Solana Down 5% — Charts Now Show A Clear Path Toward The $130 Danger Zone

Author: Parshwa Turakhiya | November 13, 2025 03:07pm

Solana (CRYPTO: SOL) fell about 5% on Thursday as the token slipped deeper into a multi-week downtrend.

Sellers Press Price Below $150 Support

SOL Price Dynamics (Source: TradingView)

Solana broke below the $150 level after failing to hold the mid-range support that marked the market's July floor.

Price has now returned to the $144–$148 demand zone, which remains the last high-volume shelf before the chart opens toward deeper support near $130.

A descending trendline from the September high continues to guide each lower high.

The latest rejection at the EMA band between $168 and $185 reinforced that ceiling and triggered the current leg lower.

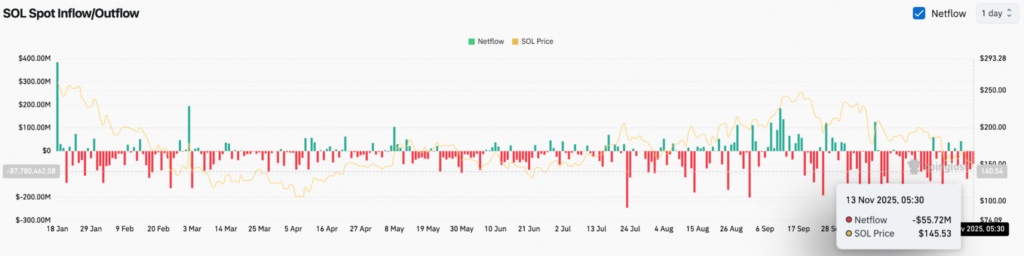

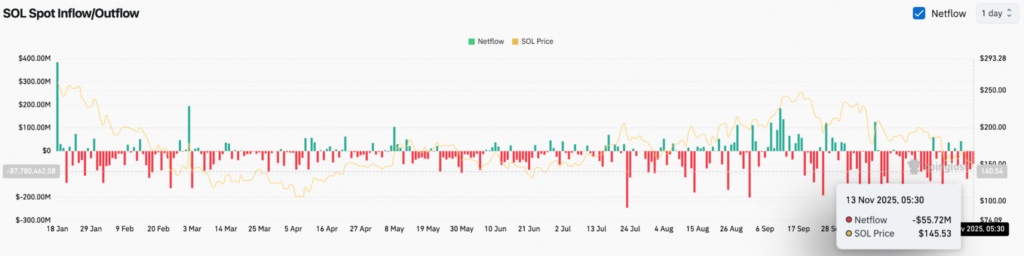

Flows Turn Negative As Outflows Mount

SOL Netflows (Source: Coinglass)

According to Coinglass, Solana saw net outflows of almost $56 million on Nov. 13, extending a multi-week run of red prints.

Outflows have dominated since mid-August and have matched each strong downside move.

Investors tracking liquidity patterns may see these readings as confirmation that the trend remains heavy.

Short-Term Signals Show Continued Weakness

SOL Price Analysis (Source: TradingView)

On the 30-minute chart, Solana fell below the Supertrend line after the indicator flipped bearish near $157.

The breakdown sent volatility higher and pushed RSI toward oversold conditions near 19.

Oversold readings can trigger brief relief bounces, but the short-term bias stays negative unless price regains the $151–$153 area.

Failure to reclaim that zone keeps sellers in control of intraday momentum.

Read Next:

Image: Shutterstock

Posted In: $SOL