This Is What Whales Are Betting On Cipher Mining

Author: Benzinga Insights | November 13, 2025 11:01am

Whales with a lot of money to spend have taken a noticeably bullish stance on Cipher Mining.

Looking at options history for Cipher Mining (NASDAQ:CIFR) we detected 62 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 13 are puts, for a total amount of $1,735,717 and 49, calls, for a total amount of $7,423,254.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $4.0 and $40.0 for Cipher Mining, spanning the last three months.

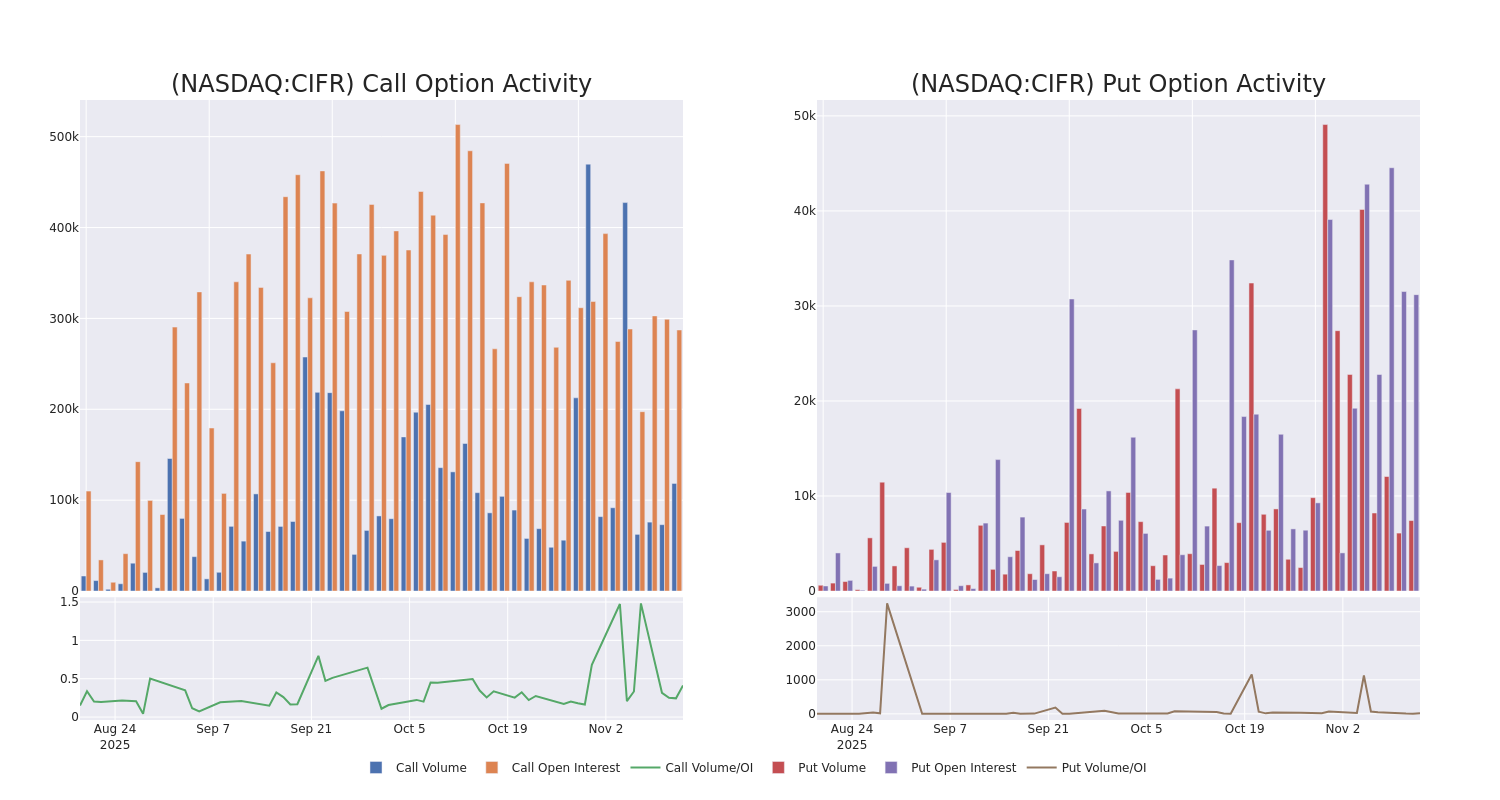

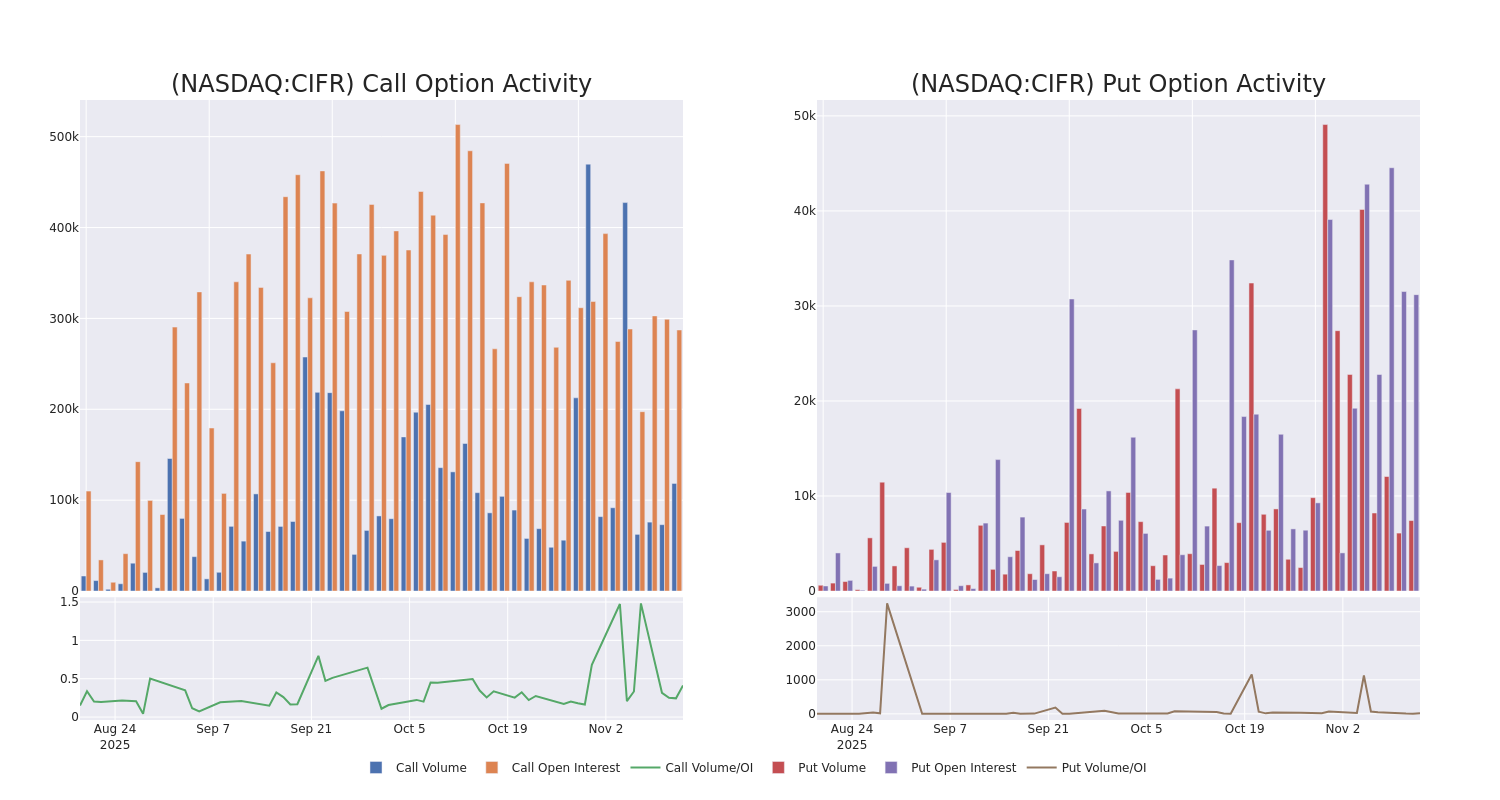

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Cipher Mining's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cipher Mining's whale trades within a strike price range from $4.0 to $40.0 in the last 30 days.

Cipher Mining Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CIFR |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$7.5 |

$7.15 |

$7.45 |

$15.00 |

$451.3K |

9.1K |

9.0K |

| CIFR |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$7.95 |

$7.55 |

$7.95 |

$15.00 |

$357.0K |

9.1K |

4.0K |

| CIFR |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$7.85 |

$7.5 |

$7.85 |

$15.00 |

$353.2K |

9.1K |

5.4K |

| CIFR |

CALL |

TRADE |

BULLISH |

01/15/27 |

$7.85 |

$7.55 |

$7.85 |

$15.00 |

$353.2K |

9.1K |

4.5K |

| CIFR |

CALL |

TRADE |

BULLISH |

01/15/27 |

$7.85 |

$7.55 |

$7.85 |

$15.00 |

$353.2K |

9.1K |

3.1K |

About Cipher Mining

Cipher Mining Inc ia an emerging technology company that operates in the Bitcoin mining ecosystem in the United States. The company is developing a cryptocurrency mining business, specializing in Bitcoin. The company is expanding and strengthening the Bitcoin network's critical infrastructure in the United States.

Current Position of Cipher Mining

- With a trading volume of 15,167,503, the price of CIFR is down by -3.97%, reaching $16.69.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 103 days from now.

Professional Analyst Ratings for Cipher Mining

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $28.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Cipher Mining, targeting a price of $27.

* Maintaining their stance, an analyst from Macquarie continues to hold a Outperform rating for Cipher Mining, targeting a price of $27.

* Consistent in their evaluation, an analyst from Clear Street keeps a Buy rating on Cipher Mining with a target price of $34.

* Consistent in their evaluation, an analyst from HC Wainwright & Co. keeps a Buy rating on Cipher Mining with a target price of $30.

* Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Cipher Mining, targeting a price of $26.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cipher Mining, Benzinga Pro gives you real-time options trades alerts.

Posted In: CIFR