Market Whales and Their Recent Bets on Morgan Stanley Options

Author: Benzinga Insights | November 11, 2025 03:02pm

Deep-pocketed investors have adopted a bearish approach towards Morgan Stanley (NYSE:MS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Morgan Stanley. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 0% leaning bullish and 42% bearish. Among these notable options, 12 are puts, totaling $437,576, and 2 are calls, amounting to $116,290.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $185.0 for Morgan Stanley during the past quarter.

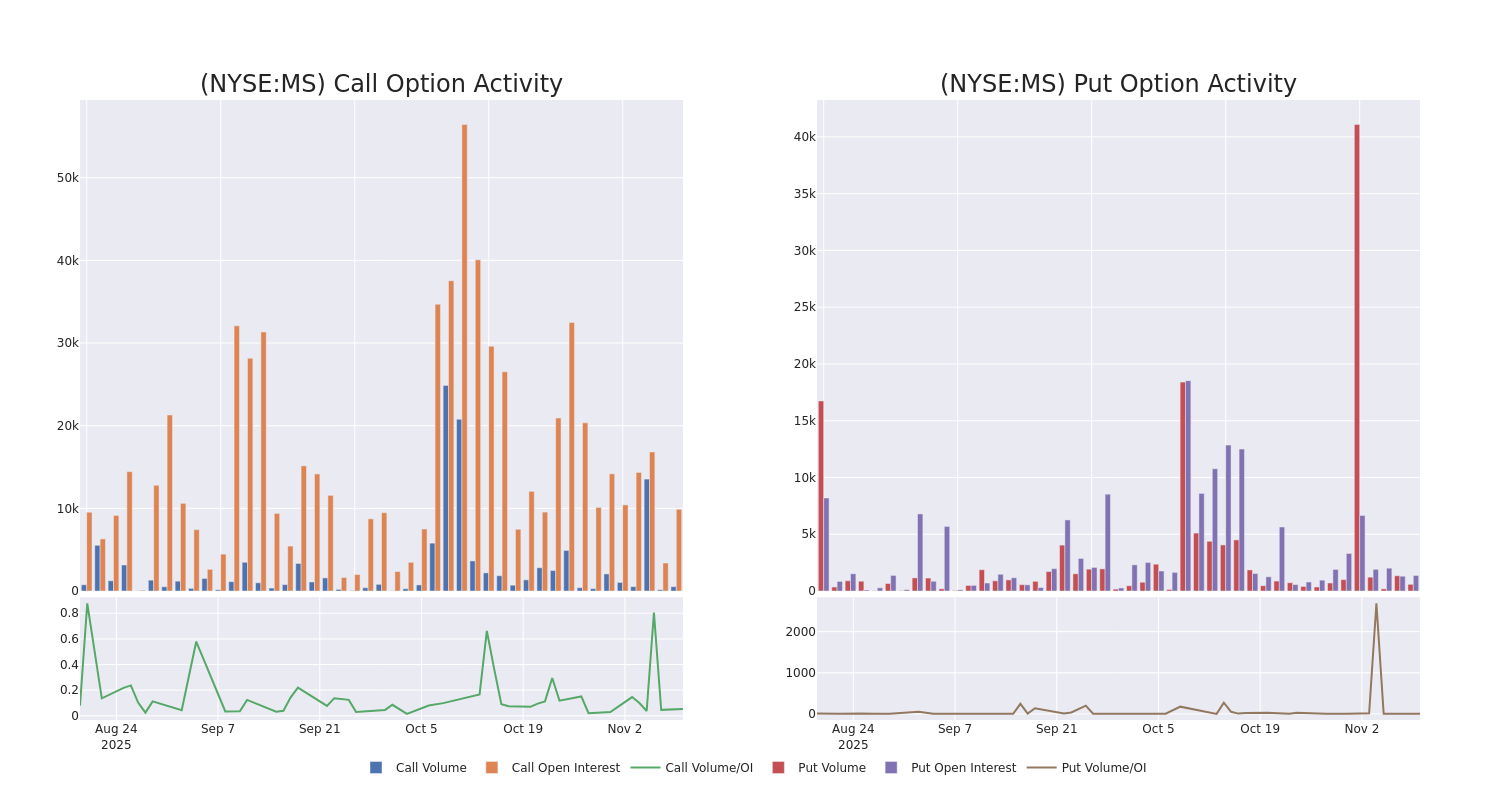

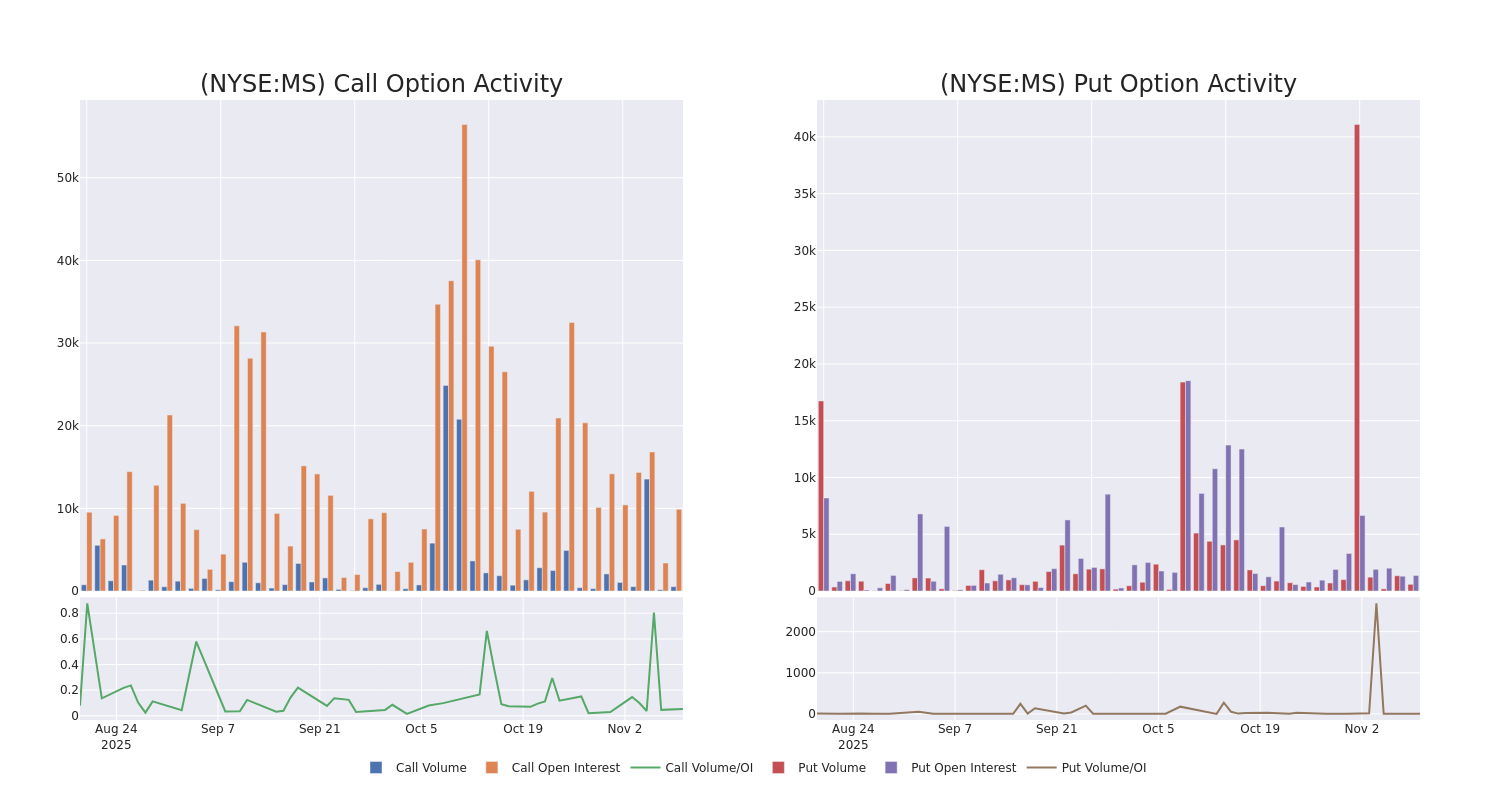

Volume & Open Interest Development

In today's trading context, the average open interest for options of Morgan Stanley stands at 676.8, with a total volume reaching 1,305.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $85.0 to $185.0, throughout the last 30 days.

Morgan Stanley Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MS |

CALL |

SWEEP |

NEUTRAL |

01/16/26 |

$16.35 |

$14.95 |

$16.02 |

$155.00 |

$80.0K |

2.4K |

52 |

| MS |

PUT |

SWEEP |

BEARISH |

01/21/28 |

$3.85 |

$3.3 |

$3.85 |

$85.00 |

$71.2K |

0 |

185 |

| MS |

PUT |

SWEEP |

BEARISH |

01/16/26 |

$20.35 |

$20.05 |

$20.05 |

$185.00 |

$40.6K |

15 |

67 |

| MS |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$15.85 |

$15.05 |

$15.45 |

$180.00 |

$38.6K |

59 |

50 |

| MS |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$15.45 |

$15.25 |

$15.34 |

$180.00 |

$38.3K |

59 |

75 |

About Morgan Stanley

Morgan Stanley is a massive global financial services firm, with offices in 42 countries and more than 80,000 employees as of year-end 2024. The firm cut its teeth in investment banking and institutional trading, where it maintains a strong presence today, but generates the lion share of its income from wealth and asset management franchises, where it boasted $7.9 trillion in client assets at the end of its most recent fiscal year. After reincorporation as a bank holding company in the wake of the global financial crisis, Morgan Stanley also boasts a top 10 banking franchise by deposits, with nearly $400 billion in customer deposits, predominately attributable to cash sweeps from its wealth management and brokerage businesses.

In light of the recent options history for Morgan Stanley, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Morgan Stanley's Current Market Status

- With a volume of 1,665,071, the price of MS is down -0.18% at $164.75.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 65 days.

Professional Analyst Ratings for Morgan Stanley

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $179.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Barclays has decided to maintain their Overweight rating on Morgan Stanley, which currently sits at a price target of $183.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Morgan Stanley, targeting a price of $170.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Morgan Stanley, which currently sits at a price target of $175.

* Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Outperform rating on Morgan Stanley with a target price of $184.

* An analyst from Jefferies has decided to maintain their Buy rating on Morgan Stanley, which currently sits at a price target of $186.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Morgan Stanley with Benzinga Pro for real-time alerts.

Posted In: MS