Taiwan Semiconductor Unusual Options Activity

Author: Benzinga Insights | November 18, 2025 02:01pm

Investors with a lot of money to spend have taken a bullish stance on Taiwan Semiconductor (NYSE:TSM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 220 uncommon options trades for Taiwan Semiconductor.

This isn't normal.

The overall sentiment of these big-money traders is split between 56% bullish and 32%, bearish.

Out of all of the special options we uncovered, 128 are puts, for a total amount of $12,615,431, and 92 are calls, for a total amount of $6,926,092.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $450.0 for Taiwan Semiconductor over the last 3 months.

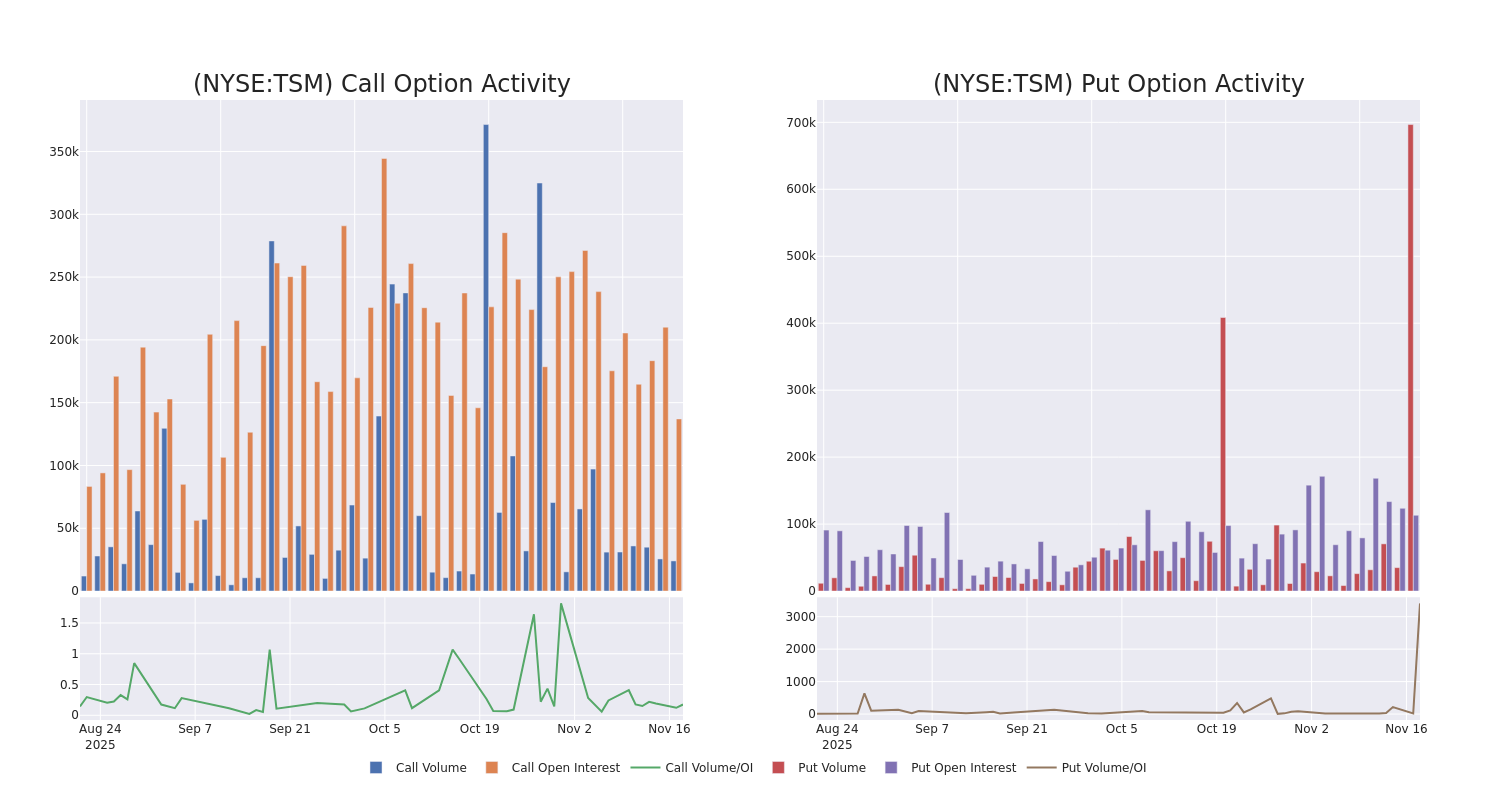

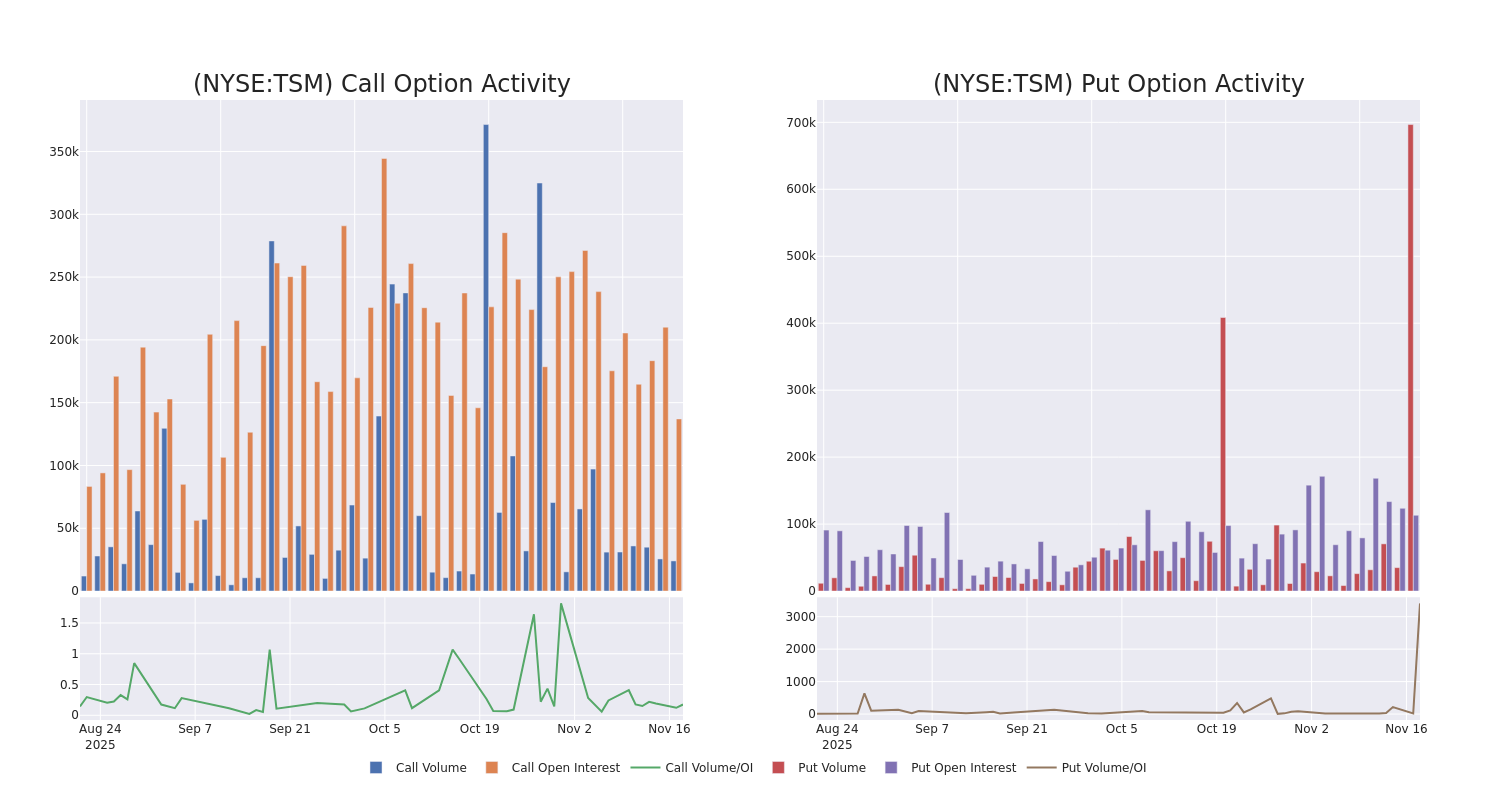

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Taiwan Semiconductor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Taiwan Semiconductor's substantial trades, within a strike price spectrum from $105.0 to $450.0 over the preceding 30 days.

Taiwan Semiconductor Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TSM |

PUT |

TRADE |

BULLISH |

12/05/25 |

$5.3 |

$4.8 |

$4.85 |

$265.00 |

$242.5K |

3.3K |

820 |

| TSM |

PUT |

TRADE |

BULLISH |

12/05/25 |

$4.9 |

$4.5 |

$4.55 |

$265.00 |

$227.5K |

3.3K |

1.3K |

| TSM |

PUT |

SWEEP |

BULLISH |

12/18/26 |

$43.05 |

$42.3 |

$42.3 |

$280.00 |

$211.5K |

389 |

53 |

| TSM |

CALL |

TRADE |

BEARISH |

06/18/26 |

$24.5 |

$24.1 |

$24.2 |

$310.00 |

$191.1K |

453 |

207 |

| TSM |

PUT |

SWEEP |

BULLISH |

01/15/27 |

$34.65 |

$34.25 |

$34.27 |

$260.00 |

$171.3K |

662 |

100 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with mid-60s market share in 2024. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public in Taiwan in 1994 and as an ADR in the US in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious base of customers, including Apple, AMD, and Nvidia, that look to apply its cutting-edge process technologies to their semiconductor designs. TSMC employs more than 83,000 people.

Having examined the options trading patterns of Taiwan Semiconductor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Taiwan Semiconductor

- With a trading volume of 8,226,658, the price of TSM is down by -0.96%, reaching $279.3.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 58 days from now.

Expert Opinions on Taiwan Semiconductor

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $360.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $360.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Taiwan Semiconductor, Benzinga Pro gives you real-time options trades alerts.

Posted In: TSM