Decoding Danaher's Options Activity: What's the Big Picture?

Author: Benzinga Insights | November 18, 2025 01:01pm

Financial giants have made a conspicuous bearish move on Danaher. Our analysis of options history for Danaher (NYSE:DHR) revealed 14 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $320,193, and 4 were calls, valued at $162,900.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $220.0 and $240.0 for Danaher, spanning the last three months.

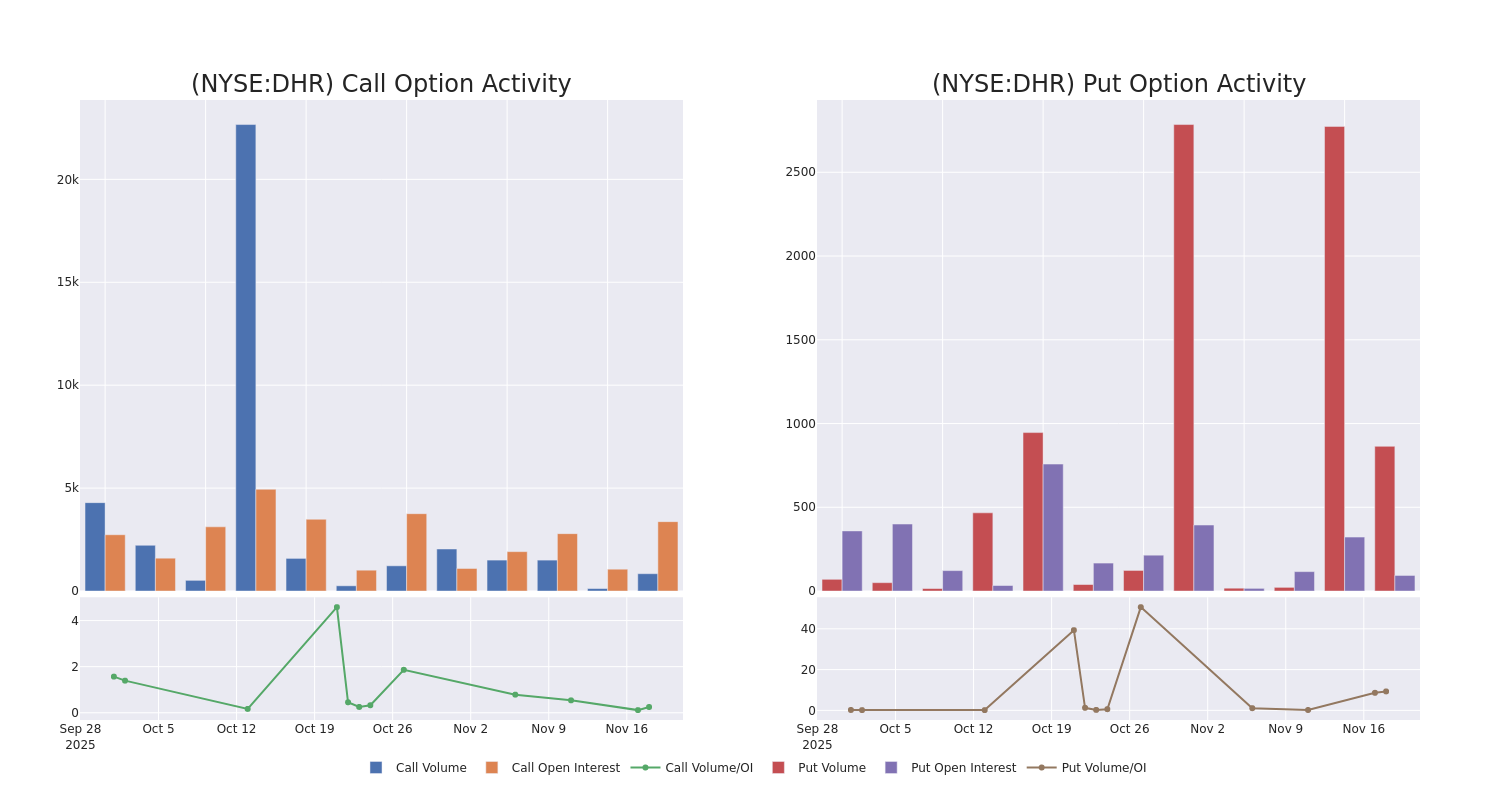

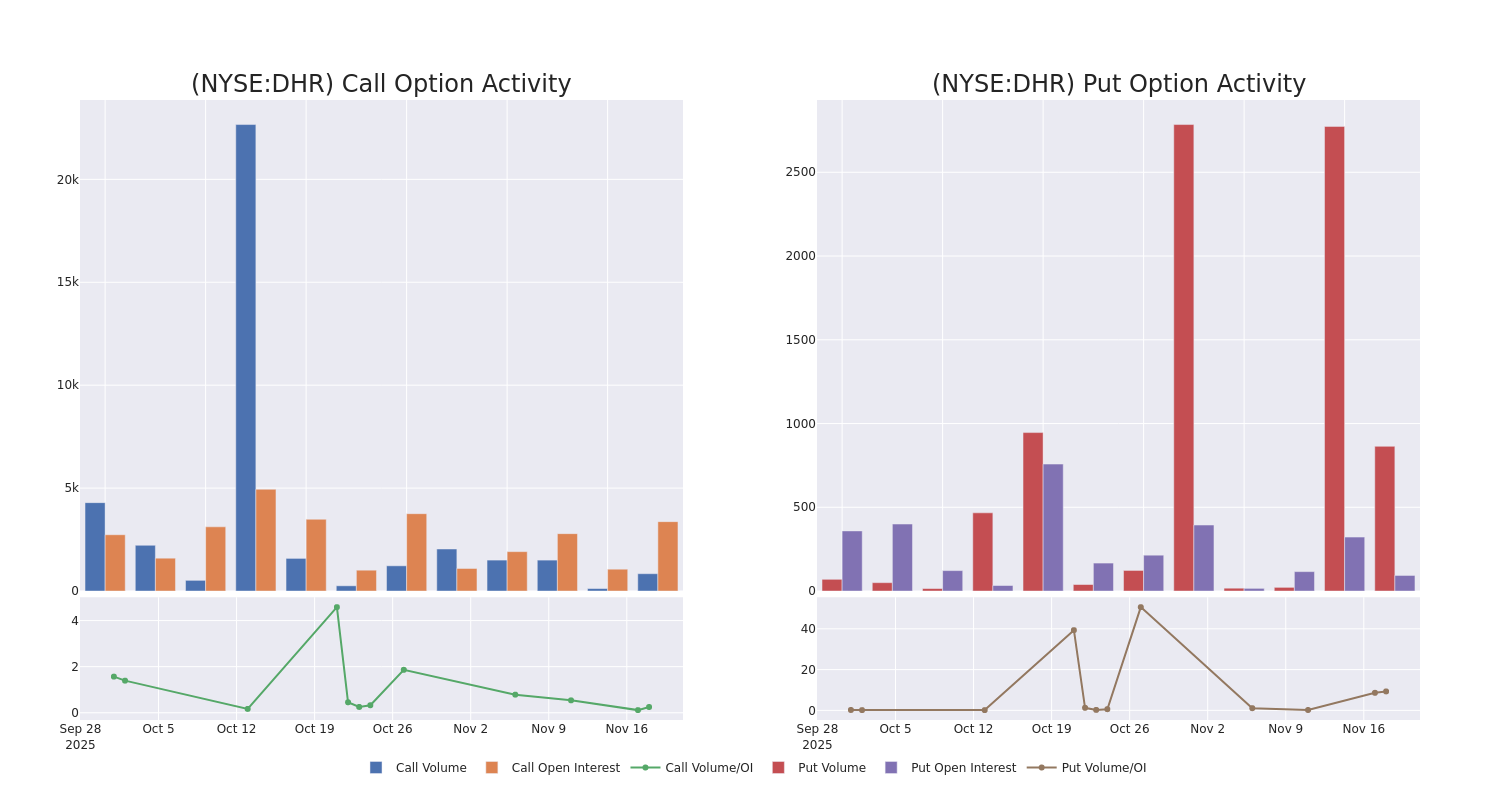

Volume & Open Interest Development

In today's trading context, the average open interest for options of Danaher stands at 866.25, with a total volume reaching 1,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Danaher, situated within the strike price corridor from $220.0 to $240.0, throughout the last 30 days.

Danaher Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DHR |

CALL |

TRADE |

BEARISH |

11/21/25 |

$3.8 |

$1.8 |

$2.35 |

$222.50 |

$58.7K |

614 |

251 |

| DHR |

CALL |

TRADE |

BEARISH |

11/21/25 |

$2.9 |

$1.75 |

$2.05 |

$222.50 |

$51.2K |

614 |

517 |

| DHR |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$21.6 |

$20.1 |

$20.84 |

$240.00 |

$35.4K |

93 |

63 |

| DHR |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$21.9 |

$21.4 |

$21.65 |

$240.00 |

$34.6K |

93 |

125 |

| DHR |

PUT |

TRADE |

BEARISH |

01/16/26 |

$21.5 |

$20.9 |

$21.35 |

$240.00 |

$34.1K |

93 |

188 |

About Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Then, through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life sciences and diagnostic industries after the late 2023 divestiture of its environmental and applied solutions group, Veralto.

In light of the recent options history for Danaher, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Danaher Standing Right Now?

- With a trading volume of 1,839,817, the price of DHR is up by 1.81%, reaching $224.42.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 71 days from now.

What The Experts Say On Danaher

In the last month, 3 experts released ratings on this stock with an average target price of $246.67.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Danaher, targeting a price of $260.

* An analyst from Barclays has decided to maintain their Overweight rating on Danaher, which currently sits at a price target of $250.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Danaher, targeting a price of $230.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Danaher options trades with real-time alerts from Benzinga Pro.

Posted In: DHR