Market Whales and Their Recent Bets on TLN Options

Author: Benzinga Insights | November 07, 2025 01:03pm

Financial giants have made a conspicuous bearish move on Talen Energy. Our analysis of options history for Talen Energy (NASDAQ:TLN) revealed 17 unusual trades.

Delving into the details, we found 29% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $742,386, and 4 were calls, valued at $145,470.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $270.0 to $400.0 for Talen Energy over the last 3 months.

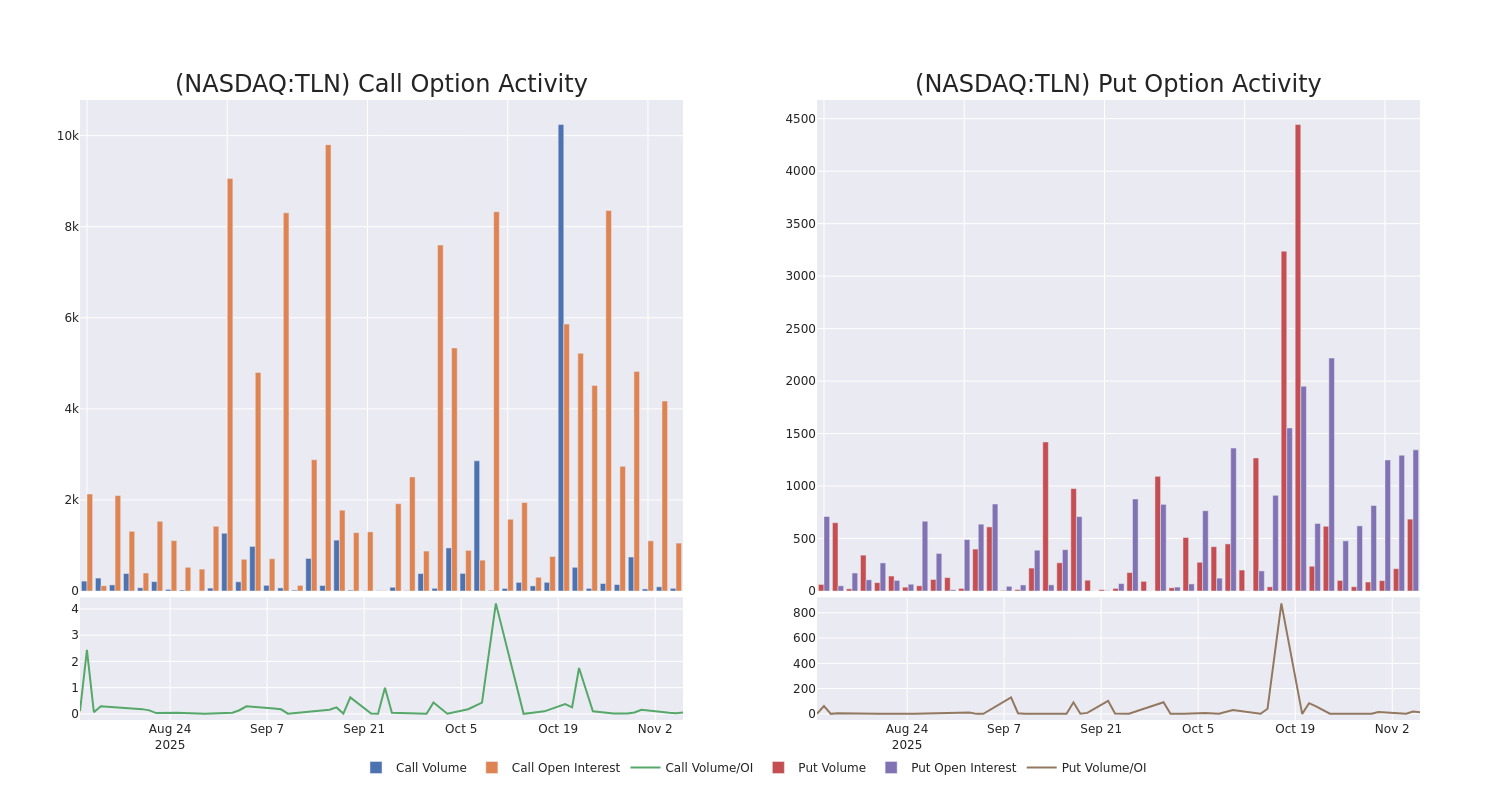

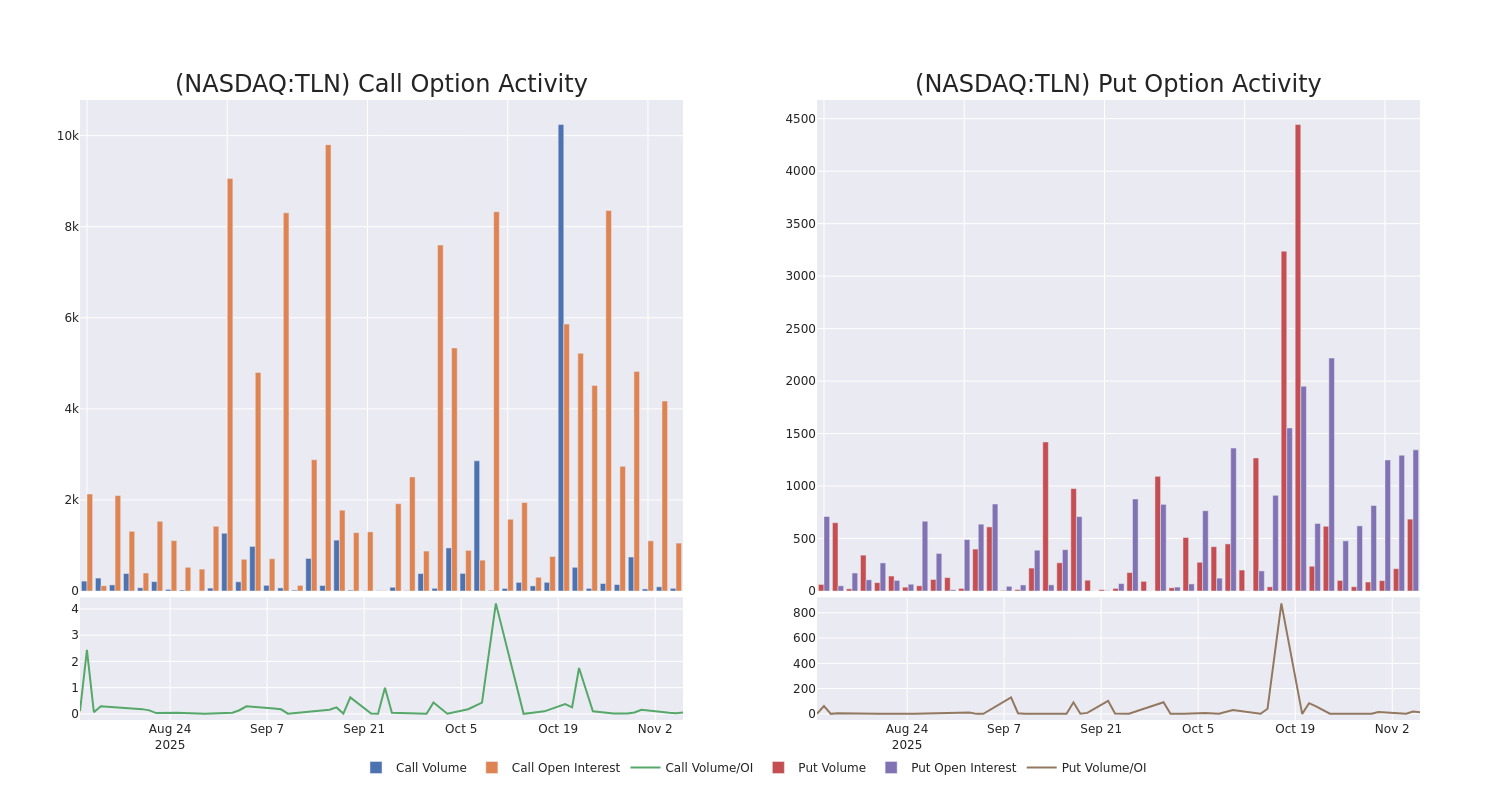

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Talen Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Talen Energy's substantial trades, within a strike price spectrum from $270.0 to $400.0 over the preceding 30 days.

Talen Energy 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TLN |

PUT |

SWEEP |

BEARISH |

11/21/25 |

$9.7 |

$9.6 |

$9.8 |

$350.00 |

$170.3K |

829 |

181 |

| TLN |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$27.6 |

$27.5 |

$27.5 |

$350.00 |

$99.0K |

24 |

237 |

| TLN |

PUT |

TRADE |

BEARISH |

12/19/25 |

$29.2 |

$28.2 |

$29.2 |

$370.00 |

$67.1K |

215 |

74 |

| TLN |

PUT |

TRADE |

BEARISH |

12/19/25 |

$29.1 |

$28.2 |

$29.1 |

$370.00 |

$64.0K |

215 |

96 |

| TLN |

CALL |

TRADE |

BULLISH |

12/19/25 |

$29.1 |

$27.2 |

$29.1 |

$380.00 |

$58.2K |

113 |

20 |

About Talen Energy

Talen Energy Corp is an independent power producer and energy infrastructure company. The company owns and operates approximately 10.7 gigawatts of power infrastructure in the United States. The group produces and sells electricity, capacity, and ancillary services into wholesale U.S. power markets, including PJM and WECC, with its generation fleet located in the Mid-Atlantic and Montana.

Where Is Talen Energy Standing Right Now?

- With a trading volume of 366,144, the price of TLN is down by -3.55%, reaching $372.25.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 111 days from now.

Expert Opinions on Talen Energy

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $444.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Talen Energy, targeting a price of $441.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Talen Energy with a target price of $442.

* An analyst from Barclays persists with their Overweight rating on Talen Energy, maintaining a target price of $439.

* Reflecting concerns, an analyst from Wells Fargo lowers its rating to Overweight with a new price target of $453.

* An analyst from Wells Fargo persists with their Overweight rating on Talen Energy, maintaining a target price of $445.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Talen Energy, Benzinga Pro gives you real-time options trades alerts.

Posted In: TLN