Looking At Rocket Lab's Recent Unusual Options Activity

Author: Benzinga Insights | November 10, 2025 10:03am

Investors with a lot of money to spend have taken a bullish stance on Rocket Lab (NASDAQ:RKLB).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with RKLB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Rocket Lab.

This isn't normal.

The overall sentiment of these big-money traders is split between 60% bullish and 40%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $137,953, and 6 are calls, for a total amount of $449,204.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $45.0 to $62.0 for Rocket Lab over the last 3 months.

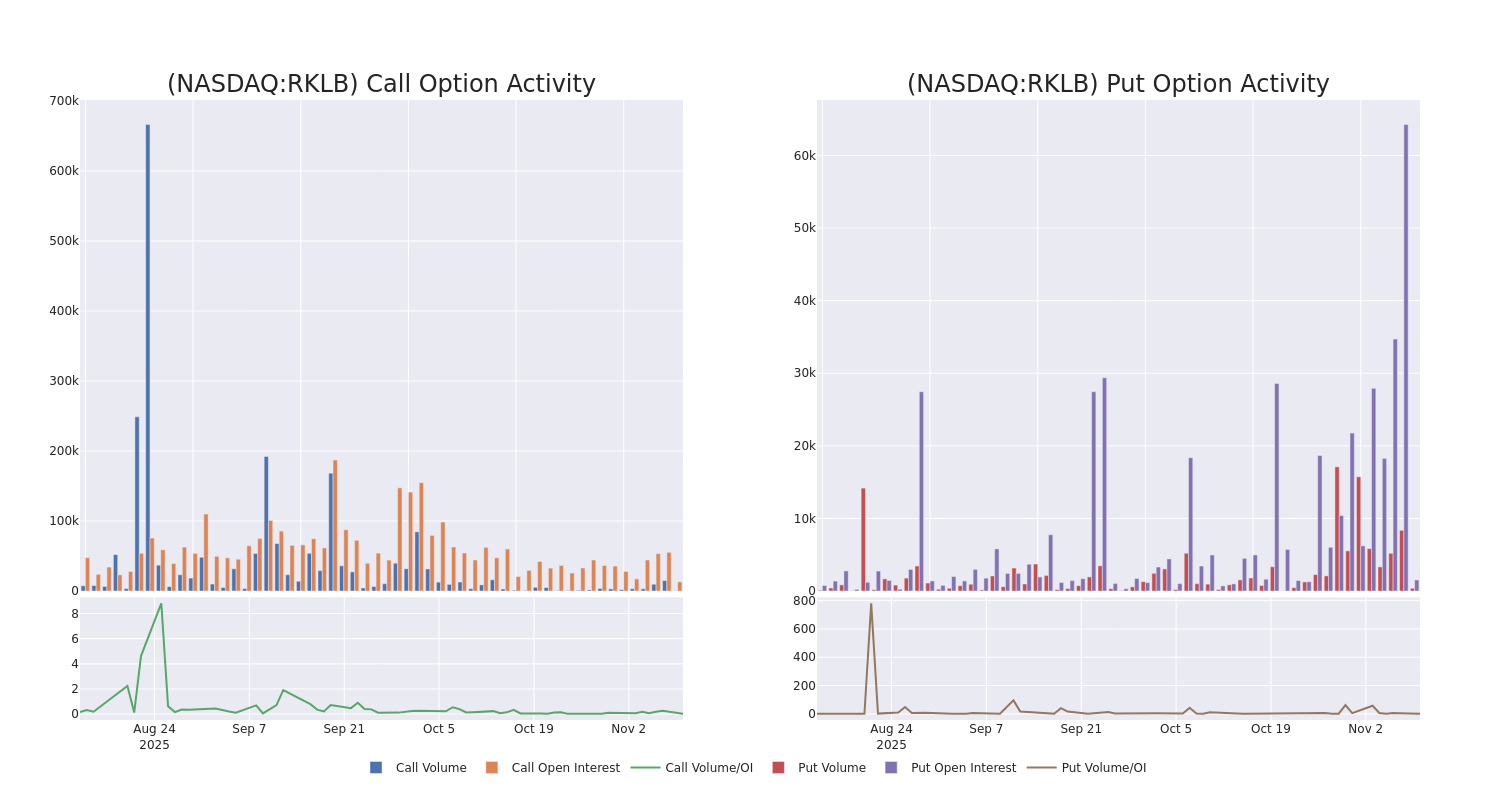

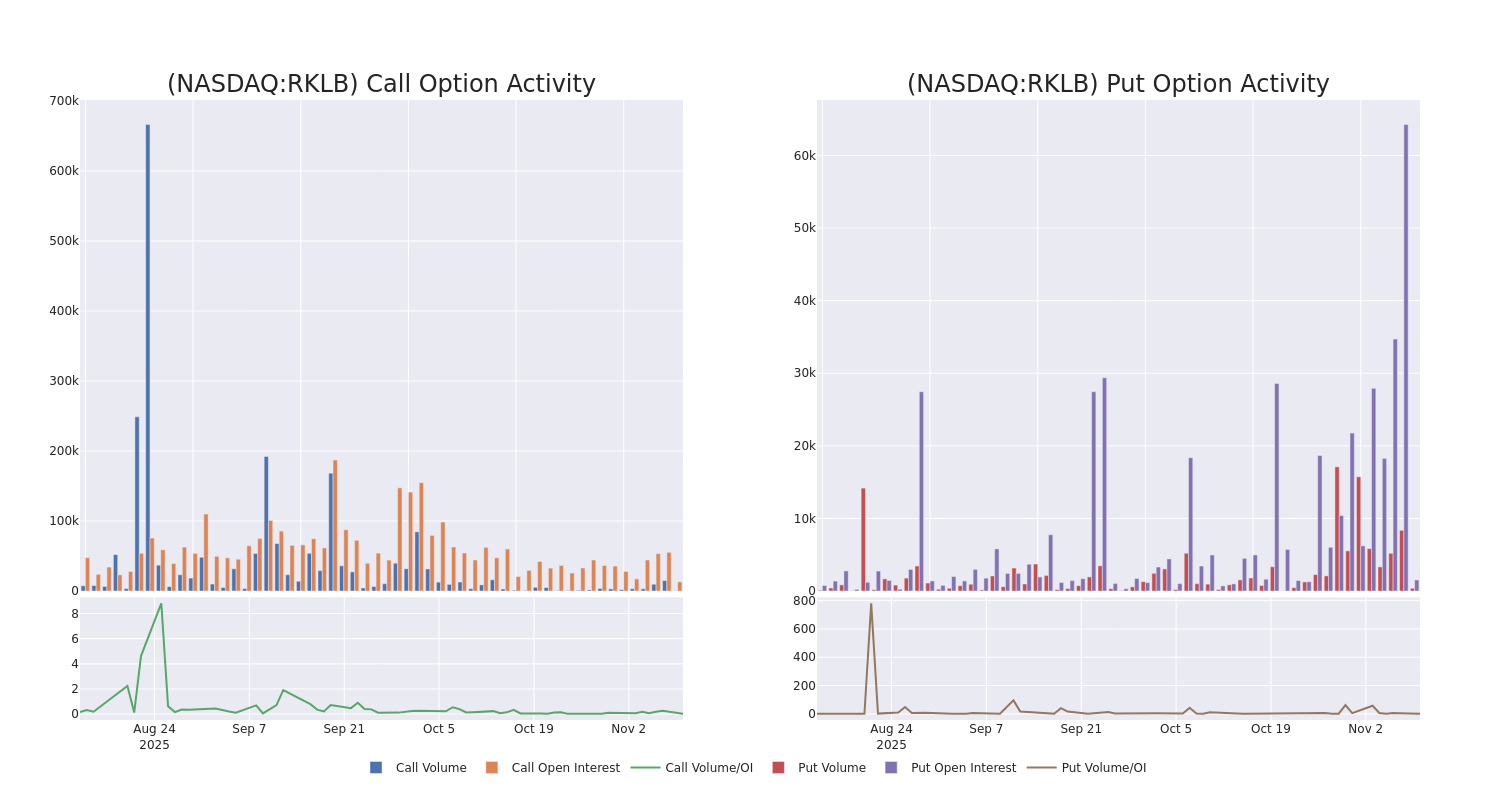

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Rocket Lab options trades today is 1626.89 with a total volume of 702.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Rocket Lab's big money trades within a strike price range of $45.0 to $62.0 over the last 30 days.

Rocket Lab Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| RKLB |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$21.35 |

$20.85 |

$20.85 |

$55.00 |

$138.8K |

1.5K |

4 |

| RKLB |

CALL |

TRADE |

BULLISH |

04/17/26 |

$15.75 |

$14.55 |

$15.75 |

$50.00 |

$78.7K |

2.4K |

94 |

| RKLB |

CALL |

TRADE |

BEARISH |

12/05/25 |

$11.3 |

$9.85 |

$10.34 |

$45.00 |

$77.5K |

805 |

75 |

| RKLB |

CALL |

TRADE |

BULLISH |

04/17/26 |

$11.75 |

$11.75 |

$11.75 |

$60.00 |

$55.2K |

7.3K |

50 |

| RKLB |

CALL |

TRADE |

BEARISH |

01/21/28 |

$27.6 |

$27.0 |

$27.0 |

$55.00 |

$51.3K |

795 |

21 |

About Rocket Lab

Rocket Lab Corp is engaged in space, building rockets, and spacecraft. It provides end-to-end mission services that provide frequent and reliable access to space for civil, defense, and commercial markets. It designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. Rocket Lab's Electron launch vehicle has delivered multiple satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The business operates in two segments Launch Services and Space Systems. Geographically it serves Japan, Germany, and rest of the world and earns key revenue from the United States.

Having examined the options trading patterns of Rocket Lab, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Rocket Lab

- With a volume of 3,632,541, the price of RKLB is up 4.04% at $53.73.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 0 days.

What The Experts Say On Rocket Lab

3 market experts have recently issued ratings for this stock, with a consensus target price of $75.33.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Rocket Lab, maintaining a target price of $68.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Rocket Lab, targeting a price of $75.

* Reflecting concerns, an analyst from Baird lowers its rating to Outperform with a new price target of $83.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rocket Lab with Benzinga Pro for real-time alerts.

Posted In: RKLB