KLA's Options Frenzy: What You Need to Know

Author: Benzinga Insights | November 10, 2025 02:01pm

Whales with a lot of money to spend have taken a noticeably bearish stance on KLA.

Looking at options history for KLA (NASDAQ:KLAC) we detected 27 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $163,072 and 23, calls, for a total amount of $1,398,710.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $600.0 to $1260.0 for KLA over the recent three months.

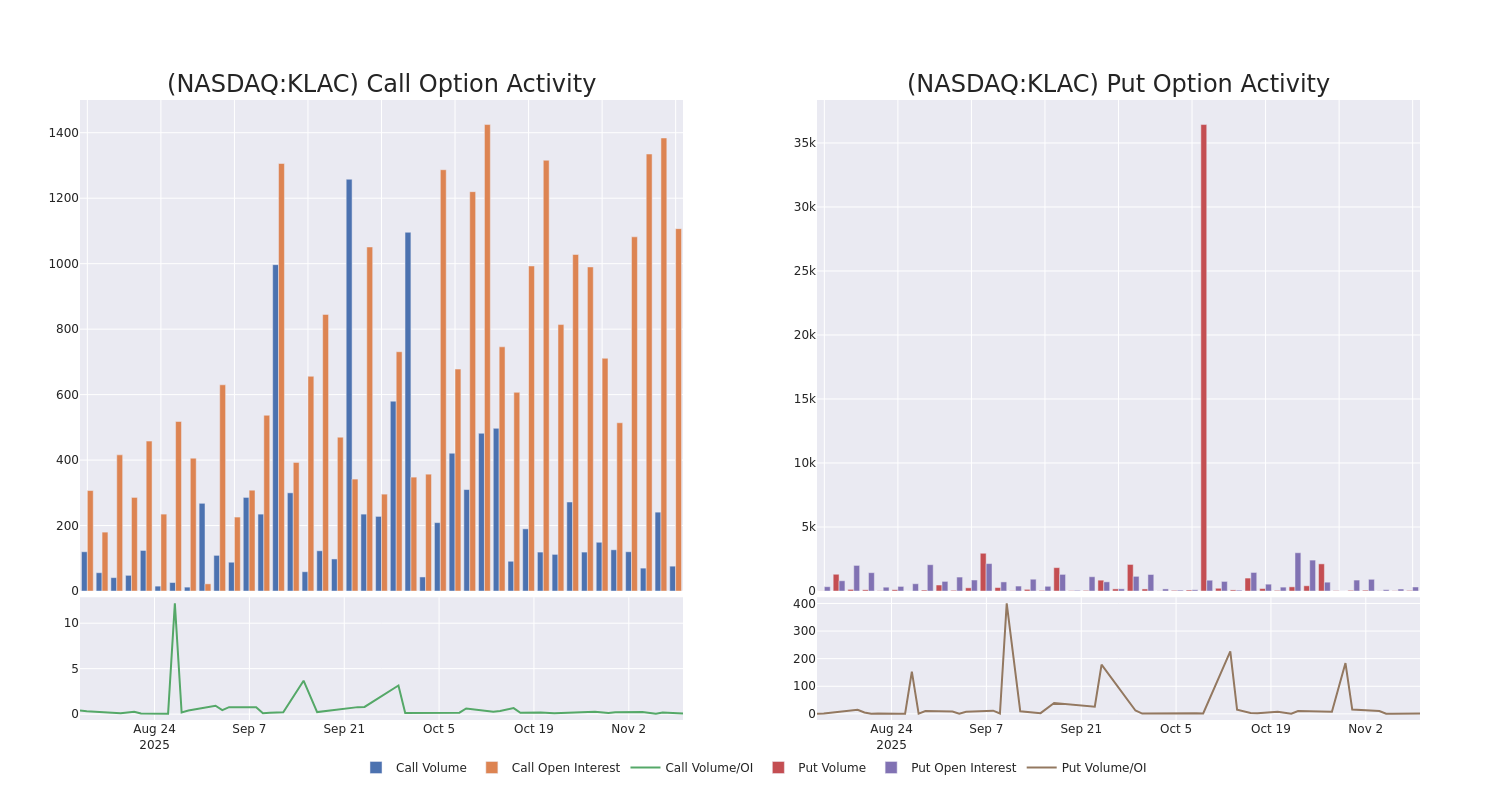

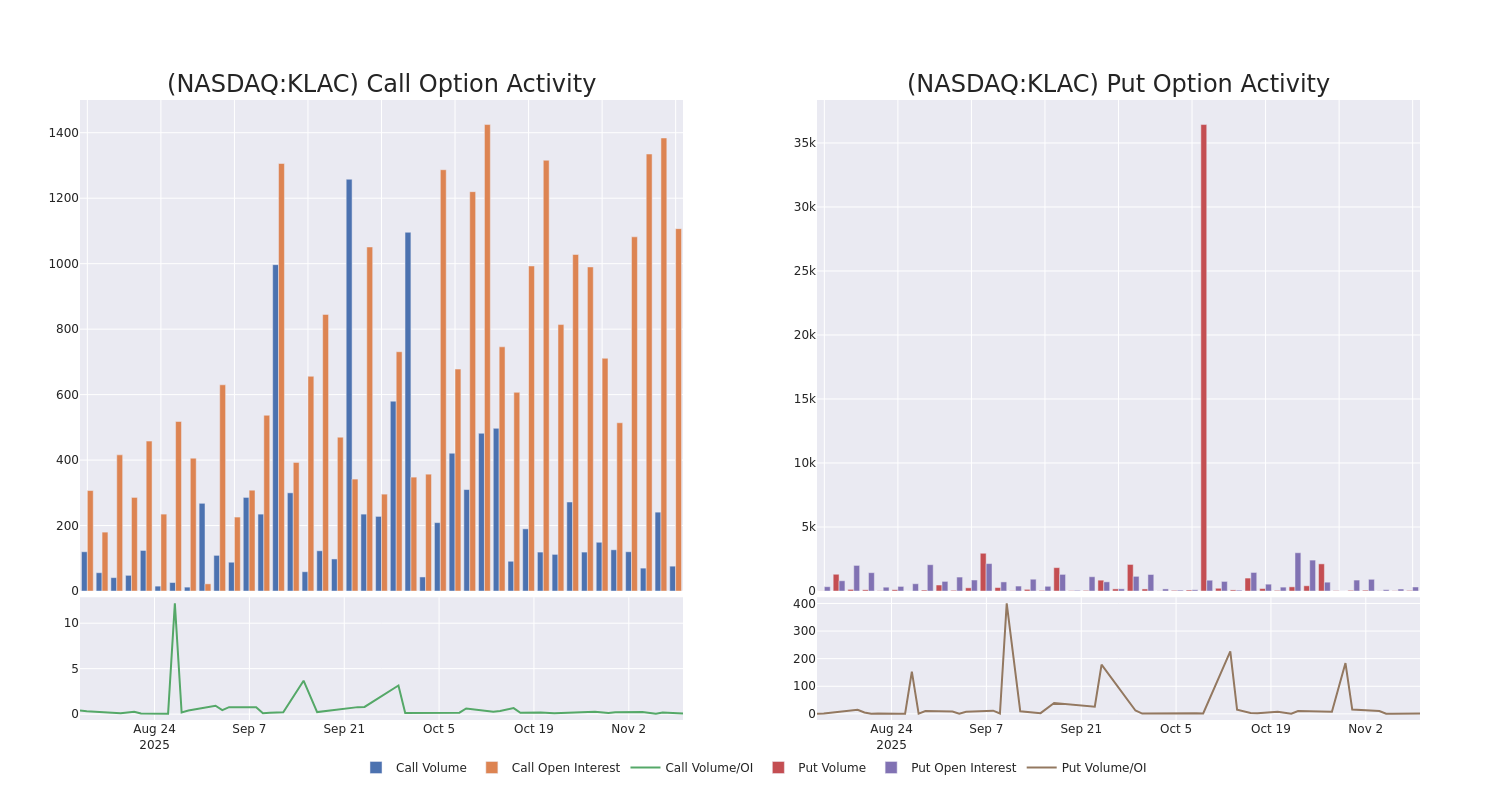

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for KLA's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across KLA's significant trades, within a strike price range of $600.0 to $1260.0, over the past month.

KLA Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| KLAC |

CALL |

TRADE |

BULLISH |

01/15/27 |

$634.5 |

$631.3 |

$634.5 |

$620.00 |

$317.2K |

114 |

5 |

| KLAC |

CALL |

TRADE |

BEARISH |

01/16/26 |

$252.0 |

$244.8 |

$247.0 |

$1000.00 |

$123.5K |

158 |

5 |

| KLAC |

CALL |

TRADE |

BULLISH |

11/21/25 |

$257.0 |

$251.9 |

$257.0 |

$960.00 |

$77.1K |

14 |

3 |

| KLAC |

CALL |

TRADE |

NEUTRAL |

12/19/25 |

$71.8 |

$67.8 |

$69.9 |

$1220.00 |

$69.9K |

48 |

23 |

| KLAC |

CALL |

SWEEP |

BULLISH |

12/19/25 |

$69.8 |

$67.9 |

$69.8 |

$1220.00 |

$69.8K |

48 |

13 |

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

In light of the recent options history for KLA, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is KLA Standing Right Now?

- With a trading volume of 311,177, the price of KLAC is up by 2.31%, reaching $1220.95.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 80 days from now.

Expert Opinions on KLA

5 market experts have recently issued ratings for this stock, with a consensus target price of $1333.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on KLA with a target price of $1250.

* An analyst from Goldman Sachs has decided to maintain their Neutral rating on KLA, which currently sits at a price target of $1280.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for KLA, targeting a price of $1350.

* An analyst from JP Morgan has decided to maintain their Overweight rating on KLA, which currently sits at a price target of $1485.

* An analyst from Barclays persists with their Overweight rating on KLA, maintaining a target price of $1300.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for KLA, Benzinga Pro gives you real-time options trades alerts.

Posted In: KLAC