Decoding Ciena's Options Activity: What's the Big Picture?

Author: Benzinga Insights | November 11, 2025 02:02pm

Financial giants have made a conspicuous bullish move on Ciena. Our analysis of options history for Ciena (NYSE:CIEN) revealed 11 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $360,276, and 3 were calls, valued at $854,680.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $165.0 to $250.0 for Ciena over the recent three months.

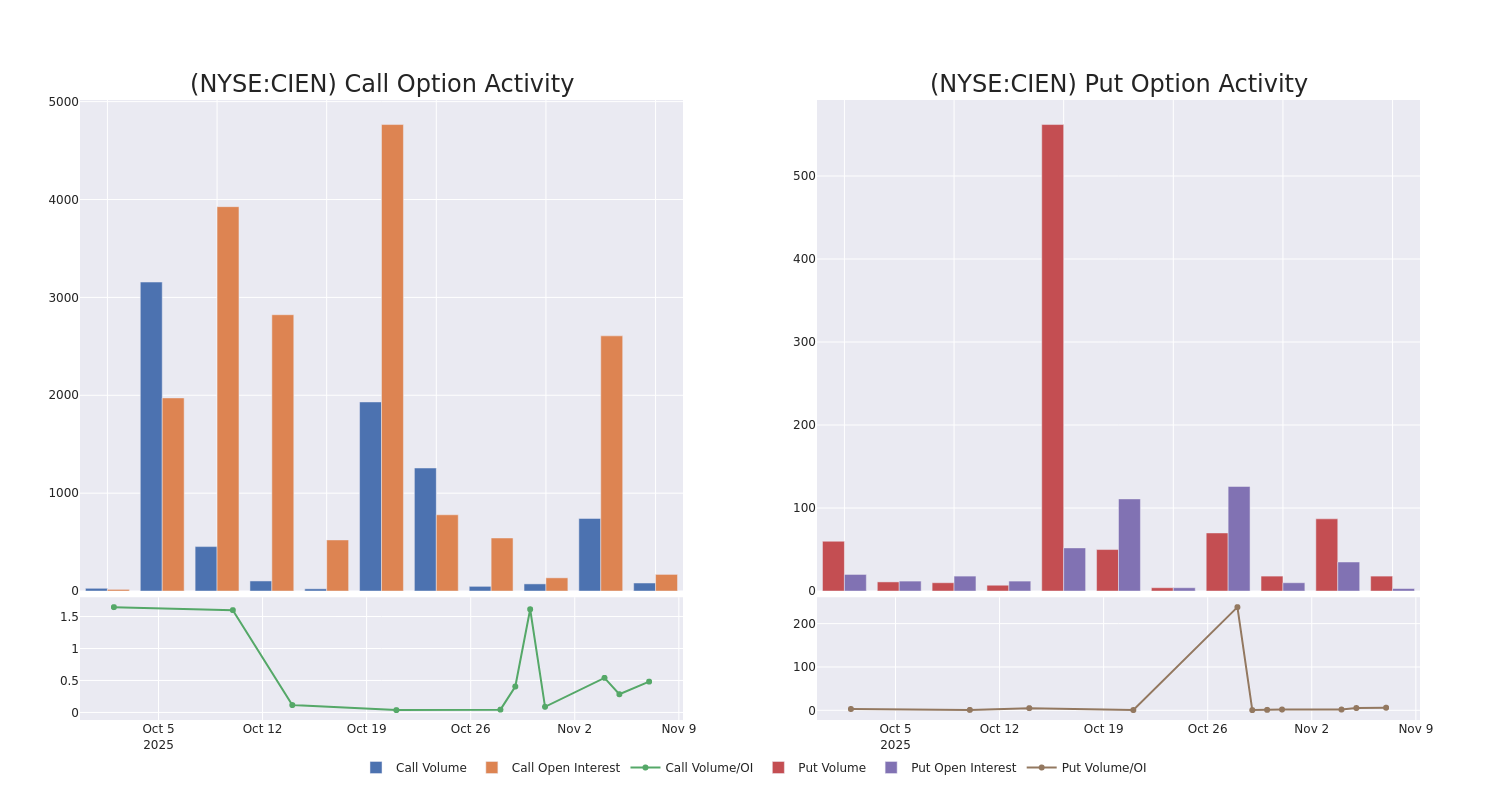

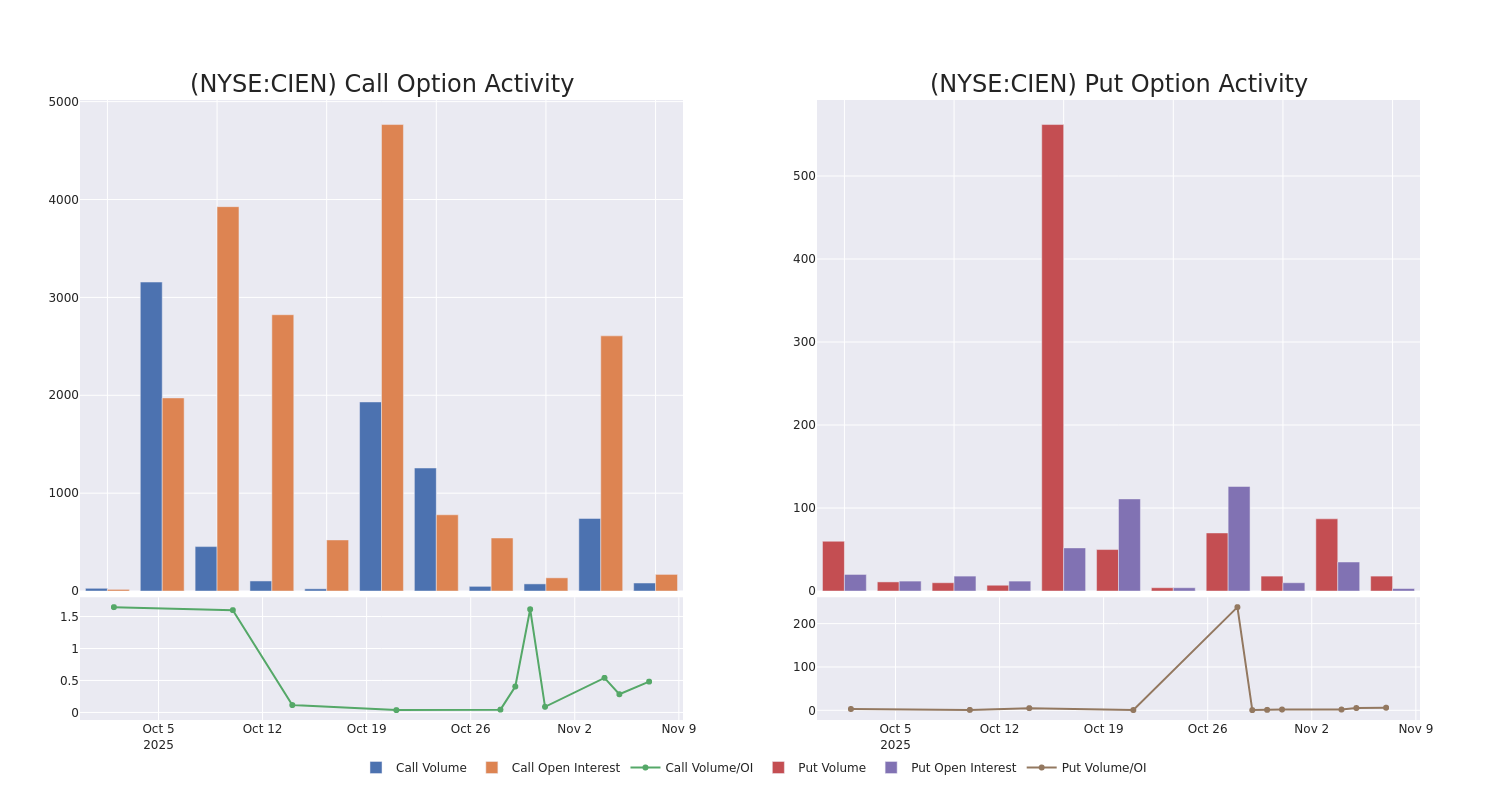

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Ciena's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Ciena's significant trades, within a strike price range of $165.0 to $250.0, over the past month.

Ciena 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CIEN |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$39.9 |

$37.5 |

$38.7 |

$180.00 |

$774.0K |

451 |

200 |

| CIEN |

PUT |

TRADE |

BULLISH |

06/18/26 |

$64.2 |

$62.4 |

$62.4 |

$240.00 |

$74.8K |

37 |

12 |

| CIEN |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$29.3 |

$28.1 |

$29.3 |

$220.00 |

$70.3K |

42 |

24 |

| CIEN |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$28.5 |

$27.6 |

$28.5 |

$220.00 |

$54.1K |

42 |

43 |

| CIEN |

CALL |

TRADE |

BEARISH |

12/19/25 |

$45.6 |

$42.5 |

$43.68 |

$165.00 |

$43.6K |

74 |

10 |

About Ciena

Ciena is a telecommunications equipment provider focused on optical transport technologies, with clients in a number of industries such as communication services providers, web-scale providers, cable operators, government, and large enterprises worldwide. The company provides equipment, software, and services that support transport, switching, aggregation, service delivery, and data traffic management.

Where Is Ciena Standing Right Now?

- Currently trading with a volume of 1,285,334, the CIEN's price is down by -2.31%, now at $203.91.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 30 days.

Professional Analyst Ratings for Ciena

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $215.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Ciena with a target price of $230.

* An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Ciena, which currently sits at a price target of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Ciena options trades with real-time alerts from Benzinga Pro.

Posted In: CIEN