Spotlight on Caterpillar: Analyzing the Surge in Options Activity

Author: Benzinga Insights | November 10, 2025 01:02pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Caterpillar.

Looking at options history for Caterpillar (NYSE:CAT) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $209,031 and 26, calls, for a total amount of $1,901,263.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $295.0 and $890.0 for Caterpillar, spanning the last three months.

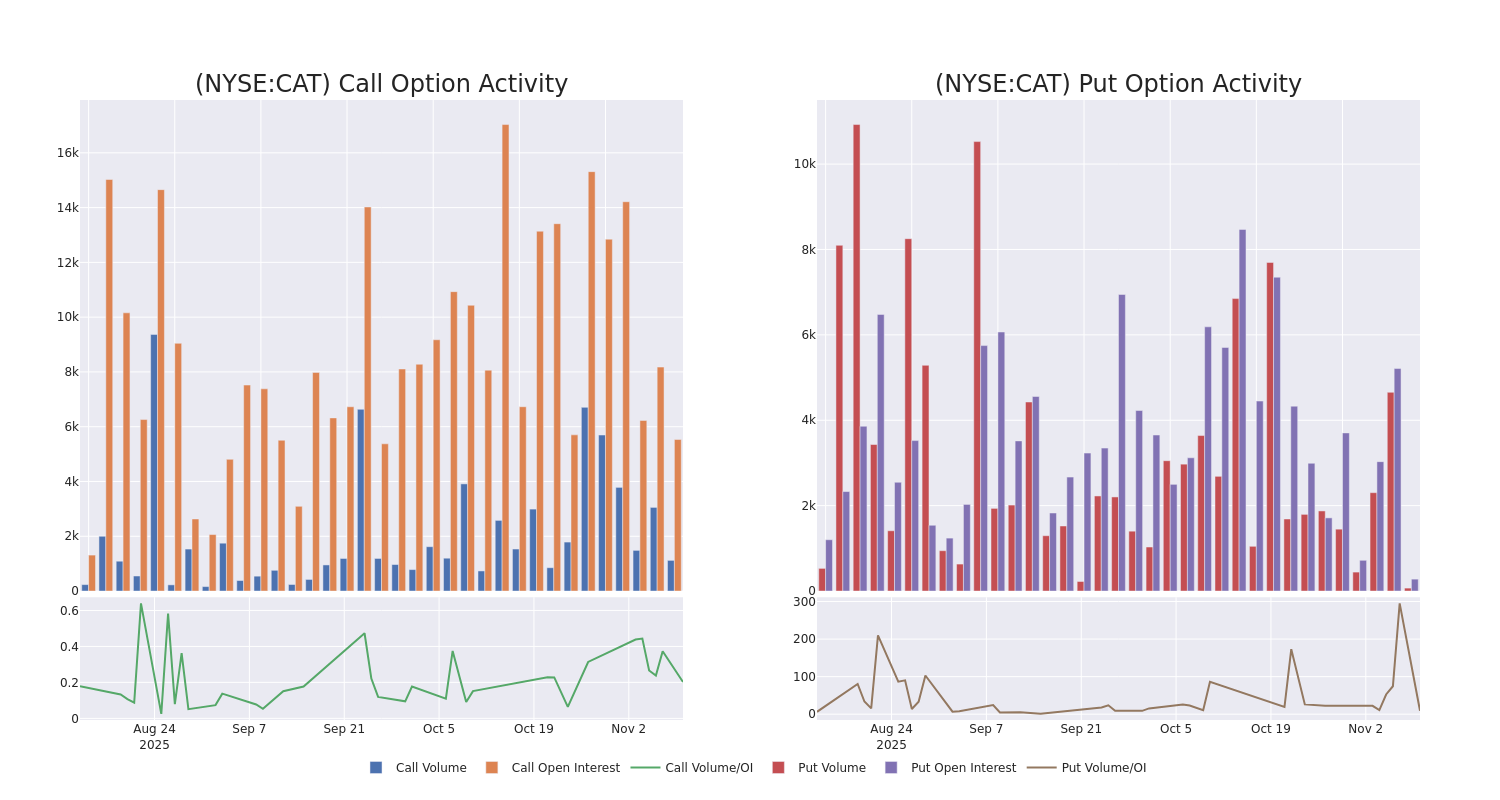

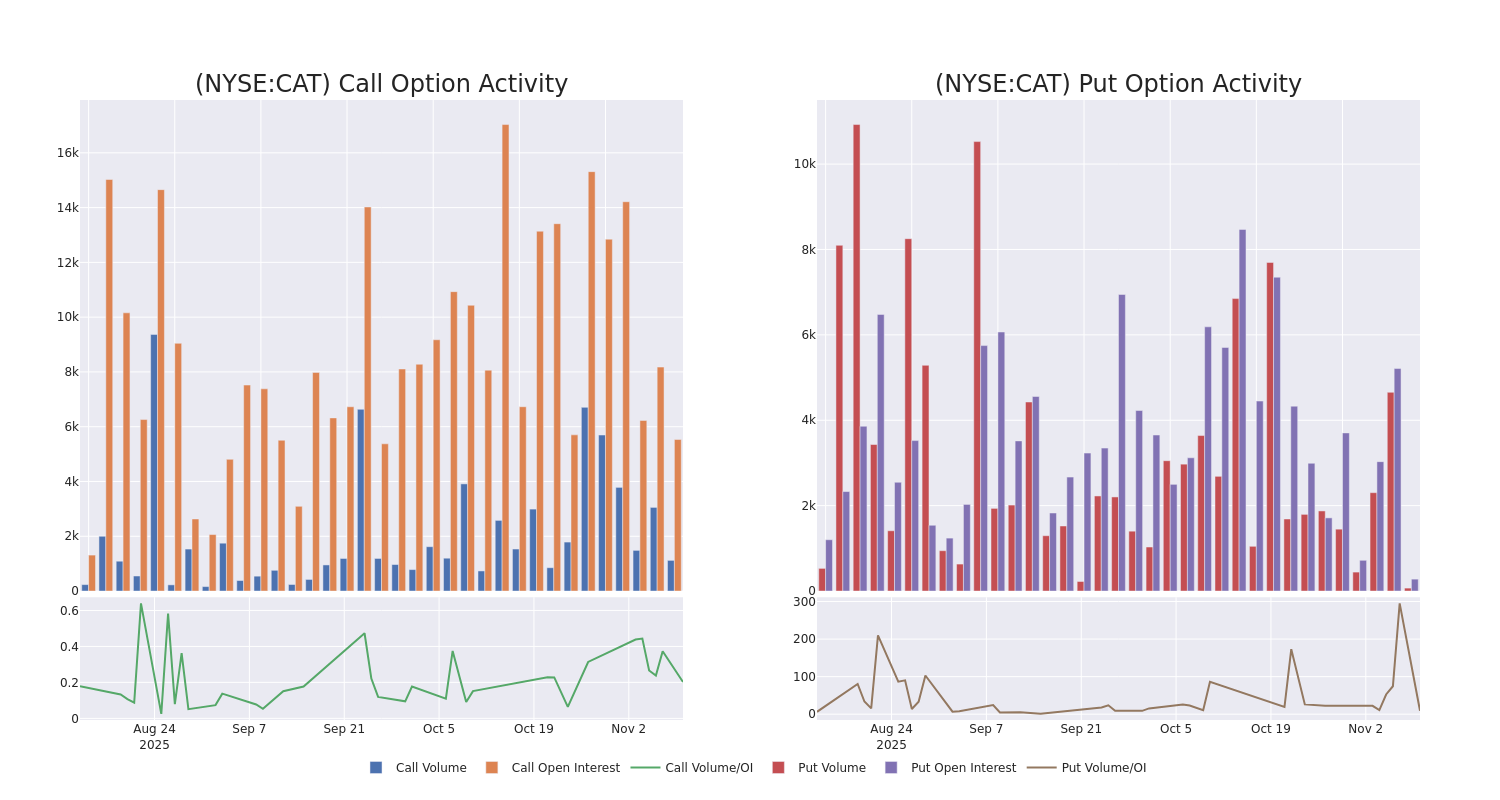

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Caterpillar's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Caterpillar's substantial trades, within a strike price spectrum from $295.0 to $890.0 over the preceding 30 days.

Caterpillar Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CAT |

CALL |

TRADE |

BULLISH |

01/15/27 |

$26.5 |

$22.5 |

$25.3 |

$800.00 |

$447.8K |

1 |

177 |

| CAT |

CALL |

TRADE |

BULLISH |

01/15/27 |

$51.0 |

$48.0 |

$51.0 |

$680.00 |

$316.2K |

15 |

62 |

| CAT |

CALL |

TRADE |

BULLISH |

01/15/27 |

$16.5 |

$13.5 |

$16.9 |

$890.00 |

$160.5K |

2 |

95 |

| CAT |

CALL |

SWEEP |

BULLISH |

03/20/26 |

$133.85 |

$131.1 |

$133.04 |

$450.00 |

$133.0K |

483 |

10 |

| CAT |

CALL |

SWEEP |

NEUTRAL |

11/21/25 |

$11.6 |

$10.65 |

$11.3 |

$565.00 |

$113.0K |

59 |

100 |

About Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Its reporting segments are construction, resource, energy, and transportation. Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has a global reach that is approximately evenly balanced between the US and the rest of the world. Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of over 150 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

After a thorough review of the options trading surrounding Caterpillar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Caterpillar

- Trading volume stands at 749,393, with CAT's price up by 1.3%, positioned at $570.39.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 80 days.

Expert Opinions on Caterpillar

In the last month, 5 experts released ratings on this stock with an average target price of $544.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $560.

* Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $729.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Underweight rating on Caterpillar with a target price of $380.

* An analyst from DA Davidson has decided to maintain their Neutral rating on Caterpillar, which currently sits at a price target of $569.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Caterpillar with a target price of $485.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Caterpillar options trades with real-time alerts from Benzinga Pro.

Posted In: CAT