In-Depth Analysis: Amazon.com Versus Competitors In Broadline Retail Industry

Author: Benzinga Insights | November 10, 2025 10:01am

In today's fast-paced and highly competitive business world, it is crucial for investors and industry followers to conduct comprehensive company evaluations. In this article, we will delve into an extensive industry comparison, evaluating Amazon.com (NASDAQ:AMZN) in relation to its major competitors in the Broadline Retail industry. By closely examining key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and highlight company's performance in the industry.

Amazon.com Background

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 74% of total, followed by Amazon Web Services (17%), and advertising services (9%). International segments constitute 22% of Amazon's total revenue, led by Germany, the United Kingdom, and Japan.

| Company |

P/E |

P/B |

P/S |

ROE |

EBITDA (in billions) |

Gross Profit (in billions) |

Revenue Growth |

| Amazon.com Inc |

34.52 |

7.07 |

3.82 |

6.02% |

$45.5 |

$91.5 |

13.4% |

| Alibaba Group Holding Ltd |

19.22 |

2.79 |

2.84 |

4.26% |

$53.52 |

$111.22 |

1.82% |

| PDD Holdings Inc |

14.64 |

3.80 |

3.50 |

8.89% |

$25.79 |

$58.13 |

7.14% |

| MercadoLibre Inc |

51.47 |

17.19 |

4.08 |

7.06% |

$0.88 |

$3.21 |

39.48% |

| Sea Ltd |

77.29 |

9.17 |

4.82 |

4.36% |

$0.58 |

$2.41 |

38.16% |

| Coupang Inc |

137.52 |

11.13 |

1.61 |

2.02% |

$0.32 |

$2.72 |

17.81% |

| JD.com Inc |

8.87 |

1.41 |

0.27 |

2.68% |

$7.34 |

$56.64 |

22.4% |

| eBay Inc |

18.58 |

8.03 |

3.71 |

13.35% |

$0.74 |

$2.0 |

9.47% |

| Vipshop Holdings Ltd |

9.98 |

1.66 |

0.65 |

3.74% |

$1.91 |

$6.05 |

-3.98% |

| Dillard's Inc |

16.74 |

4.93 |

1.46 |

3.86% |

$0.14 |

$0.58 |

1.41% |

| Ollie's Bargain Outlet Holdings Inc |

35.79 |

4.24 |

3.13 |

3.49% |

$0.09 |

$0.27 |

17.49% |

| MINISO Group Holding Ltd |

19.48 |

4.13 |

2.45 |

4.56% |

$0.73 |

$2.2 |

23.07% |

| Macy's Inc |

11.56 |

1.23 |

0.25 |

1.95% |

$0.36 |

$2.1 |

-1.9% |

| Kohl's Corp |

9.15 |

0.49 |

0.12 |

3.97% |

$0.45 |

$1.53 |

-4.98% |

| Hour Loop Inc |

62.33 |

9.18 |

0.47 |

18.14% |

$0.0 |

$0.02 |

-3.45% |

| Average |

35.19 |

5.67 |

2.1 |

5.88% |

$6.63 |

$17.79 |

11.71% |

By analyzing Amazon.com, we can infer the following trends:

-

The Price to Earnings ratio of 34.52 is 0.98x lower than the industry average, indicating potential undervaluation for the stock.

-

The elevated Price to Book ratio of 7.07 relative to the industry average by 1.25x suggests company might be overvalued based on its book value.

-

With a relatively high Price to Sales ratio of 3.82, which is 1.82x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 6.02% that is 0.14% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

Compared to its industry, the company has higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $45.5 Billion, which is 6.86x above the industry average, indicating stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $91.5 Billion, which indicates 5.14x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company's revenue growth of 13.4% exceeds the industry average of 11.71%, indicating strong sales performance and market outperformance.

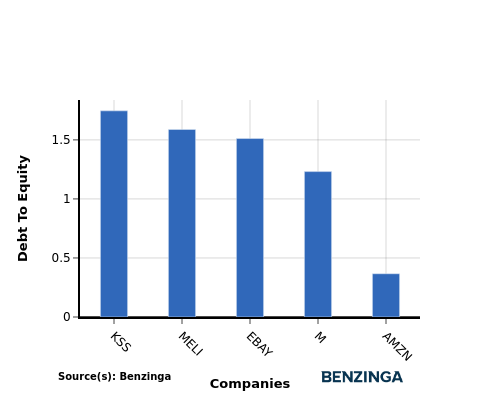

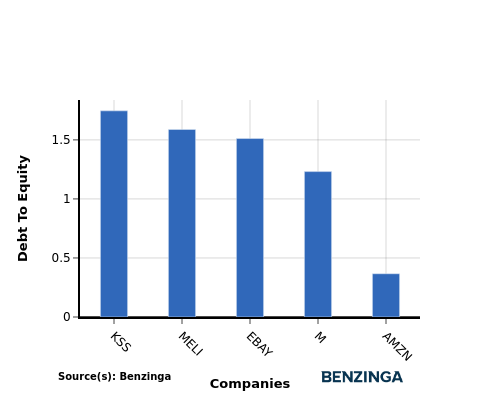

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is an important measure to assess the financial structure and risk profile of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Amazon.com stands in comparison with its top 4 peers, leading to the following comparisons:

-

Compared to its top 4 peers, Amazon.com has a stronger financial position indicated by its lower debt-to-equity ratio of 0.37.

-

This suggests that the company relies less on debt financing and has a more favorable balance between debt and equity, which can be seen as a positive attribute by investors.

Key Takeaways

For Amazon.com, the PE ratio is low compared to its peers in the Broadline Retail industry, indicating potential undervaluation. The high PB and PS ratios suggest that the market values Amazon.com's assets and sales highly. Amazon.com's high ROE, EBITDA, gross profit, and revenue growth outperform its industry peers, reflecting strong financial performance and growth potential.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AMZN