Smart Money Is Betting Big In CEG Options

Author: Benzinga Insights | November 06, 2025 03:03pm

Financial giants have made a conspicuous bearish move on Constellation Energy. Our analysis of options history for Constellation Energy (NASDAQ:CEG) revealed 40 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $839,082, and 26 were calls, valued at $1,276,532.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $220.0 to $510.0 for Constellation Energy during the past quarter.

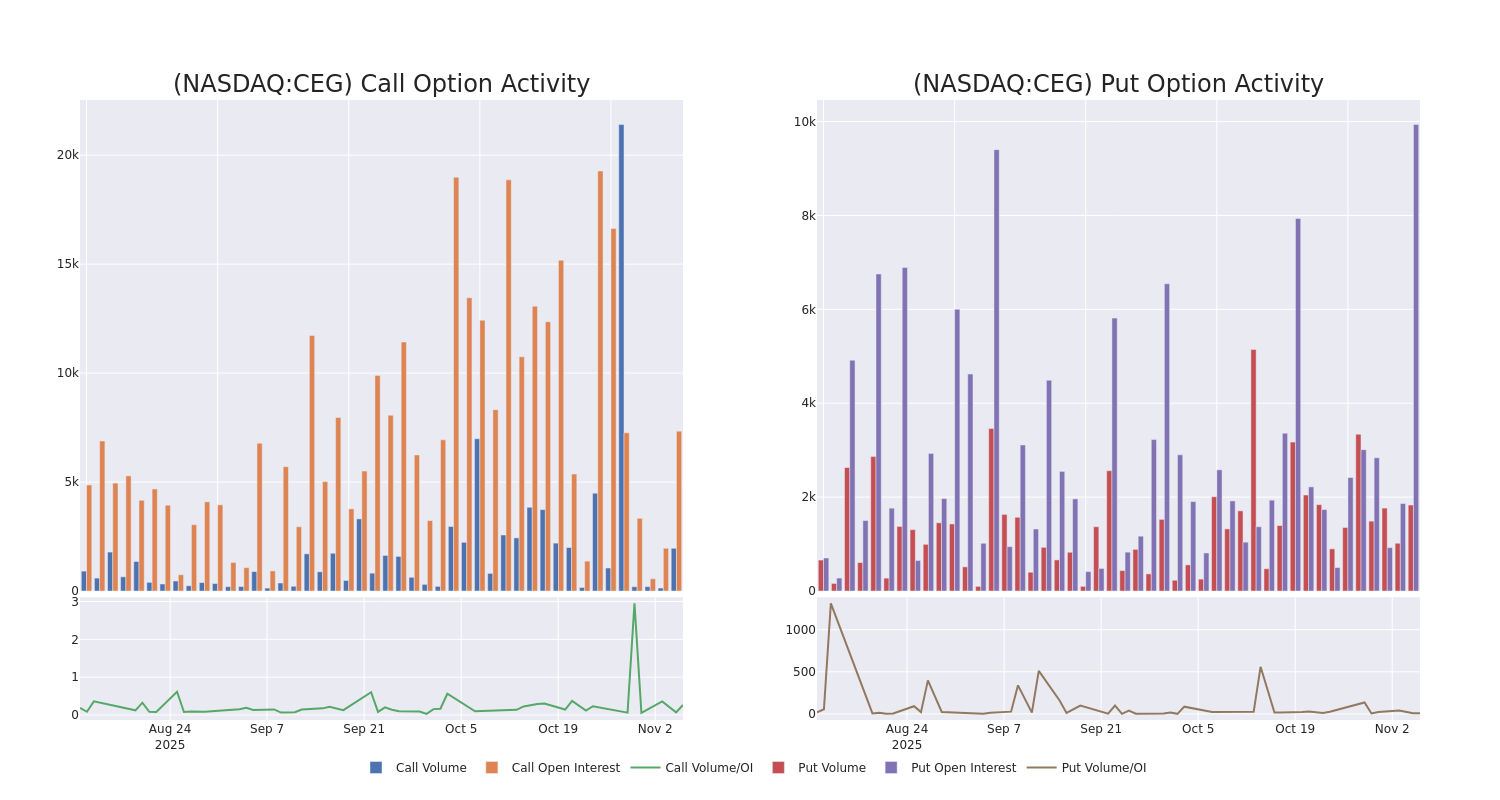

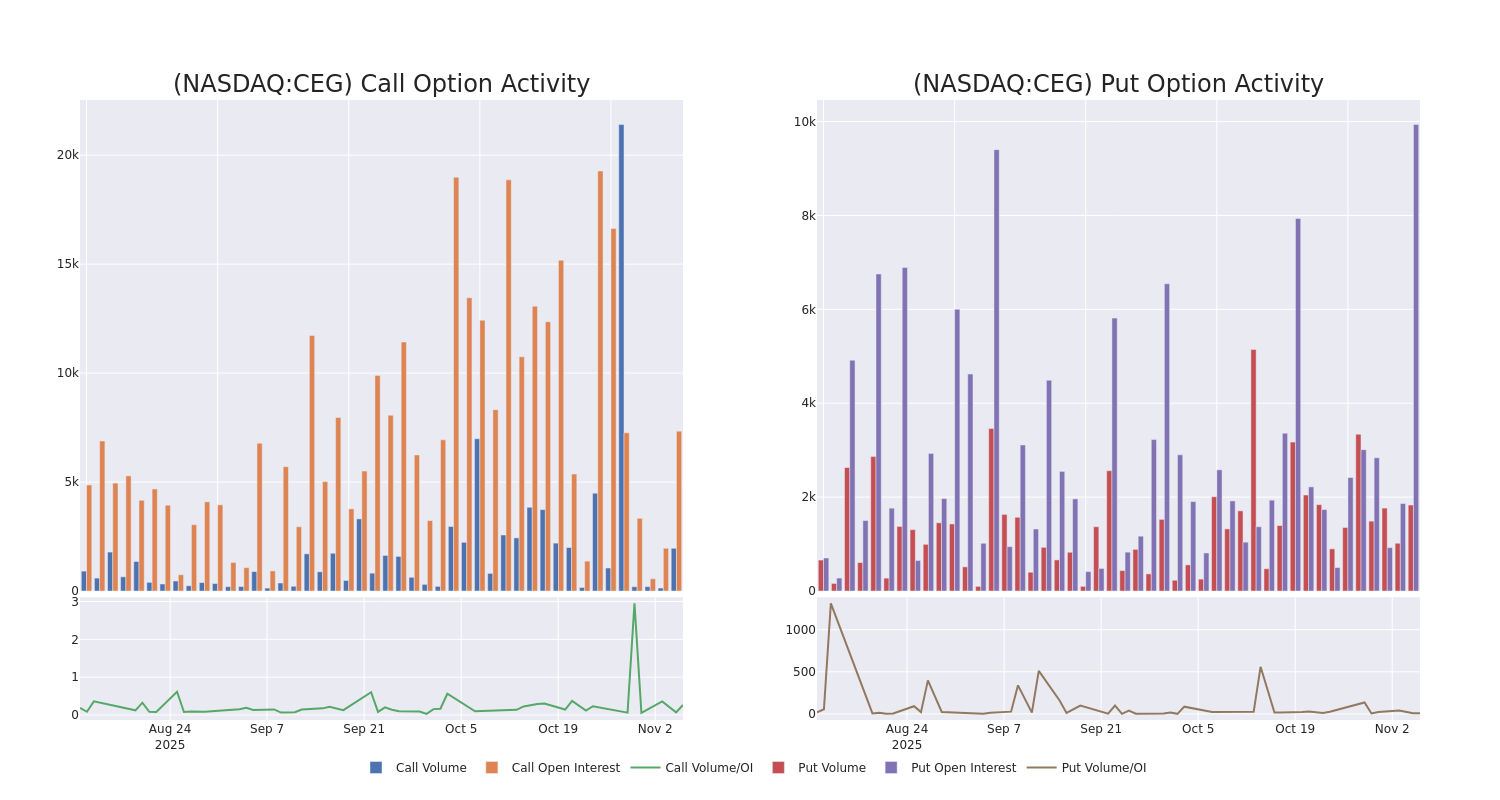

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Constellation Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Constellation Energy's significant trades, within a strike price range of $220.0 to $510.0, over the past month.

Constellation Energy Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CEG |

PUT |

TRADE |

BULLISH |

01/16/26 |

$9.4 |

$8.7 |

$8.65 |

$290.00 |

$173.0K |

2.3K |

200 |

| CEG |

CALL |

SWEEP |

BEARISH |

11/07/25 |

$76.2 |

$73.6 |

$73.6 |

$285.00 |

$117.7K |

2 |

16 |

| CEG |

PUT |

TRADE |

BEARISH |

11/07/25 |

$13.6 |

$12.2 |

$13.3 |

$355.00 |

$106.4K |

529 |

212 |

| CEG |

CALL |

TRADE |

NEUTRAL |

02/20/26 |

$6.1 |

$4.0 |

$5.2 |

$510.00 |

$99.8K |

392 |

192 |

| CEG |

CALL |

TRADE |

NEUTRAL |

02/20/26 |

$6.1 |

$4.1 |

$5.2 |

$510.00 |

$96.7K |

392 |

378 |

About Constellation Energy

Constellation Energy Corp producer of carbon-free energy and a supplier of energy products and services. The company offers generating capacity that includes nuclear, wind, solar, natural gas, and hydroelectric assets. It sells electricity, natural gas, and other energy-related products and sustainable solutions to various types of customers, including distribution utilities, municipalities, cooperatives, and commercial, industrial, public sector, and residential customers in markets across multiple geographic regions. Its operating segments and reporting units are Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions.

Present Market Standing of Constellation Energy

- Trading volume stands at 2,119,143, with CEG's price down by -3.34%, positioned at $351.1.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 1 days.

What Analysts Are Saying About Constellation Energy

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $422.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Mizuho has decided to maintain their Neutral rating on Constellation Energy, which currently sits at a price target of $390.

* An analyst from Keybanc persists with their Overweight rating on Constellation Energy, maintaining a target price of $417.

* An analyst from Seaport Global upgraded its action to Buy with a price target of $407.

* An analyst from Wells Fargo downgraded its action to Overweight with a price target of $478.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Constellation Energy, targeting a price of $422.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

Posted In: CEG