Sea Unusual Options Activity

Author: Benzinga Insights | November 07, 2025 10:03am

Whales with a lot of money to spend have taken a noticeably bearish stance on Sea.

Looking at options history for Sea (NYSE:SE) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $232,574 and 2, calls, for a total amount of $93,950.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $200.0 for Sea over the recent three months.

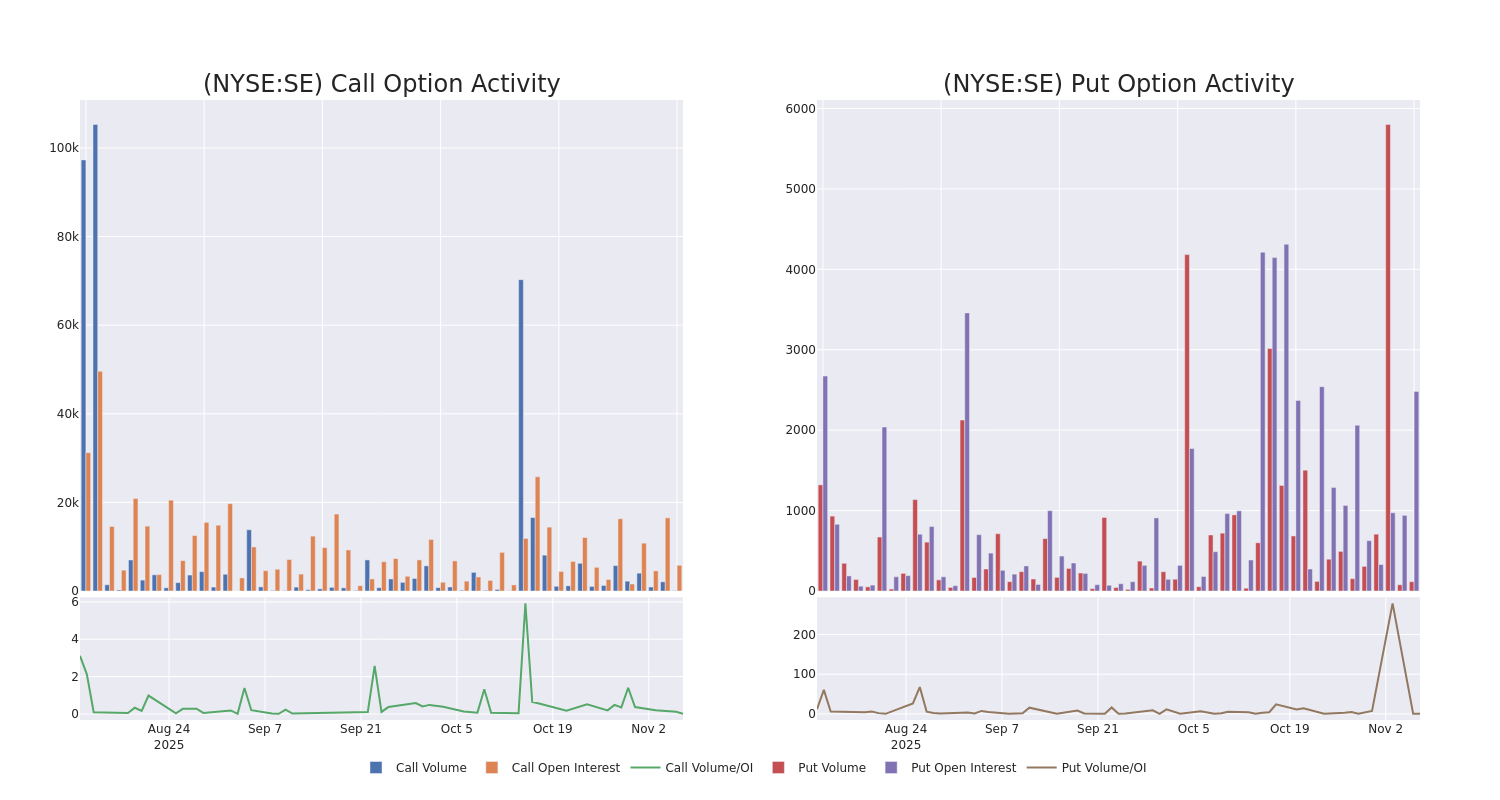

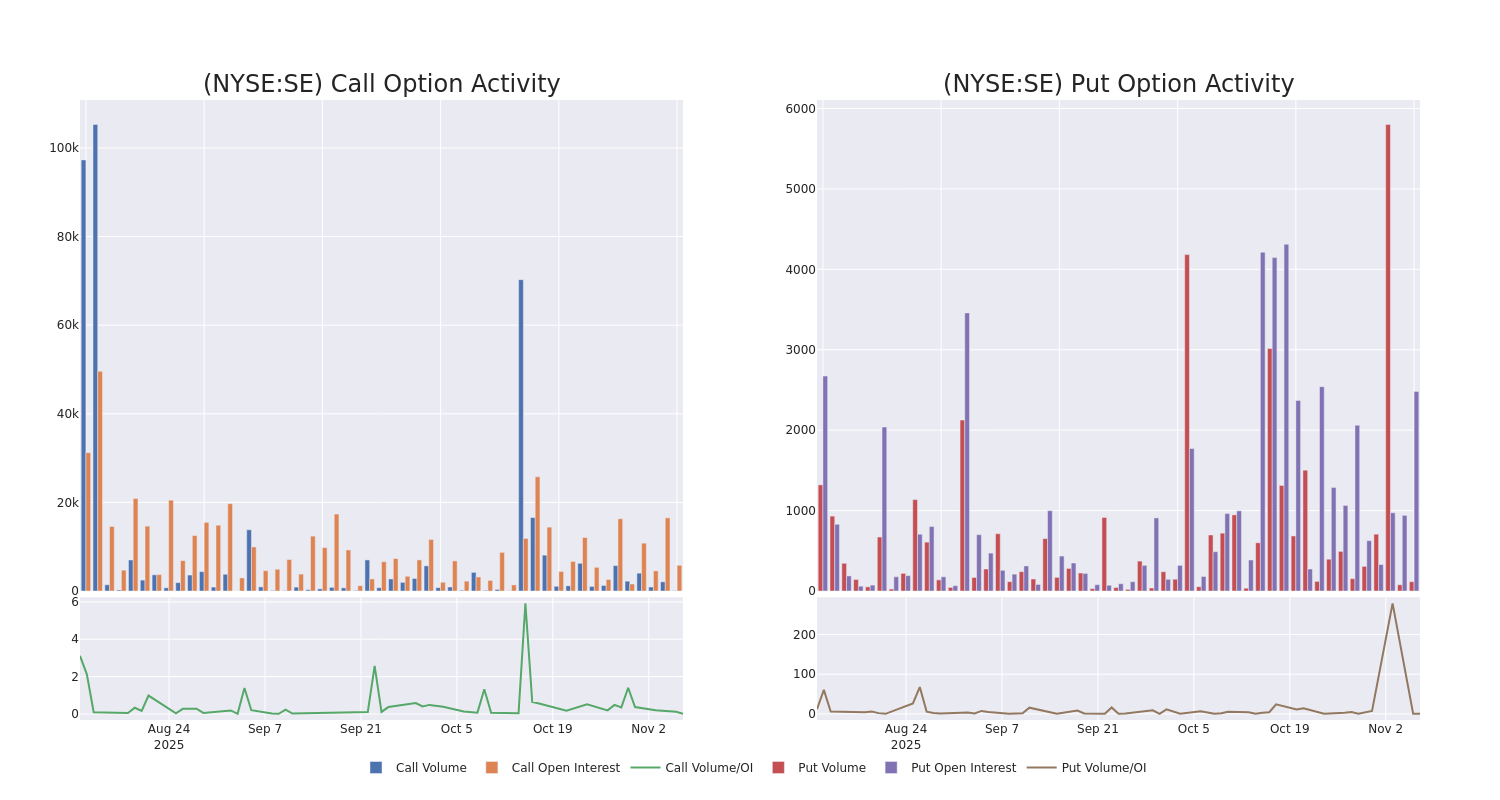

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Sea options trades today is 1036.0 with a total volume of 197.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Sea's big money trades within a strike price range of $145.0 to $200.0 over the last 30 days.

Sea Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SE |

CALL |

SWEEP |

BULLISH |

02/20/26 |

$8.0 |

$7.75 |

$8.0 |

$170.00 |

$62.4K |

5.4K |

81 |

| SE |

PUT |

TRADE |

BEARISH |

11/21/25 |

$13.3 |

$11.45 |

$13.3 |

$155.00 |

$53.2K |

998 |

41 |

| SE |

PUT |

SWEEP |

NEUTRAL |

11/07/25 |

$1.41 |

$1.4 |

$1.4 |

$149.00 |

$42.0K |

77 |

1 |

| SE |

PUT |

TRADE |

NEUTRAL |

12/19/25 |

$10.25 |

$9.25 |

$9.67 |

$145.00 |

$38.6K |

397 |

42 |

| SE |

PUT |

TRADE |

BEARISH |

11/21/25 |

$23.9 |

$22.15 |

$23.9 |

$170.00 |

$35.8K |

581 |

22 |

About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea's third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Following our analysis of the options activities associated with Sea, we pivot to a closer look at the company's own performance.

Present Market Standing of Sea

- Trading volume stands at 496,217, with SE's price down by -3.26%, positioned at $148.55.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 4 days.

What The Experts Say On Sea

In the last month, 2 experts released ratings on this stock with an average target price of $200.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities upgraded its action to Buy with a price target of $215.

* Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Sea with a target price of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Sea, Benzinga Pro gives you real-time options trades alerts.

Posted In: SE