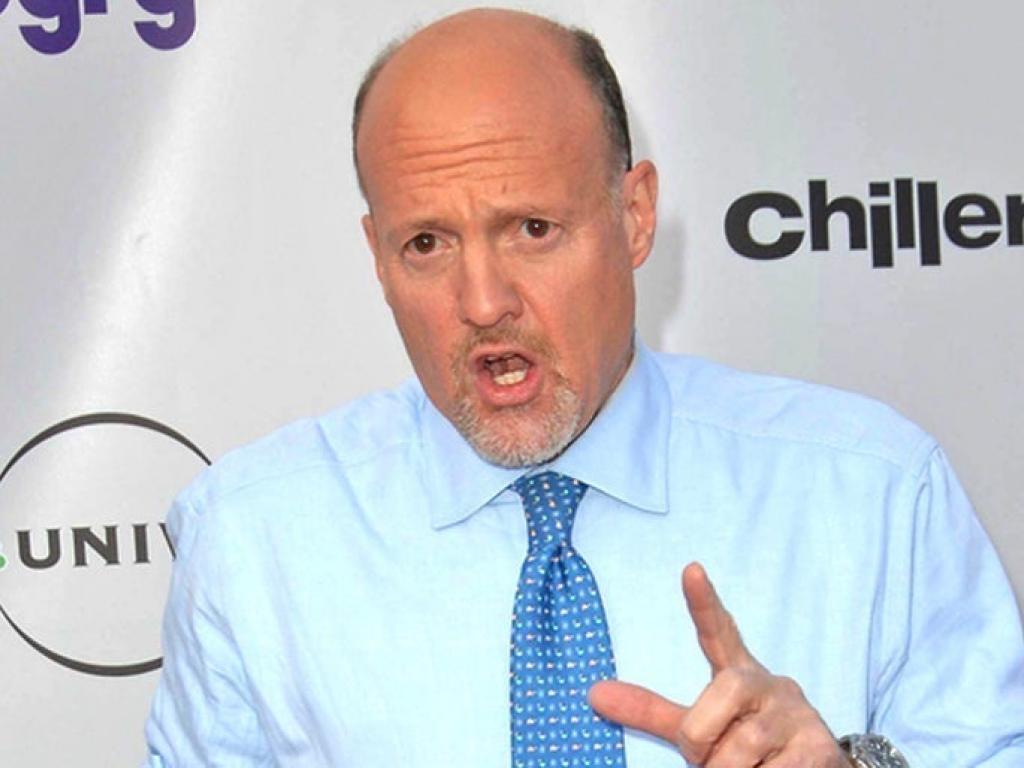

Jim Cramer Warns 'The Business Is Really Bad' At This Consumer Cyclical Stock

Author: Avi Kapoor | November 14, 2025 08:07am

On CNBC's “Mad Money Lightning Round,” on Thursday, Jim Cramer said he would not own CarMax, Inc. (NYSE:KMX) stock. “I think that the business is really bad there,” he noted.

Supporting his view, Barclays analyst John Babcock initiated coverage of CarMax on Nov. 12 with an Underweight rating and a price target of $28.

Cramer said the “fundamentals are very good” at ServiceNow, Inc. (NYSE:NOW). “If you invest for the long term, I want you to hold it,” he added.

Supporting his view, ServiceNow, on Oct. 29, reported better-than-expected third-quarter financial results and announced a five-for-one stock split. ServiceNow reported quarterly earnings of $4.82 per share, which beat the analyst estimate of $4.27. Quarterly revenue came in at $3.4 billion, which beat the analyst consensus estimate of $3.35 billion.

When asked about Conagra Brands, Inc. (NYSE:CAG), he said, “I do not invest in companies that have flat revenues for multiple years.”

The company, on Oct. 1, reported quarterly net sales of $2.63 billion, down 5.8% from the prior-year period, while adjusted earnings per share of 39 cents fell 26.4%.

Price Action:

- ServiceNow shares fell 1.7% to settle at $849.69 on Thursday.

- CarMax shares gained 1.1% to close at $34.79.

- Conagra shares rose 0.5% to settle at $17.43 on Thursday.

Read Next:

Photo: Shutterstock

Posted In: CAG KMX NOW