Buffett Is Underwater Vs. S&P 500 In 2025: $137 Million Loss On Pool Corp Stock Since Q2 Not Helping

Author: Chris Katje | November 12, 2025 02:40pm

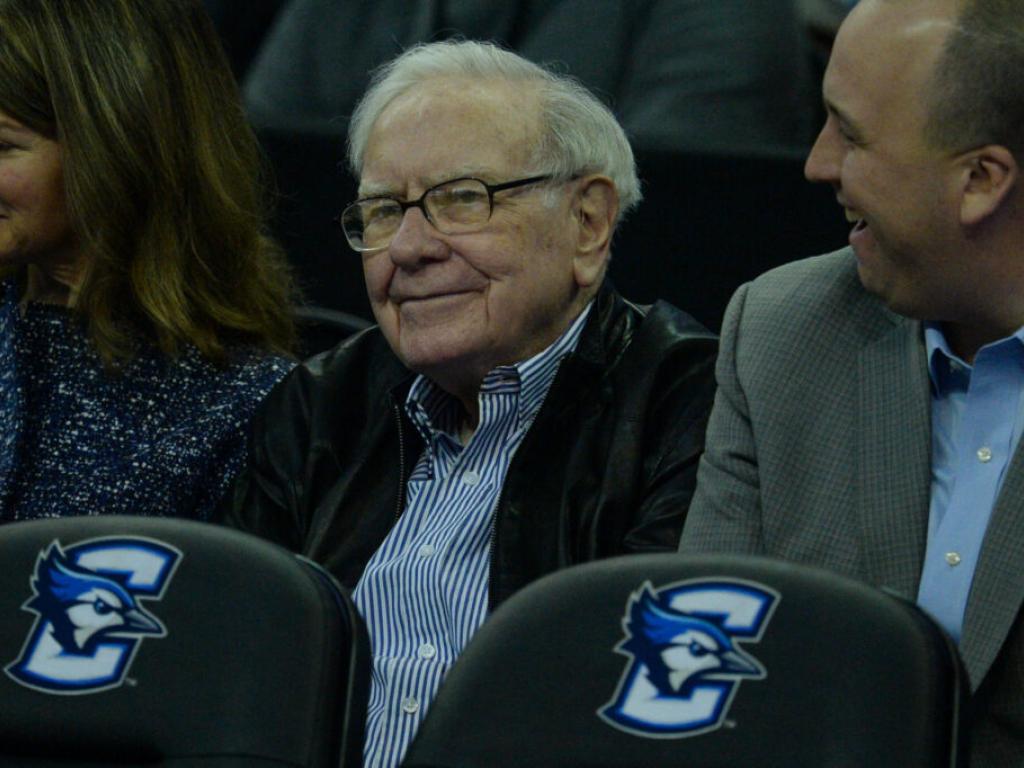

As 2025 draws to a close, it’s evident that legendary investor Warren Buffett underperformed the S&P 500 during his last year as CEO of Berkshire Hathaway Inc (NYSE:BRK)(NYSE:BRK).

Several stocks in the Berkshire Hathaway portfolio have underperformed the market this year, including Pool Corp (NASDAQ:POOL), one of the newer picks from the Buffett-led conglomerate.

Pool Corp Stock Struggles

In the second quarter of 2025, Berkshire's 13F filing revealed that Buffett and his team of investors increased their position in Pool Corp stock by 136%.

That increase followed the first quarter, when the stake grew by 145%.

Berkshire Hathaway first took a stake in Pool Corp in the third quarter of 2024, buying 404,057 shares.

At the end of the second quarter of 2025, the position stood at 3,458,885 shares.

Pool Corp is the world's leading wholesale distributor of pool equipment, parts and supplies. The company has missed analyst revenue estimates for three straight quarters, and shares have taken a hit in 2025.

The stock trades at $251.87 today, versus a closing price of $291.48 on June 30 to end the second quarter.

This means that Berkshire Hathaway's stake is currently worth $871,189,364.95 and down $137,006,434.85 since the end of the second quarter. The $137 million decline represents a loss of around 13.6% since the end of the second quarter.

Read Also: Market Expert Jay Woods Highlights ‘Interesting’ Trades By Warren Buffett: ‘Is The Style Of Berkshire Getting More Active Than Passive?’

Underperforming the S&P 500

With his retirement as CEO of Berkshire Hathaway nearly here, there is little doubt that Buffett will go down as one of the greatest investors of all time.

The legendary investor could end his run on a bad note with Berkshire Hathaway currently trailing the S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY).

Berkshire Hathaway beat the SPDR S&P 500 ETF Trust in 11 of the last 20 years, including three of the last four years.

Year-to-date, Berkshire Hathaway stock is up 11.3%, compared to a 16.9% gain for the SPY. With less than two months to go, it would take a strong finish by Berkshire and some of its investments to beat the S&P 500.

One of the next potential catalysts is coming this week. The third-quarter 13F filing from Buffett and Berkshire Hathaway is nearly here and will show whether any new positions were taken, whether any positions were sold in their entirety, and what changes were made.

With Pool Corp one of the recent favorites seeing strong increases in the position size this year, the report will show if the trend continues in the third quarter or not.

Read Next:

© Steven Branscombe-Imagn Images

Posted In: BRK POOL SPY