Check Out What Whales Are Doing With PLTR

Author: Benzinga Insights | November 12, 2025 01:01pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Palantir Technologies.

Looking at options history for Palantir Technologies (NASDAQ:PLTR) we detected 103 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 51% with bearish.

From the overall spotted trades, 51 are puts, for a total amount of $3,128,424 and 52, calls, for a total amount of $14,352,224.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $410.0 for Palantir Technologies during the past quarter.

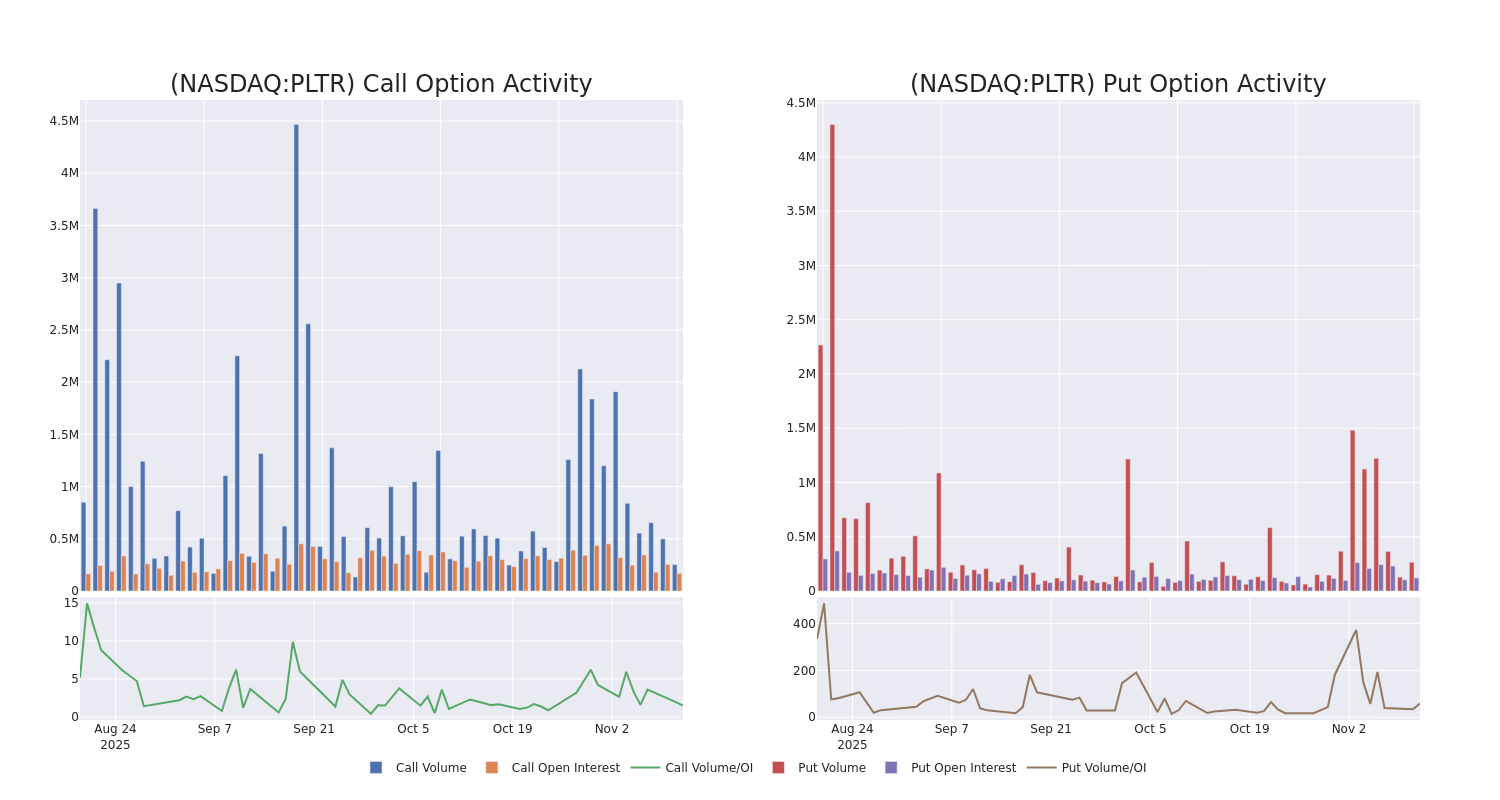

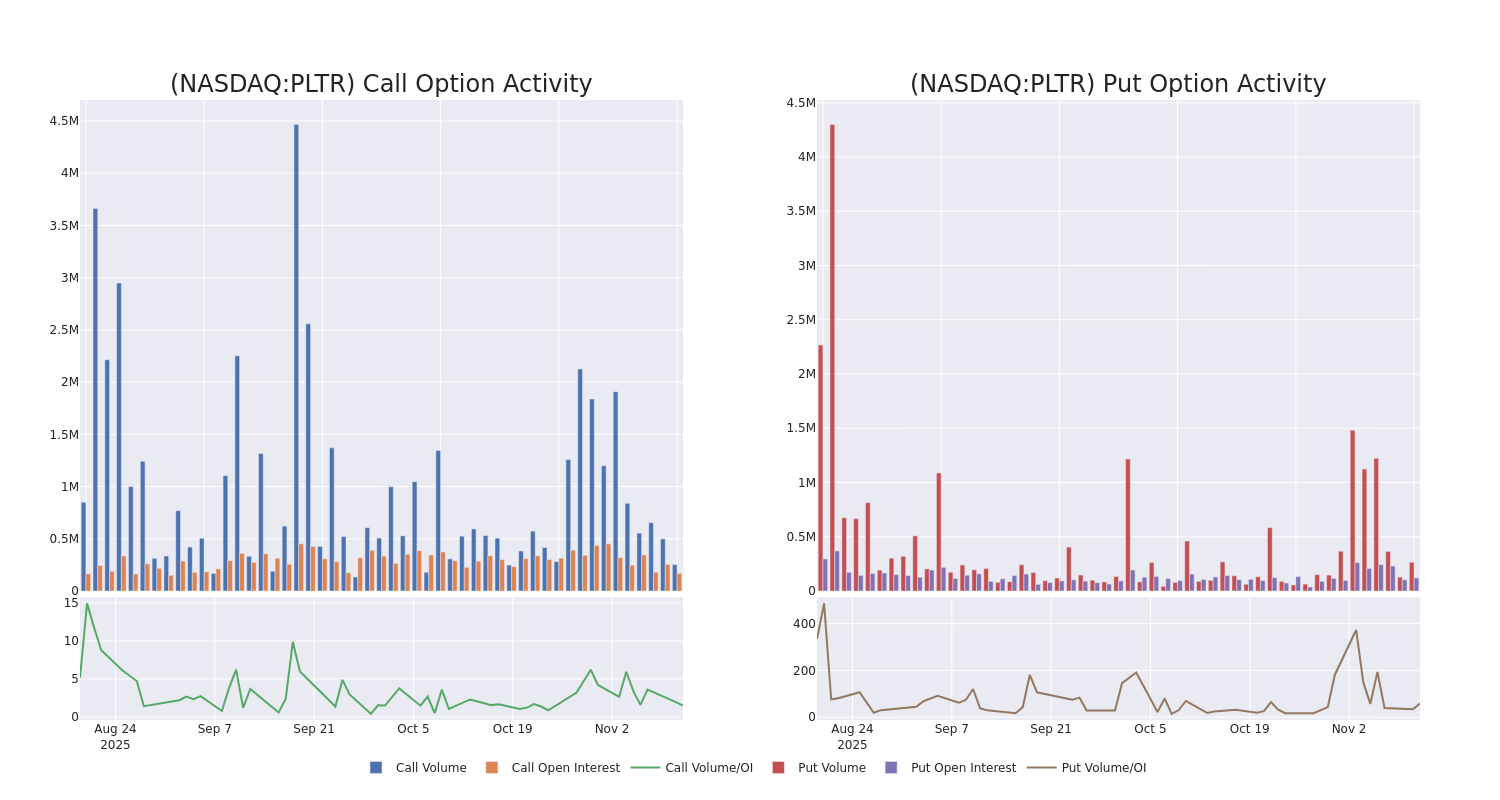

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palantir Technologies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palantir Technologies's whale trades within a strike price range from $35.0 to $410.0 in the last 30 days.

Palantir Technologies Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PLTR |

CALL |

SWEEP |

NEUTRAL |

11/21/25 |

$147.1 |

$146.15 |

$146.64 |

$35.00 |

$7.9M |

9.0K |

315 |

| PLTR |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$148.45 |

$147.1 |

$147.9 |

$35.00 |

$2.9M |

18.9K |

200 |

| PLTR |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$147.0 |

$146.45 |

$146.65 |

$35.00 |

$571.9K |

9.0K |

1.8K |

| PLTR |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$146.85 |

$146.6 |

$146.64 |

$35.00 |

$263.9K |

9.0K |

1.9K |

| PLTR |

PUT |

SWEEP |

NEUTRAL |

12/26/25 |

$24.45 |

$23.85 |

$24.11 |

$200.00 |

$240.8K |

33 |

393 |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. Palantir works only with entities in Western-allied nations and reserves the right not to work with anyone that is antithetical to Western values. The Denver-based company was founded in 2003 and went public in 2020.

Current Position of Palantir Technologies

- With a trading volume of 34,728,143, the price of PLTR is down by -4.48%, reaching $182.4.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 82 days from now.

Professional Analyst Ratings for Palantir Technologies

5 market experts have recently issued ratings for this stock, with a consensus target price of $208.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Buy rating on Palantir Technologies, which currently sits at a price target of $255.

* An analyst from Piper Sandler persists with their Overweight rating on Palantir Technologies, maintaining a target price of $201.

* Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Neutral rating for Palantir Technologies, targeting a price of $198.

* An analyst from Baird persists with their Neutral rating on Palantir Technologies, maintaining a target price of $200.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Palantir Technologies, targeting a price of $190.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palantir Technologies with Benzinga Pro for real-time alerts.

Posted In: PLTR