Check Out What Whales Are Doing With IBM

Author: Benzinga Insights | November 13, 2025 11:01am

Financial giants have made a conspicuous bearish move on IBM. Our analysis of options history for IBM (NYSE:IBM) revealed 19 unusual trades.

Delving into the details, we found 26% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $309,101, and 13 were calls, valued at $896,045.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $350.0 for IBM over the last 3 months.

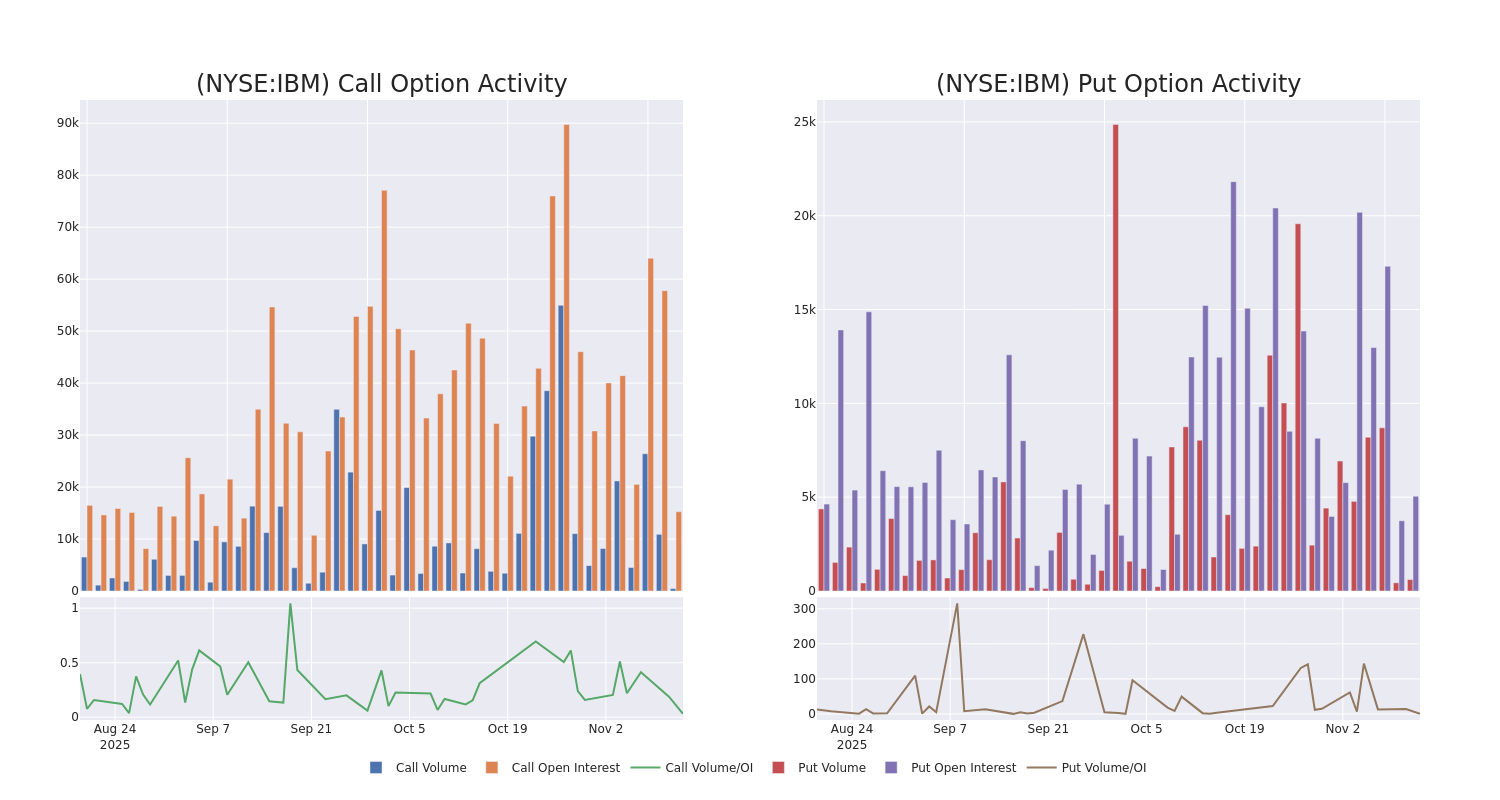

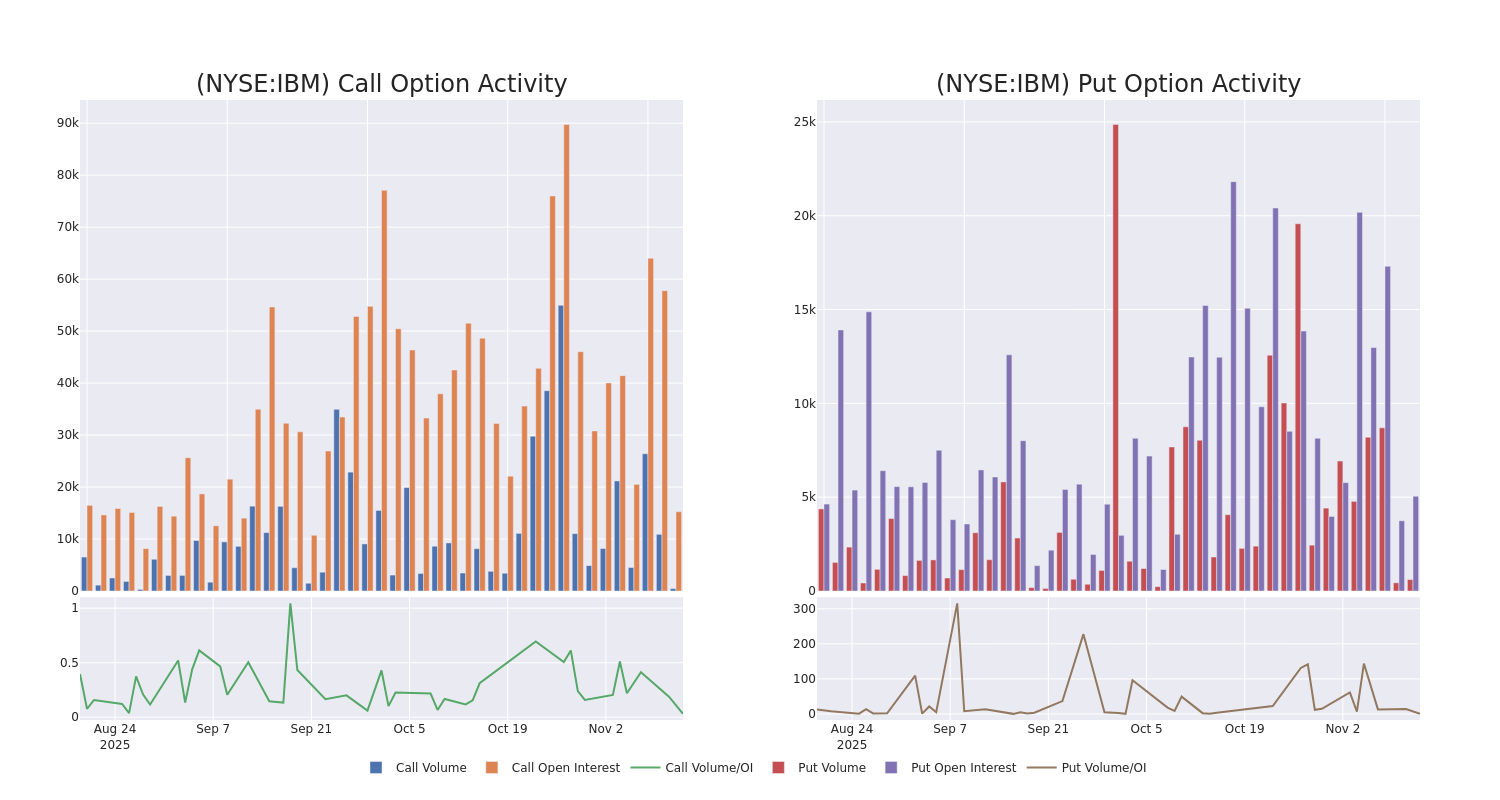

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for IBM's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM's whale trades within a strike price range from $150.0 to $350.0 in the last 30 days.

IBM Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| IBM |

CALL |

TRADE |

BULLISH |

01/16/26 |

$23.0 |

$22.4 |

$23.0 |

$300.00 |

$230.0K |

3.0K |

101 |

| IBM |

CALL |

TRADE |

BEARISH |

05/15/26 |

$97.3 |

$95.5 |

$95.5 |

$220.00 |

$95.5K |

2.9K |

10 |

| IBM |

CALL |

SWEEP |

BULLISH |

05/15/26 |

$95.5 |

$94.3 |

$95.49 |

$220.00 |

$95.4K |

2.9K |

10 |

| IBM |

CALL |

TRADE |

BEARISH |

01/16/26 |

$9.05 |

$8.5 |

$8.5 |

$330.00 |

$85.0K |

1.5K |

27 |

| IBM |

PUT |

TRADE |

BULLISH |

11/21/25 |

$5.0 |

$4.0 |

$4.2 |

$310.00 |

$84.0K |

1.3K |

42 |

About IBM

Incorporated in 1911, International Business Machines, or IBM, is one of the oldest technology companies in the world. It provides software, IT consulting services, and hardware to help business customers modernize their technology workflows. IBM operates in 175 countries and employs approximately 300,000 people. The company has a robust roster of business partners to service its clients, which includes 95% of all Fortune 500 companies. IBM's products, including Red Hat, watsonx, and mainframes, handle some of the world's most important data workloads in areas like finance and retail.

In light of the recent options history for IBM, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of IBM

- Trading volume stands at 1,109,945, with IBM's price down by -1.63%, positioned at $309.84.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 76 days.

What The Experts Say On IBM

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $305.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Buy rating on IBM, which currently sits at a price target of $315.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $315.

* Maintaining their stance, an analyst from Jefferies continues to hold a Hold rating for IBM, targeting a price of $300.

* Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on IBM with a target price of $295.

* An analyst from RBC Capital has decided to maintain their Outperform rating on IBM, which currently sits at a price target of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IBM options trades with real-time alerts from Benzinga Pro.

Posted In: IBM