Looking At Rocket Lab's Recent Unusual Options Activity

Author: Benzinga Insights | November 18, 2025 03:01pm

Financial giants have made a conspicuous bullish move on Rocket Lab. Our analysis of options history for Rocket Lab (NASDAQ:RKLB) revealed 59 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 17 were puts, with a value of $1,496,676, and 42 were calls, valued at $3,018,928.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $110.0 for Rocket Lab over the recent three months.

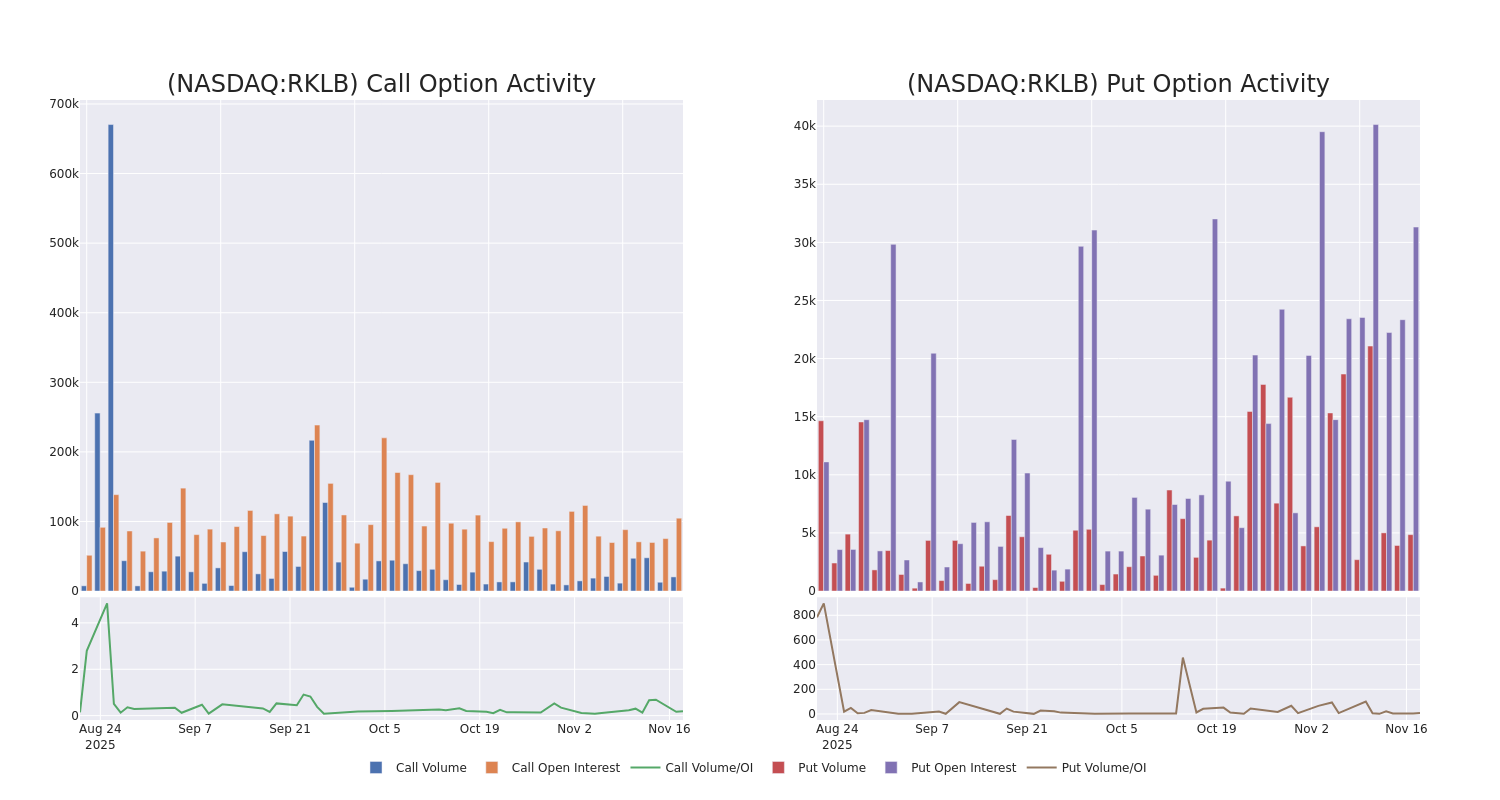

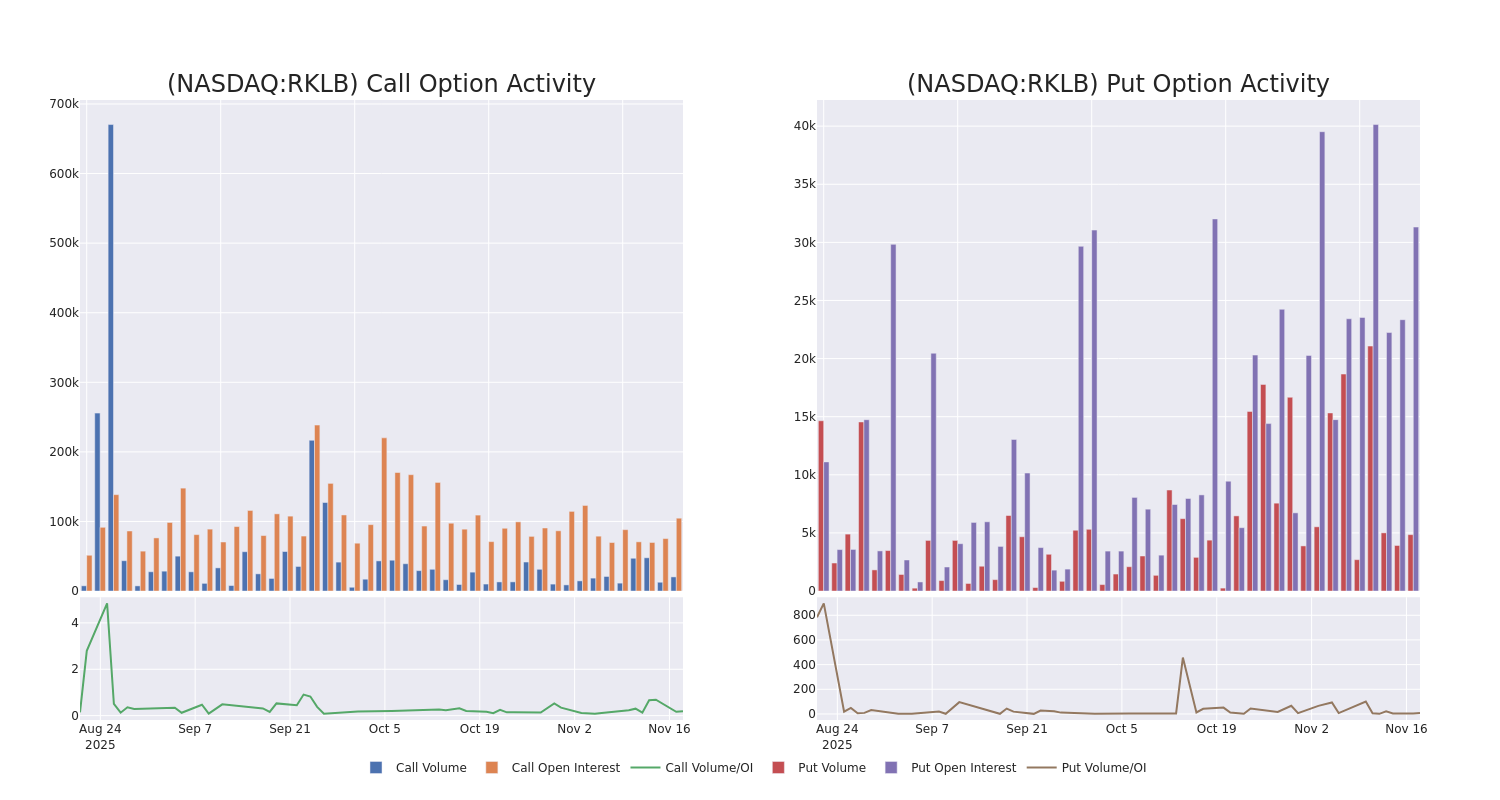

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Rocket Lab's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Rocket Lab's significant trades, within a strike price range of $15.0 to $110.0, over the past month.

Rocket Lab Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| RKLB |

PUT |

SWEEP |

BULLISH |

12/19/25 |

$6.6 |

$6.55 |

$6.56 |

$46.00 |

$327.7K |

965 |

78 |

| RKLB |

PUT |

TRADE |

BEARISH |

04/17/26 |

$6.9 |

$6.85 |

$6.9 |

$39.00 |

$318.0K |

127 |

513 |

| RKLB |

CALL |

SWEEP |

BULLISH |

01/21/28 |

$11.15 |

$10.85 |

$11.15 |

$110.00 |

$278.7K |

10.2K |

860 |

| RKLB |

CALL |

SWEEP |

BEARISH |

01/21/28 |

$10.65 |

$10.15 |

$10.56 |

$110.00 |

$264.3K |

10.2K |

359 |

| RKLB |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$11.8 |

$11.1 |

$11.8 |

$60.00 |

$236.0K |

2.3K |

264 |

About Rocket Lab

Rocket Lab Corp is engaged in space, building rockets, and spacecraft. It provides end-to-end mission services that provide frequent and reliable access to space for civil, defense, and commercial markets. It designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. Rocket Lab's Electron launch vehicle has delivered multiple satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The business operates in two segments Launch Services and Space Systems. Geographically it serves Japan, Germany, and rest of the world and earns key revenue from the United States.

Where Is Rocket Lab Standing Right Now?

- With a trading volume of 13,217,893, the price of RKLB is down by -0.02%, reaching $43.3.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 100 days from now.

What The Experts Say On Rocket Lab

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.33.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Stifel has revised its rating downward to Buy, adjusting the price target to $75.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Rocket Lab with a target price of $67.

* Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Rocket Lab with a target price of $63.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Rocket Lab options trades with real-time alerts from Benzinga Pro.

Posted In: RKLB