Spotlight on Applied Mat: Analyzing the Surge in Options Activity

Author: Benzinga Insights | November 17, 2025 12:02pm

Investors with a lot of money to spend have taken a bullish stance on Applied Mat (NASDAQ:AMAT).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMAT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 16 uncommon options trades for Applied Mat.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 25%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $969,673, and 13 are calls, for a total amount of $1,257,509.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $330.0 for Applied Mat during the past quarter.

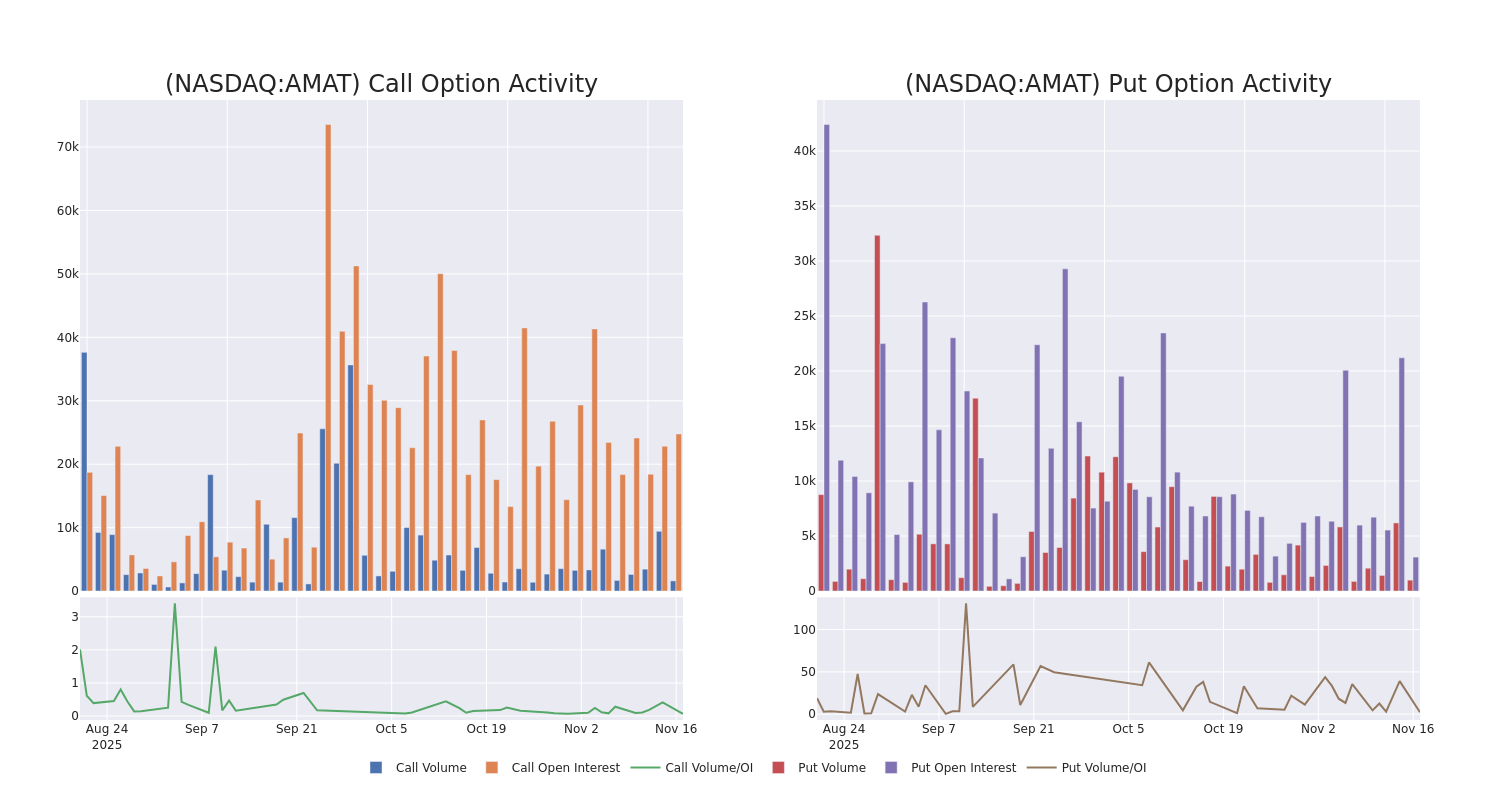

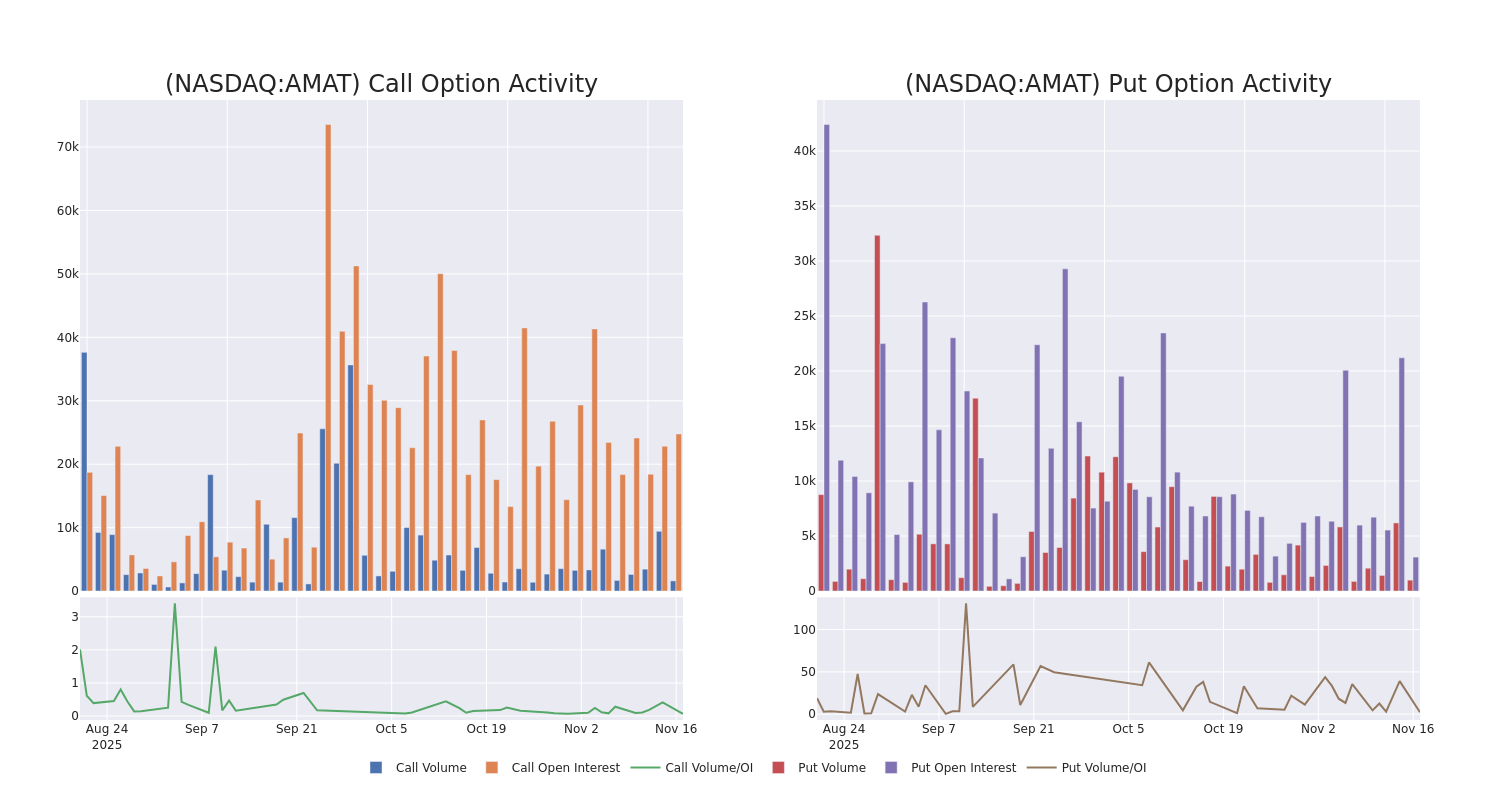

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Mat's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Applied Mat's significant trades, within a strike price range of $110.0 to $330.0, over the past month.

Applied Mat Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AMAT |

PUT |

TRADE |

NEUTRAL |

03/20/26 |

$9.3 |

$9.0 |

$9.13 |

$195.00 |

$639.1K |

1.0K |

714 |

| AMAT |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$6.45 |

$6.3 |

$6.3 |

$260.00 |

$597.3K |

2.1K |

956 |

| AMAT |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$11.25 |

$10.95 |

$10.95 |

$220.00 |

$278.1K |

1.9K |

268 |

| AMAT |

CALL |

TRADE |

NEUTRAL |

12/18/26 |

$128.0 |

$124.5 |

$126.35 |

$110.00 |

$126.3K |

156 |

10 |

| AMAT |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$16.05 |

$16.05 |

$16.05 |

$330.00 |

$81.8K |

182 |

0 |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment manufacturer in the world. It has a broad portfolio spanning nearly every corner of the WFE ecosystem. Applied Materials holds leading market share in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

In light of the recent options history for Applied Mat, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Applied Mat Standing Right Now?

- Trading volume stands at 2,431,568, with AMAT's price up by 2.19%, positioned at $230.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 87 days.

What The Experts Say On Applied Mat

5 market experts have recently issued ratings for this stock, with a consensus target price of $252.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Applied Mat with a target price of $250.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $300.

* An analyst from B. Riley Securities downgraded its action to Buy with a price target of $270.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Applied Mat, targeting a price of $250.

* An analyst from Craig-Hallum has revised its rating downward to Hold, adjusting the price target to $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Applied Mat, Benzinga Pro gives you real-time options trades alerts.

Posted In: AMAT