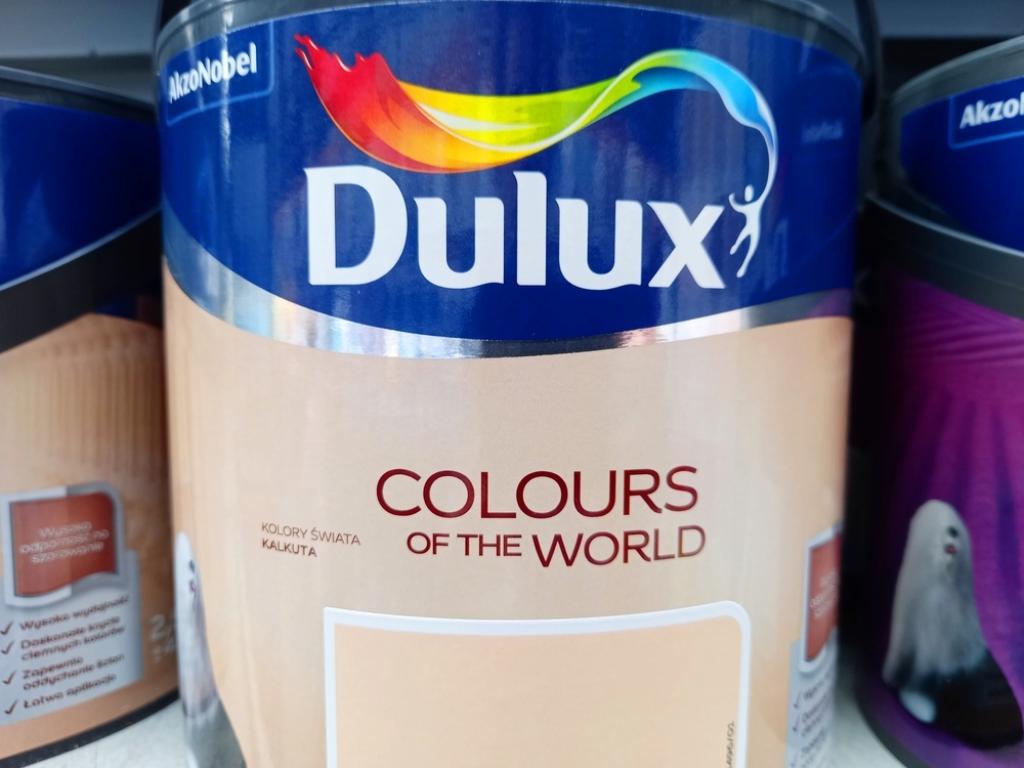

Dulux Paint Parent Akzo Nobel And Axalta Merge To Form $25 Billion Coatings Giant

Author: Akanksha Bakshi | November 18, 2025 06:50am

Two leading names in the coatings sector are preparing for a major shift, with Axalta Coating Systems Ltd. (NYSE:AXTA) shares surging following the announcement.

Akzo Nobel N.V. (OTC:AKZOY) and Axalta Coating Systems announced that they will merge in an all-stock transaction between equals, a move expected to create a global coatings powerhouse valued at approximately $25 billion.

AkzoNobel N.V. owns a broad portfolio spanning decorative and performance coatings, including well-known paint brands like Dulux, Hammerite, Cuprinol, and Polycell, along with professional and industrial lines such as International, Sikkens, Interpon, and Alabastine.

Axalta Coating Systems' portfolio includes leading refinish, commercial vehicle, and industrial coatings, including Cromax, Spies Hecker, Standox, and Imron, along with powder and protective lines such as Alesta, Nap-Gard, and Voltatex, plus additional brands like Duxone, Nason, and Raptor.

Deal Terms And Scale

The new entity will combine the two companies' complementary portfolios, creating a business with projected 2024 revenues of around $17 billion and a free cash flow of about $1.5 billion.

Also Read: Sherwin-Williams Shines In Q3 Thanks To Strong Paint And Coatings Sales Despite Soft Demand

The merger is expected to deliver approximately $600 million in run-rate cost synergies, with around 90% of those savings anticipated to occur within three years of the closing date.

The combined business will span over 160 countries and bring together specialty coatings brands across various end markets, including industrial, mobility, decorative, marine, and protective segments.

The merger is designed to enhance innovation, expand geographic reach, and deliver a comprehensive range of coatings solutions.

Leadership And Structure

Following the merger, the unified company will be domiciled in the Netherlands and listed solely on the New York Stock Exchange after a brief dual listing period. Headquarters will be located in both Amsterdam and Philadelphia.

Governance will feature a one-tier board chaired by Rakesh Sachdev, the current chair of Axalta's board. Greg Poux-Guillaume, CEO of AkzoNobel, will become CEO of the combined entity, and Chris Villavarayan, CEO of Axalta, will serve as Deputy CEO.

The shareholders of both companies are expected to vote in mid-2026, with a closing target of late 2026 to early 2027, subject to regulatory approvals and other customary closing conditions.

Upon closing, Akzo Nobel shareholders will own approximately 55% of the combined company, and Axalta shareholders will own roughly 45%. The exchange ratio is 0.6539 Akzo Nobel shares for each Axalta share.

Financial Profile And Outlook

With the estimated synergies and combined scale, the company expects adjusted EBITDA margins of nearly 20% and healthy cash generation, providing flexibility for dividend payments and capital returns. Net leverage is guided toward 2.0×-2.5×. Key benefits include global scale, innovation platforms, and operational efficiency.

Price Action: AXTA shares were trading higher by 6.64% to $30.05 premarket at last check Tuesday.

Read Next:

Photo by Magda Wygralak via Shutterstock

Posted In: AKZOY AXTA