A Closer Look at Boeing's Options Market Dynamics

Author: Benzinga Insights | November 12, 2025 12:02pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Boeing.

Looking at options history for Boeing (NYSE:BA) we detected 60 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $1,338,116 and 42, calls, for a total amount of $2,315,513.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $105.0 and $240.0 for Boeing, spanning the last three months.

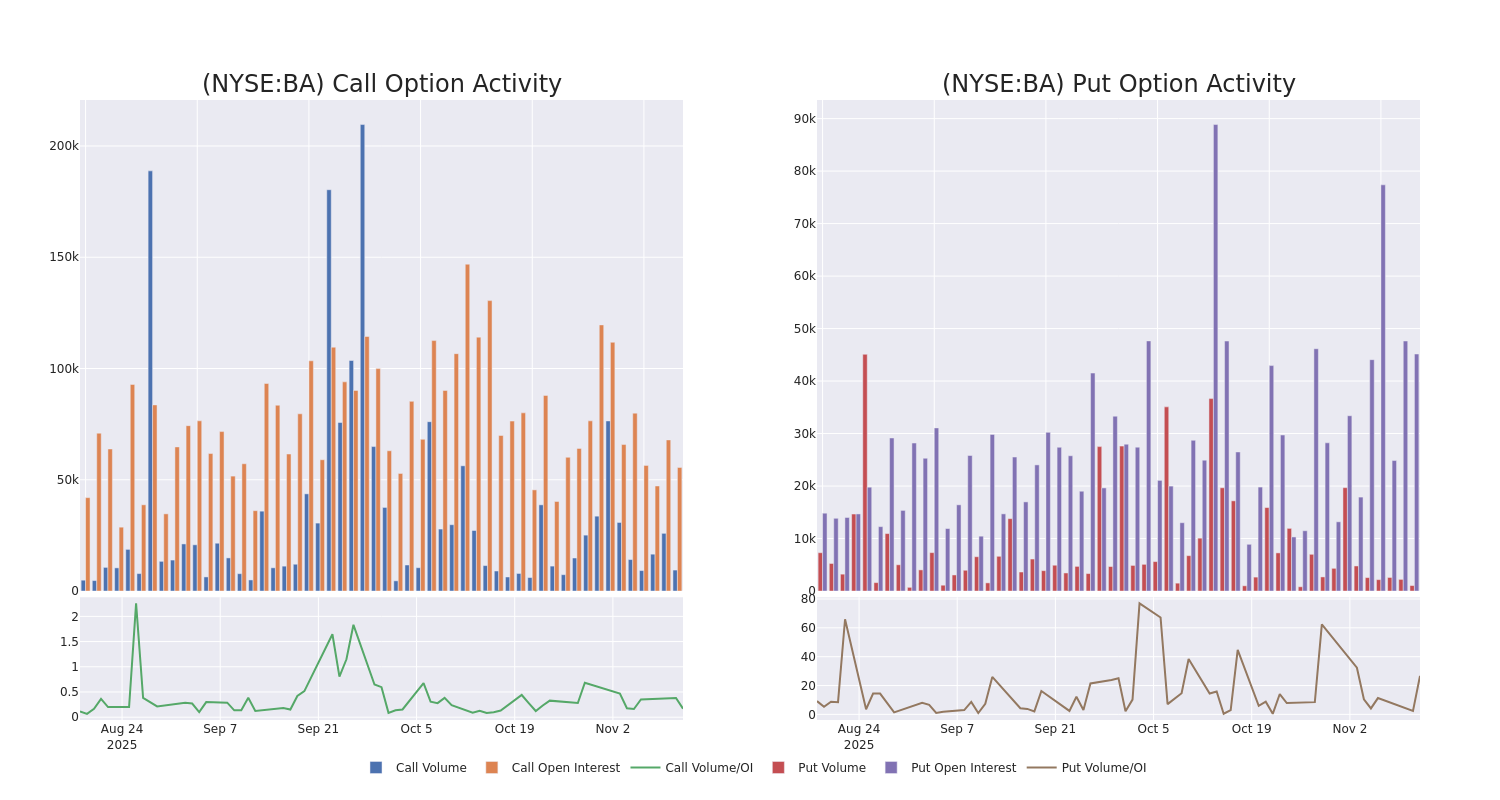

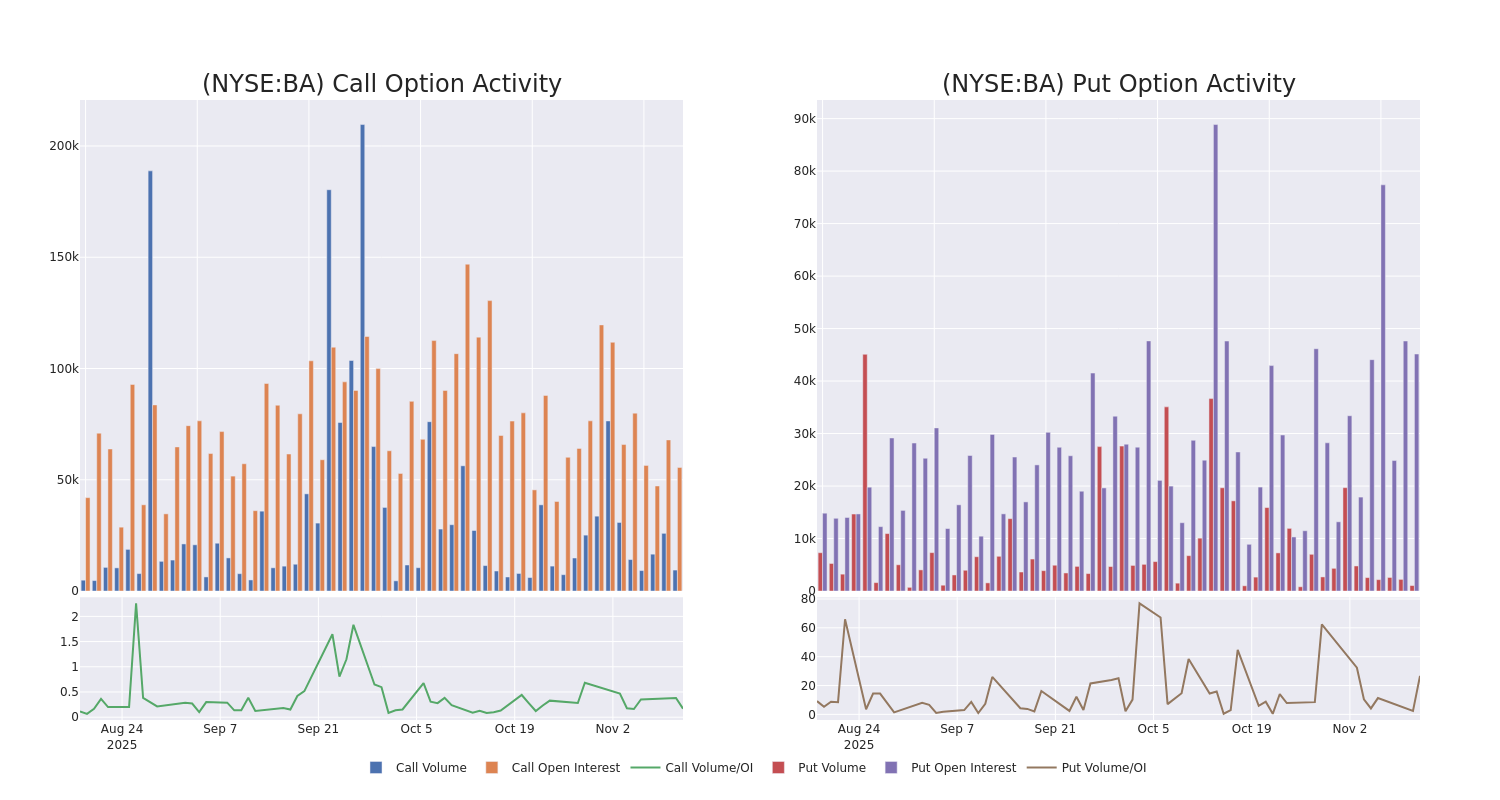

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Boeing's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Boeing's significant trades, within a strike price range of $105.0 to $240.0, over the past month.

Boeing Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BA |

CALL |

SWEEP |

BEARISH |

01/15/27 |

$19.2 |

$18.5 |

$18.5 |

$235.00 |

$166.5K |

700 |

90 |

| BA |

PUT |

TRADE |

NEUTRAL |

02/20/26 |

$32.5 |

$31.9 |

$32.2 |

$225.00 |

$161.0K |

1.6K |

50 |

| BA |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$27.25 |

$24.65 |

$26.0 |

$220.00 |

$130.0K |

4.3K |

56 |

| BA |

PUT |

SWEEP |

BEARISH |

11/21/25 |

$6.3 |

$5.95 |

$6.15 |

$200.00 |

$94.7K |

13.7K |

164 |

| BA |

CALL |

TRADE |

BEARISH |

12/26/25 |

$9.25 |

$8.55 |

$8.55 |

$195.00 |

$85.5K |

125 |

5 |

About Boeing

Boeing is a major aerospace and defense firm operating in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with defense contractors such as Lockheed Martin and Northrop Grumman to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

After a thorough review of the options trading surrounding Boeing, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Boeing's Current Market Status

- With a volume of 2,456,068, the price of BA is down -0.2% at $194.82.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 76 days.

Expert Opinions on Boeing

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $248.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Boeing, which currently sits at a price target of $240.

* In a positive move, an analyst from Freedom Capital Markets has upgraded their rating to Buy and adjusted the price target to $223.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Boeing with a target price of $255.

* An analyst from UBS has decided to maintain their Buy rating on Boeing, which currently sits at a price target of $275.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Boeing options trades with real-time alerts from Benzinga Pro.

Posted In: BA