Decoding Vertiv Holdings's Options Activity: What's the Big Picture?

Author: Benzinga Insights | November 07, 2025 11:03am

Investors with a lot of money to spend have taken a bearish stance on Vertiv Holdings (NYSE:VRT).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VRT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 47 uncommon options trades for Vertiv Holdings.

This isn't normal.

The overall sentiment of these big-money traders is split between 38% bullish and 48%, bearish.

Out of all of the special options we uncovered, 21 are puts, for a total amount of $1,813,888, and 26 are calls, for a total amount of $1,673,447.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $270.0 for Vertiv Holdings over the last 3 months.

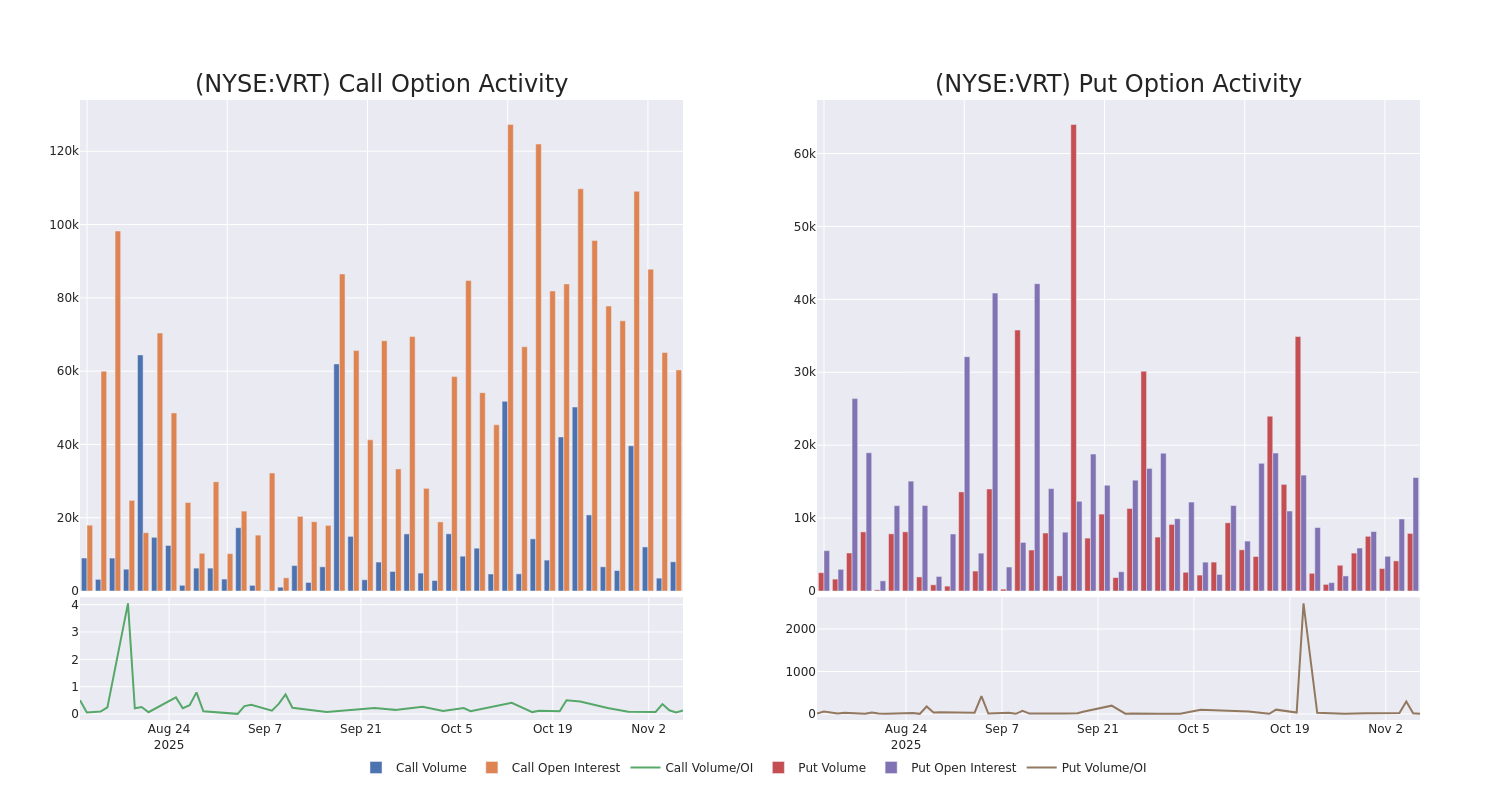

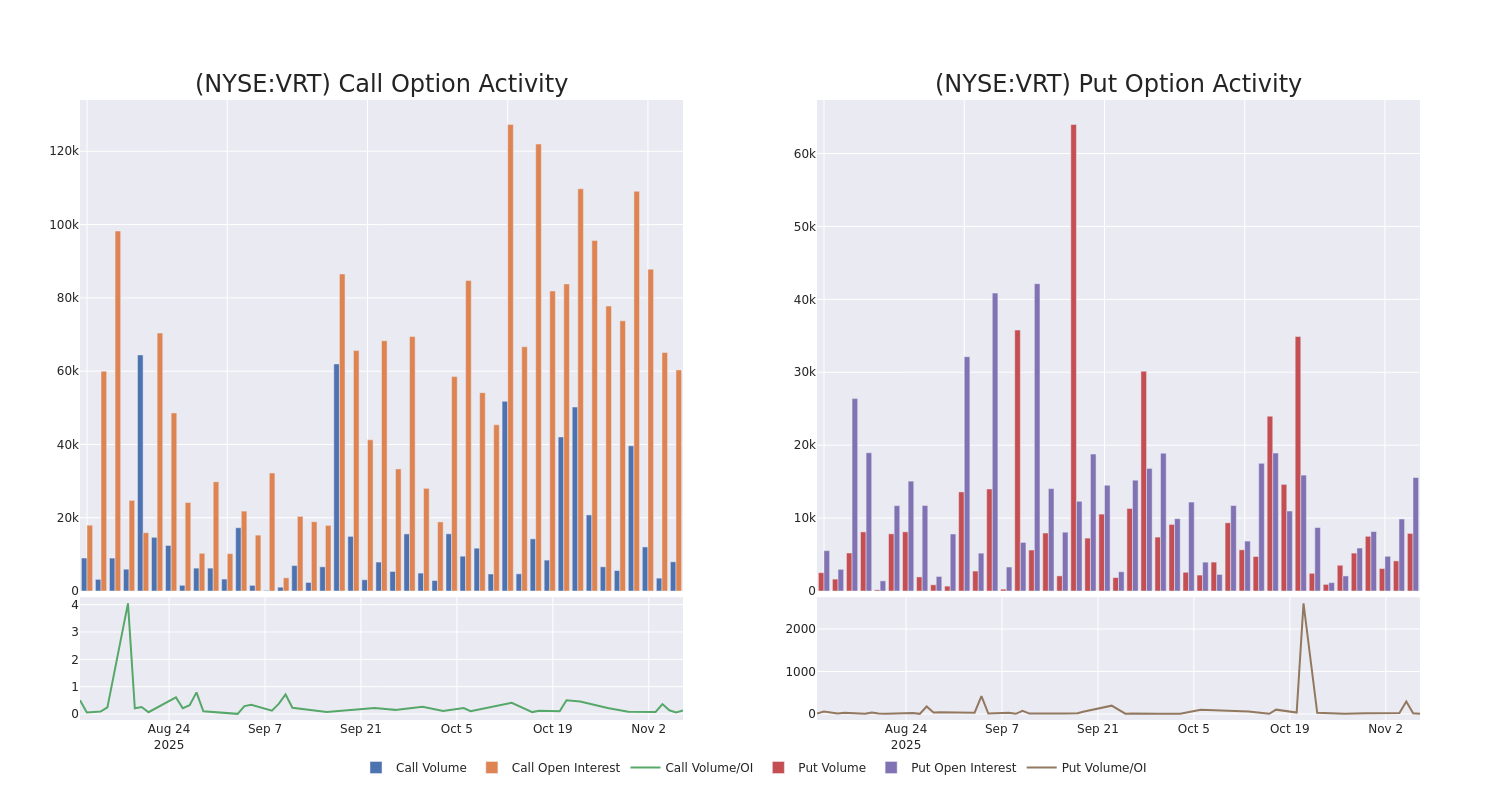

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Vertiv Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertiv Holdings's whale trades within a strike price range from $90.0 to $270.0 in the last 30 days.

Vertiv Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VRT |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$3.45 |

$3.25 |

$3.45 |

$190.00 |

$251.9K |

9.5K |

804 |

| VRT |

PUT |

SWEEP |

BULLISH |

11/07/25 |

$4.85 |

$3.05 |

$3.75 |

$177.50 |

$241.8K |

1.9K |

611 |

| VRT |

PUT |

TRADE |

NEUTRAL |

12/19/25 |

$1.6 |

$0.88 |

$1.2 |

$125.00 |

$240.0K |

1.0K |

2.7K |

| VRT |

PUT |

TRADE |

BEARISH |

11/14/25 |

$11.7 |

$10.75 |

$11.7 |

$180.00 |

$234.0K |

919 |

479 |

| VRT |

PUT |

SWEEP |

BEARISH |

11/14/25 |

$11.75 |

$11.55 |

$11.75 |

$180.00 |

$183.3K |

919 |

178 |

About Vertiv Holdings

Vertiv has roots tracing back to 1946 when its founder, Ralph Liebert, developed an air-cooling system for mainframe data rooms. As computers started making their way into commercial applications in 1965, Liebert developed one of the first computer room air conditioning, or CRAC, units, enabling the precise control of temperature and humidity. The firm has slowly expanded its data center portfolio through internal product development and the acquisition of thermal and power management products like condensers, busways, and switches. Vertiv has global operations today; its products can be found in data centers in most regions throughout the world.

Current Position of Vertiv Holdings

- With a trading volume of 3,544,268, the price of VRT is down by -3.6%, reaching $176.44.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 96 days from now.

What Analysts Are Saying About Vertiv Holdings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $191.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Vertiv Holdings, targeting a price of $190.

* An analyst from Barclays persists with their Equal-Weight rating on Vertiv Holdings, maintaining a target price of $170.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Vertiv Holdings with a target price of $192.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Vertiv Holdings, targeting a price of $206.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Vertiv Holdings with a target price of $198.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Holdings with Benzinga Pro for real-time alerts.

Posted In: VRT