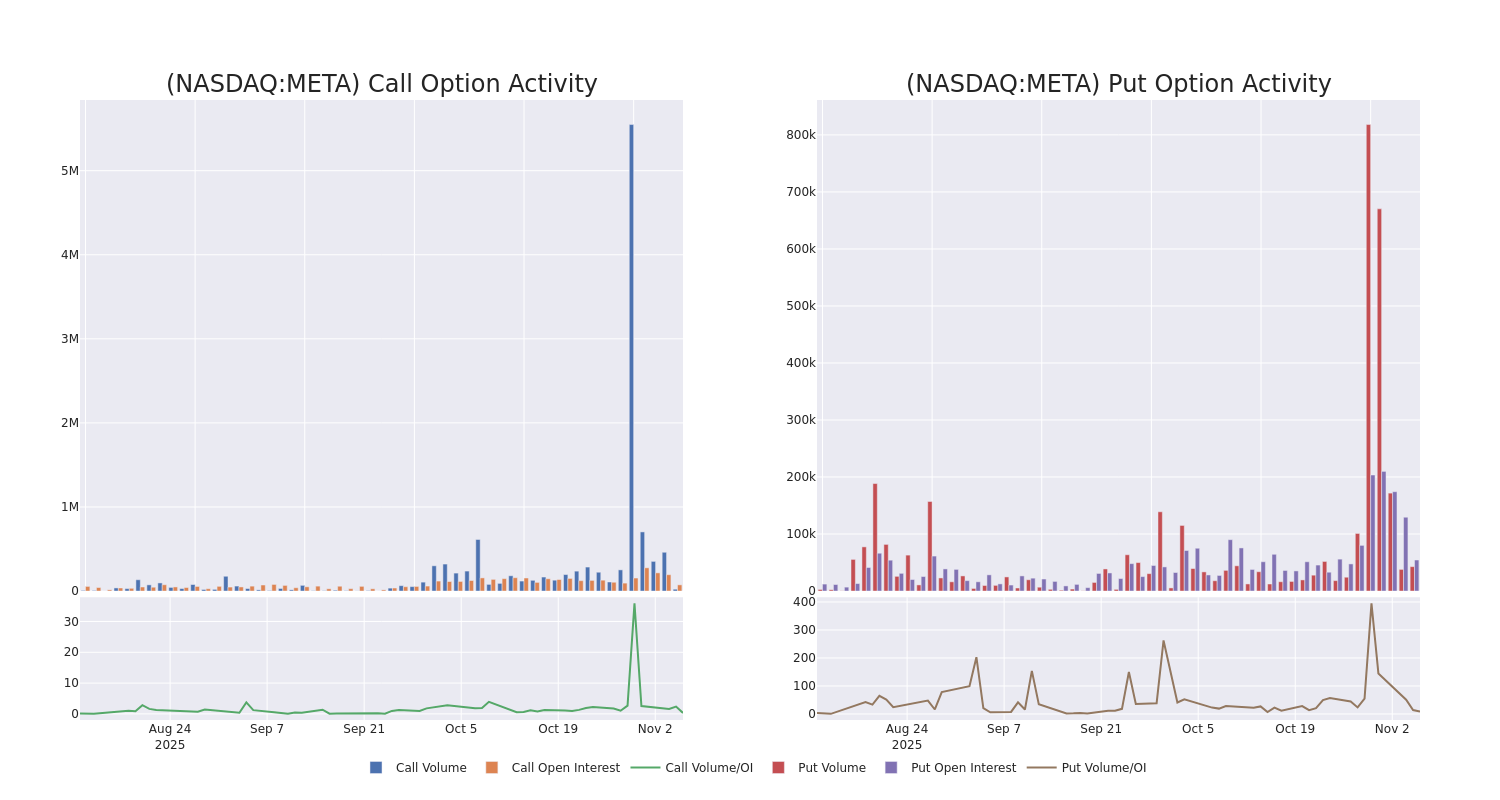

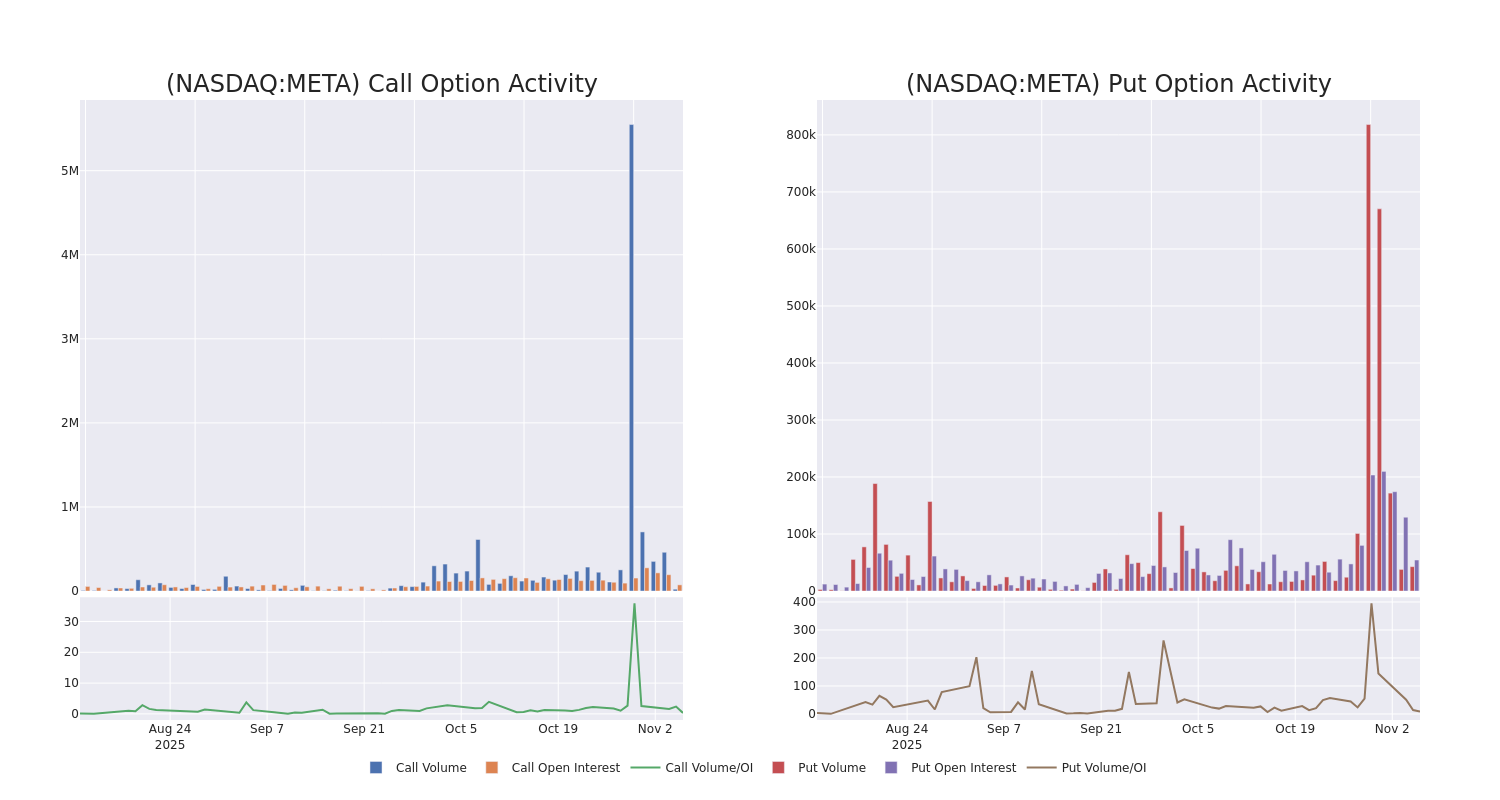

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Meta Platforms's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Meta Platforms's whale trades within a strike price range from $580.0 to $750.0 in the last 30 days.

Meta Platforms 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| META |

CALL |

SWEEP |

BULLISH |

11/07/25 |

$1.3 |

$1.27 |

$1.3 |

$650.00 |

$247.2K |

11.6K |

873 |

| META |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$10.95 |

$10.8 |

$10.95 |

$580.00 |

$218.8K |

2.4K |

248 |

| META |

PUT |

TRADE |

BULLISH |

01/15/27 |

$101.7 |

$101.3 |

$101.3 |

$650.00 |

$202.6K |

1.4K |

0 |

| META |

PUT |

SWEEP |

NEUTRAL |

11/07/25 |

$1.27 |

$1.25 |

$1.27 |

$605.00 |

$177.8K |

4.4K |

3.5K |

| META |

PUT |

TRADE |

BEARISH |

11/07/25 |

$64.45 |

$63.65 |

$64.45 |

$700.00 |

$122.4K |

580 |

7 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

In light of the recent options history for Meta Platforms, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Meta Platforms

- With a volume of 3,013,936, the price of META is down -1.54% at $626.18.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 83 days.

What The Experts Say On Meta Platforms

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $853.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo persists with their Overweight rating on Meta Platforms, maintaining a target price of $802.

* An analyst from Canaccord Genuity persists with their Buy rating on Meta Platforms, maintaining a target price of $900.

* An analyst from Raymond James downgraded its action to Strong Buy with a price target of $825.

* An analyst from Oppenheimer persists with their Outperform rating on Meta Platforms, maintaining a target price of $825.

* An analyst from UBS persists with their Buy rating on Meta Platforms, maintaining a target price of $915.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Meta Platforms, Benzinga Pro gives you real-time options trades alerts.

Posted In: META