A Peek at Peraso's Future Earnings

Author: Benzinga Insights | November 07, 2025 01:05pm

Peraso (NASDAQ:PRSO) is gearing up to announce its quarterly earnings on Monday, 2025-11-10. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Peraso will report an earnings per share (EPS) of $-0.22.

Peraso bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

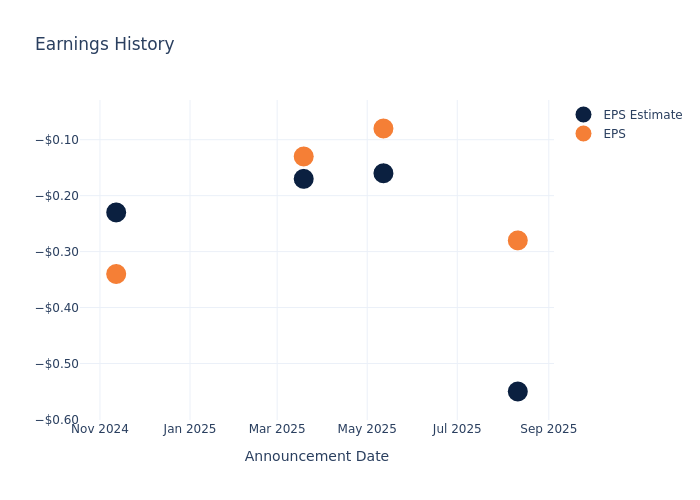

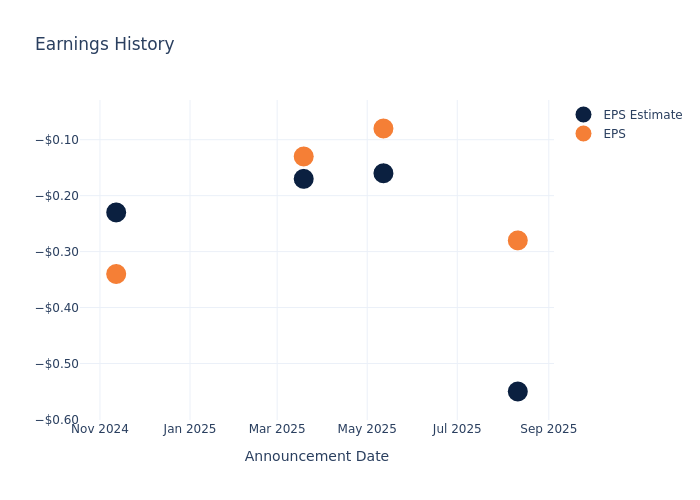

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.27, leading to a 1.17% drop in the share price the following trading session.

Here's a look at Peraso's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

-0.55 |

-0.16 |

-0.17 |

-0.23 |

| EPS Actual |

-0.28 |

-0.08 |

-0.13 |

-0.34 |

| Price Change % |

-1.00 |

-12.00 |

-3.00 |

-20.00 |

Stock Performance

Shares of Peraso were trading at $1.155 as of November 06. Over the last 52-week period, shares are down 4.46%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Peraso visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PRSO