A Preview Of Kanzhun's Earnings

Author: Benzinga Insights | November 17, 2025 10:00am

Kanzhun (NASDAQ:BZ) is set to give its latest quarterly earnings report on Tuesday, 2025-11-18. Here's what investors need to know before the announcement.

Analysts estimate that Kanzhun will report an earnings per share (EPS) of $0.23.

The market awaits Kanzhun's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

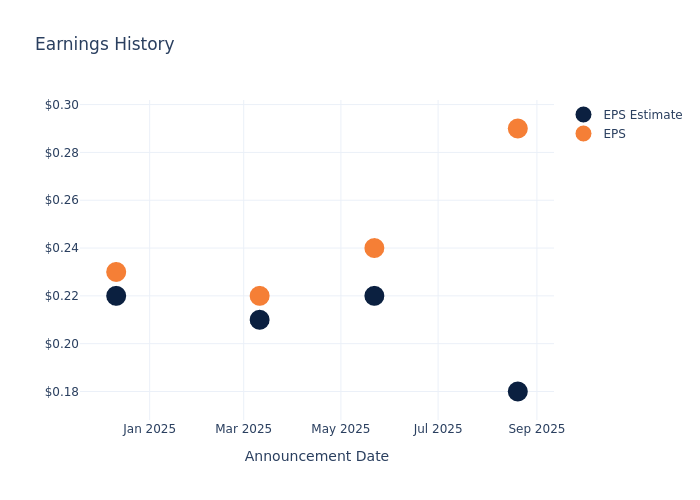

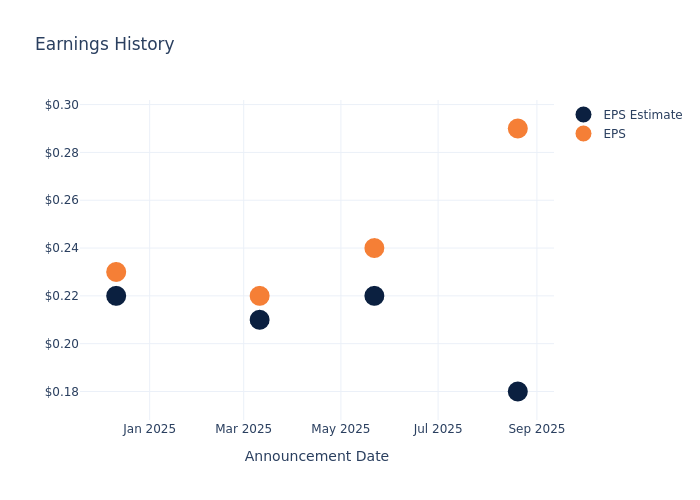

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.11, leading to a 6.61% increase in the share price on the subsequent day.

Here's a look at Kanzhun's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.18 |

0.22 |

0.21 |

0.22 |

| EPS Actual |

0.29 |

0.24 |

0.22 |

0.23 |

| Price Change % |

7.00 |

1.00 |

2.00 |

2.00 |

Kanzhun Share Price Analysis

Shares of Kanzhun were trading at $20.56 as of November 14. Over the last 52-week period, shares are up 50.63%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Kanzhun

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Kanzhun.

Analysts have given Kanzhun a total of 3 ratings, with the consensus rating being Buy. The average one-year price target is $25.0, indicating a potential 21.6% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Paylocity Holding, Dayforce and Robert Half, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Paylocity Holding, with an average 1-year price target of $186.25, suggesting a potential 805.89% upside.

- Analysts currently favor an Neutral trajectory for Dayforce, with an average 1-year price target of $73.12, suggesting a potential 255.64% upside.

- Analysts currently favor an Neutral trajectory for Robert Half, with an average 1-year price target of $34.2, suggesting a potential 66.34% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary outlines pivotal metrics for Paylocity Holding, Dayforce and Robert Half, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Paycom Software |

Neutral |

9.16% |

$407.90M |

6.31% |

| Paylocity Holding |

Buy |

12.46% |

$279.79M |

4.11% |

| Dayforce |

Neutral |

9.45% |

$242.80M |

-7.29% |

| Robert Half |

Neutral |

-7.54% |

$504.23M |

3.30% |

Key Takeaway:

Kanzhun ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity. Overall, Kanzhun's performance is strong in terms of revenue and profit growth, but it lags behind in generating returns for its equity holders.

About Kanzhun

Kanzhun's Boss Zhipin job platform connects job seekers and employers. Boss Zhipin is China's largest online recruitment platform based on monthly active users, or MAU, and was established in 2014. Kanzhun earns revenue by providing services to enterprise customers primarily through its mobile app, which promotes engagement between recruiters and workers and operates on a recommendation basis powered by artificial intelligence. The platform specializes in transportation, logistics, construction, and service-based industries. About 85% of the companies looking to hire are small and medium-size enterprises. Its main competitors are 58.com, 51job, and Zhilian Zhaopin. Tencent has a 9.2% stake in Kanzhun.

Unraveling the Financial Story of Kanzhun

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Kanzhun's revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 9.69%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Kanzhun's net margin is impressive, surpassing industry averages. With a net margin of 34.36%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Kanzhun's ROE excels beyond industry benchmarks, reaching 4.44%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Kanzhun's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.48% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Kanzhun's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

To track all earnings releases for Kanzhun visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BZ