Boeing Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | November 19, 2025 11:01am

Whales with a lot of money to spend have taken a noticeably bearish stance on Boeing.

Looking at options history for Boeing (NYSE:BA) we detected 72 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 32 are puts, for a total amount of $4,873,855 and 40, calls, for a total amount of $3,656,105.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $300.0 for Boeing over the recent three months.

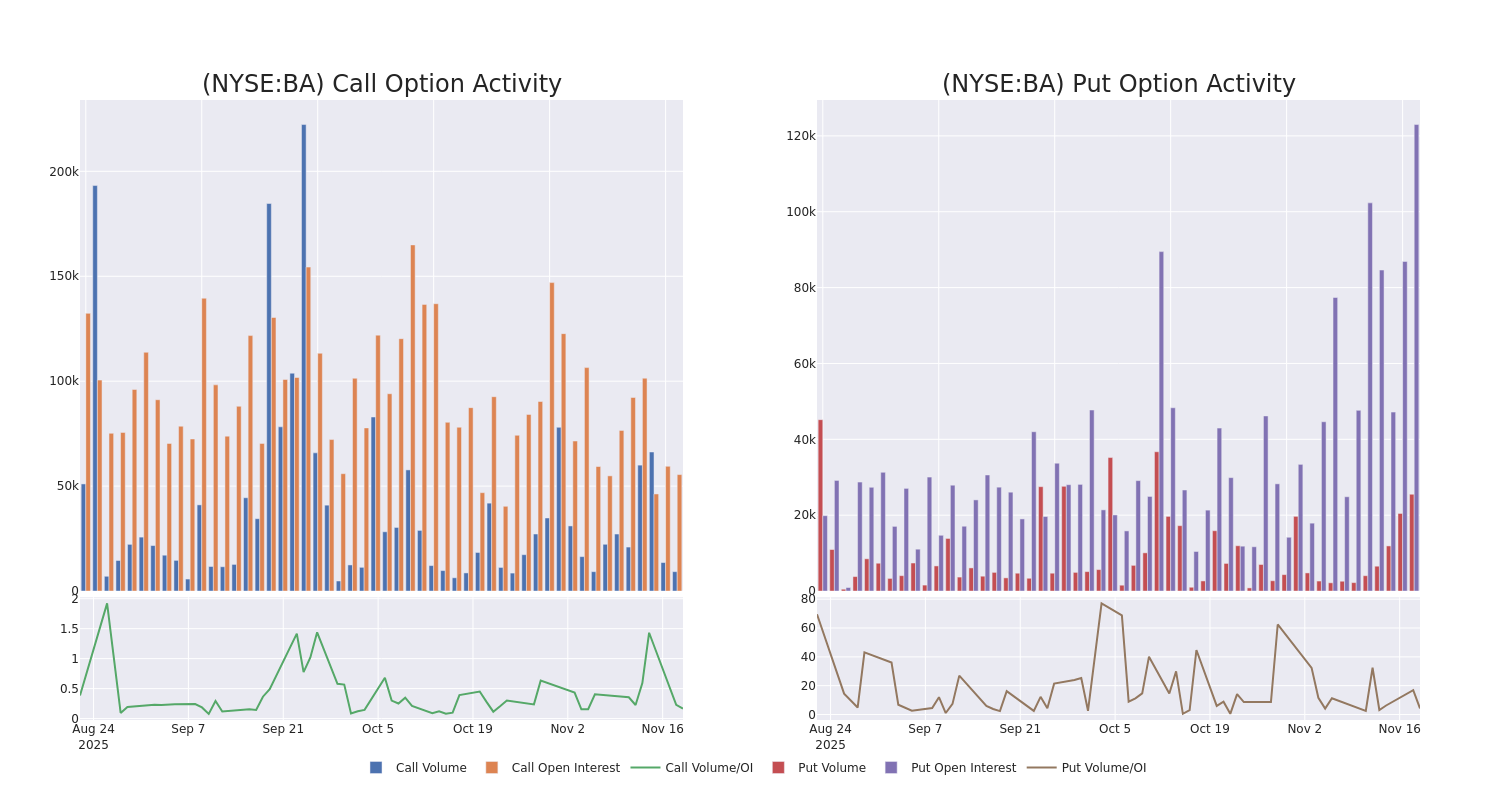

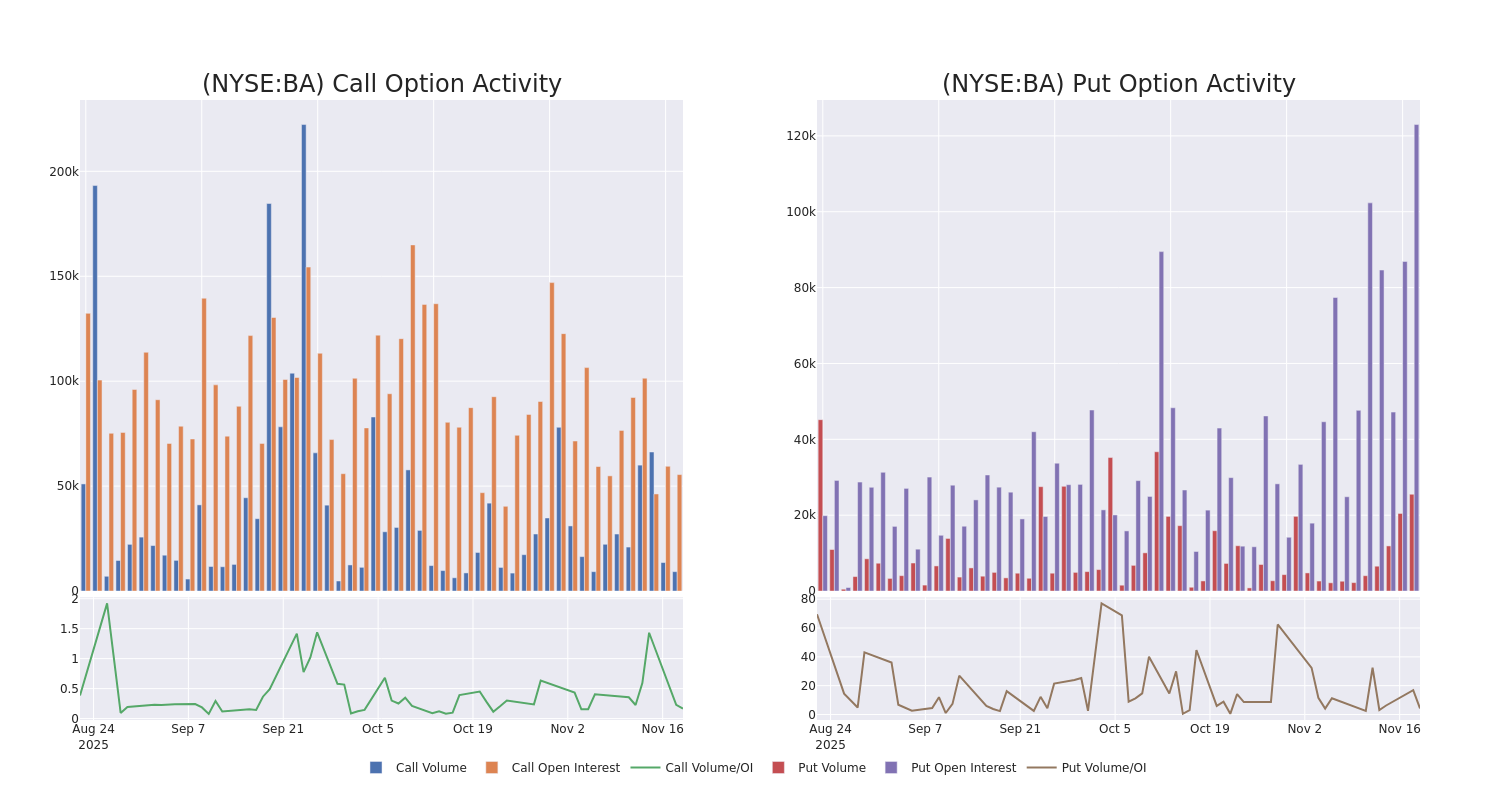

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Boeing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Boeing's substantial trades, within a strike price spectrum from $100.0 to $300.0 over the preceding 30 days.

Boeing Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BA |

PUT |

SWEEP |

NEUTRAL |

02/20/26 |

$11.2 |

$10.35 |

$10.87 |

$185.00 |

$489.6K |

6.9K |

459 |

| BA |

CALL |

TRADE |

BULLISH |

01/15/27 |

$37.9 |

$35.8 |

$37.16 |

$175.00 |

$464.5K |

710 |

125 |

| BA |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$45.5 |

$43.5 |

$44.5 |

$230.00 |

$445.0K |

1.6K |

144 |

| BA |

PUT |

TRADE |

BEARISH |

01/16/26 |

$30.0 |

$29.5 |

$29.95 |

$215.00 |

$374.3K |

2.2K |

126 |

| BA |

PUT |

TRADE |

NEUTRAL |

01/16/26 |

$3.25 |

$2.95 |

$3.08 |

$170.00 |

$369.6K |

5.5K |

1.2K |

About Boeing

Boeing is a major aerospace and defense firm operating in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with defense contractors such as Lockheed Martin and Northrop Grumman to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

Having examined the options trading patterns of Boeing, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Boeing

- Currently trading with a volume of 3,578,482, the BA's price is down by -2.4%, now at $185.07.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 69 days.

Professional Analyst Ratings for Boeing

4 market experts have recently issued ratings for this stock, with a consensus target price of $248.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Boeing, maintaining a target price of $240.

* Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Boeing, targeting a price of $255.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Boeing with a target price of $275.

* In a positive move, an analyst from Freedom Capital Markets has upgraded their rating to Buy and adjusted the price target to $223.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Boeing options trades with real-time alerts from Benzinga Pro.

Posted In: BA