Dogecoin Down 5% To 16 Cents As Sellers Crush Every Bounce

Author: Parshwa Turakhiya | November 06, 2025 12:53pm

Dogecoin (CRYPTO: DOGE) fell almost 5% on Thursday, with price sliding below 16 cents amid heavy selling pressure.

Trendline Resistance Keeps Price Capped

DOGE Price Action (Source: TradingView)

Dogecoin continues to respect the descending trendline from the October high.

Every bounce toward the 20-, 50-, and 100-day EMAs has failed, confirming sellers remain in control.

The token sits inside a broad correction structure with no successful defense of key supports.

Each attempt to reclaim the 20-day EMA has triggered fresh selling.

That pattern reinforces a clear sequence of lower highs and lower lows.

Key Support Near $0.15 Faces Pressure

Dogecoin has returned to its critical demand zone between $0.15–$0.155, previously identified as a weak low.

Losing this level could expose the next liquidity pocket around $0.14.

A close below that area would signal acceleration toward deeper downside targets.

The structure will only change if price breaks the descending trendline and closes above $0.186–$0.200.

That zone aligns with the 100-day EMA and prior supply cluster from late September.

Flows And Derivatives Confirm Weakness

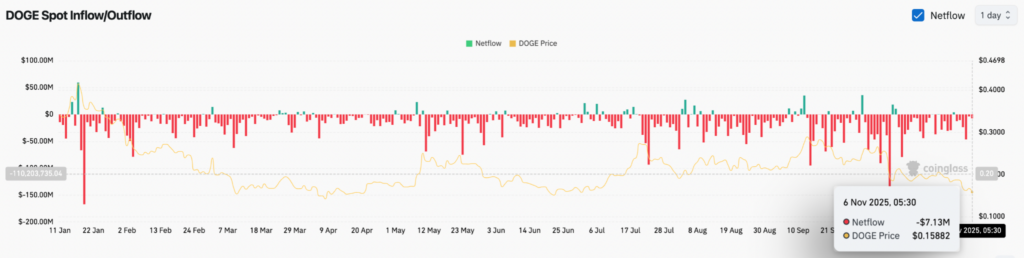

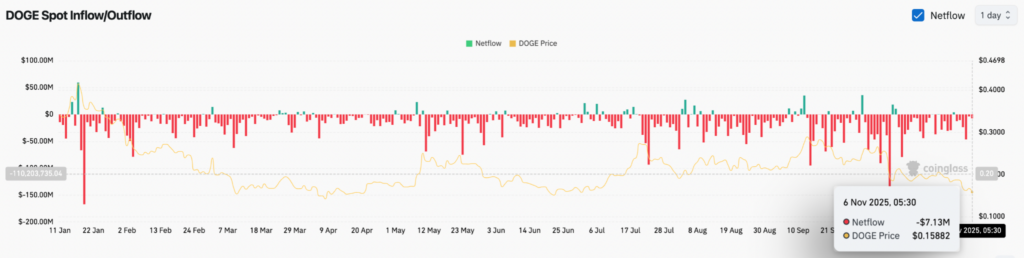

DOGE Netflows (Source: Coinglass)

Spot flow data shows persistent outflows, with about $7.1 million leaving exchanges on Nov. 6.

Such outflows during a downtrend usually signal distribution rather than accumulation.

That suggests holders are exiting rather than positioning for a rebound.

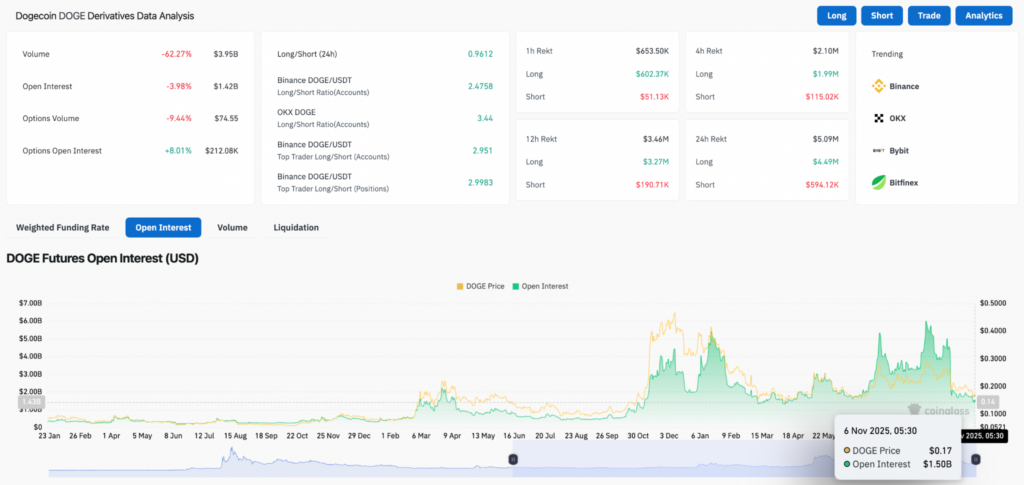

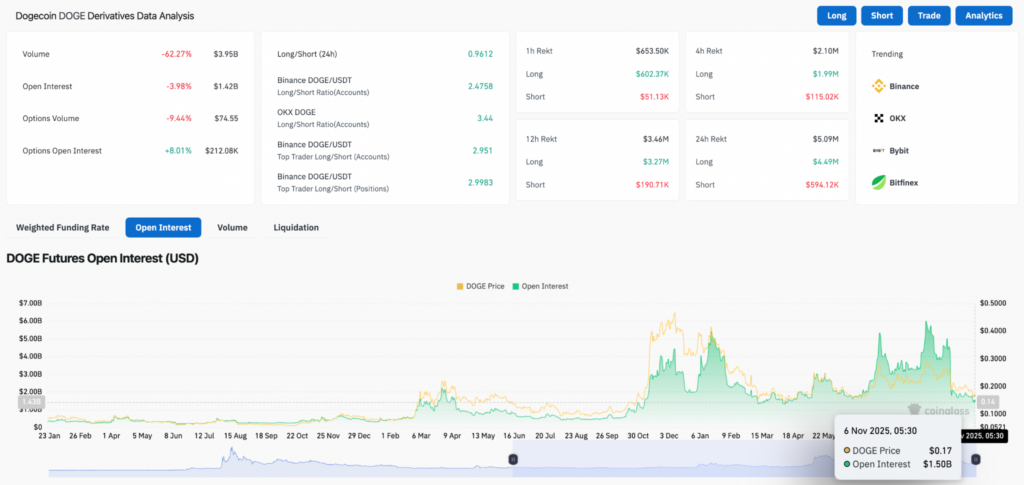

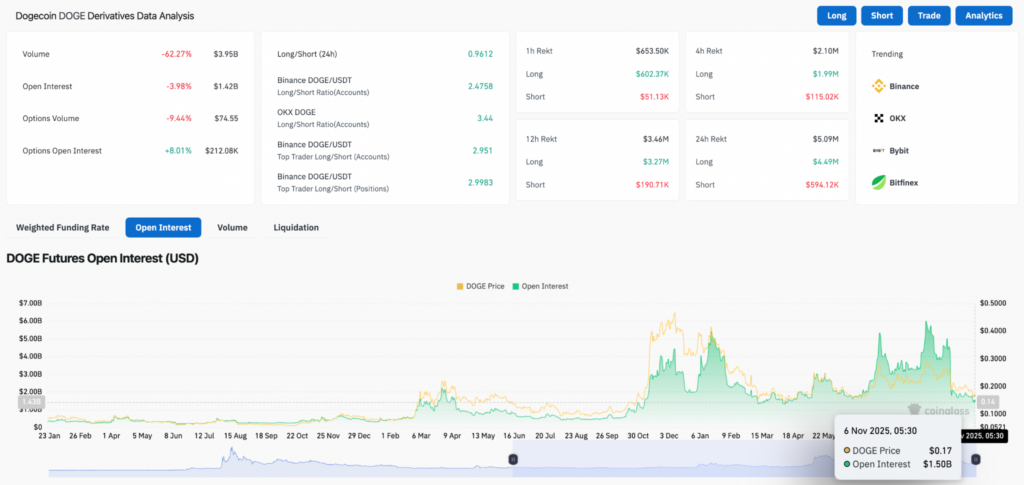

DOGE Derivative Analysis (Source: Coinglass)

Open interest in futures fell about 4%, showing traders cutting exposure instead of adding risk.

Long/short ratios appear skewed toward longs, but the price reaction proves those positions lack strength.

Derivatives volume dropped over 60%, highlighting fading speculation and investor caution.

Read Next:

Image: Shutterstock

Posted In: $DOGE