Behind the Scenes of Micron Technology's Latest Options Trends

Author: Benzinga Insights | November 20, 2025 10:03am

Financial giants have made a conspicuous bearish move on Micron Technology. Our analysis of options history for Micron Technology (NASDAQ:MU) revealed 50 unusual trades.

Delving into the details, we found 34% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 22 were puts, with a value of $2,146,894, and 28 were calls, valued at $2,535,833.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $310.0 for Micron Technology over the last 3 months.

Analyzing Volume & Open Interest

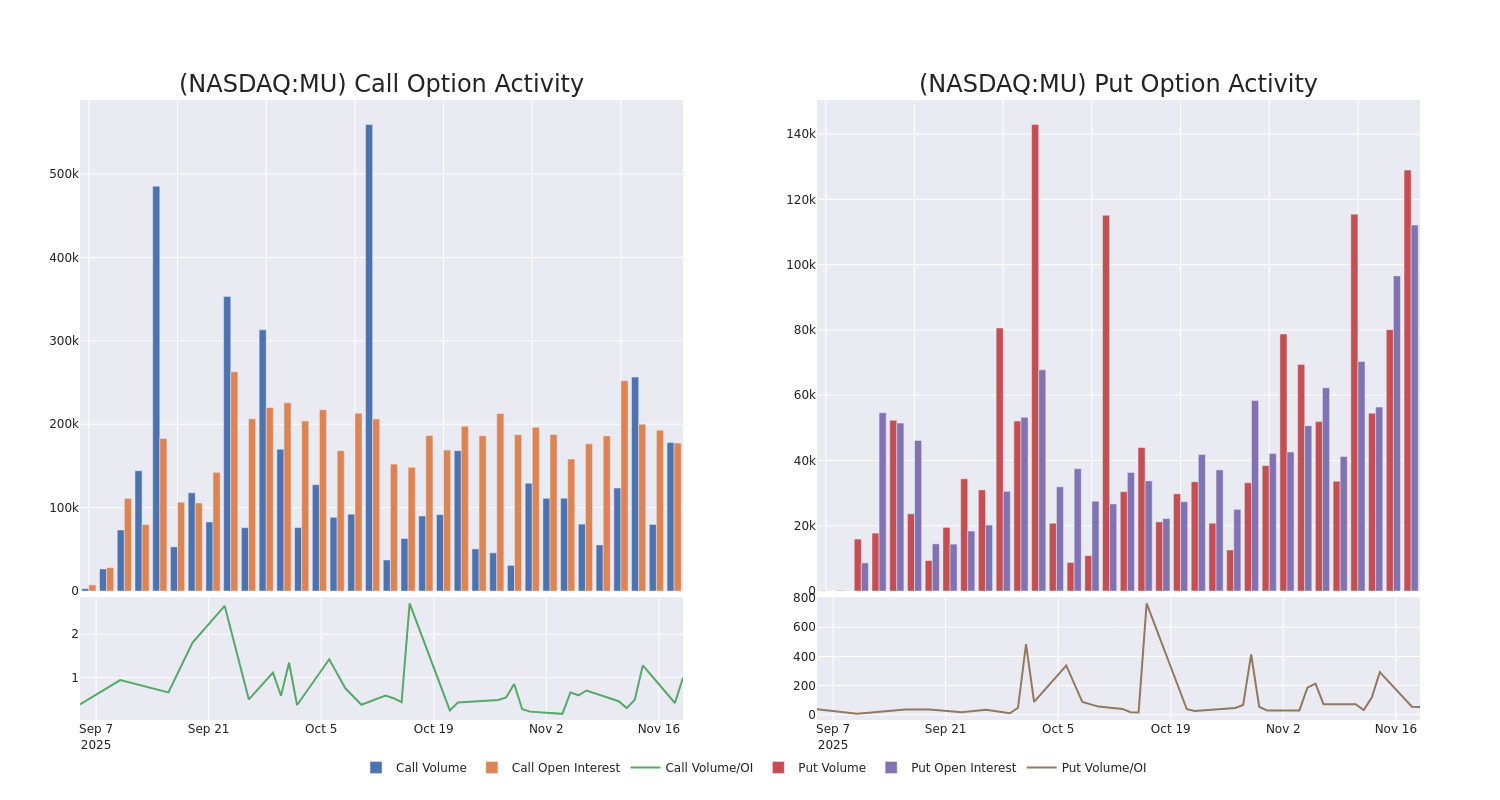

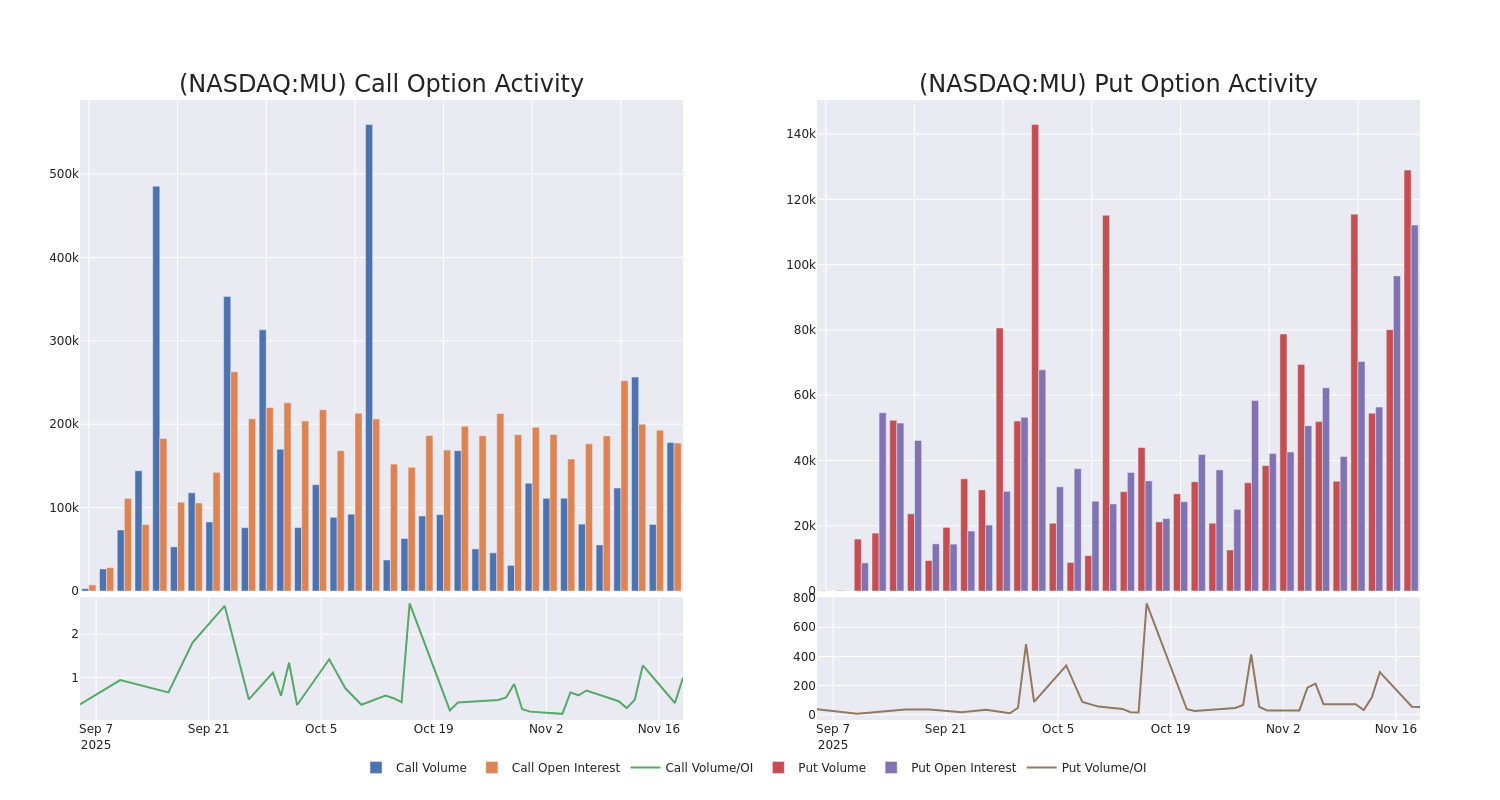

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Micron Technology's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Micron Technology's substantial trades, within a strike price spectrum from $155.0 to $310.0 over the preceding 30 days.

Micron Technology Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MU |

CALL |

SWEEP |

BULLISH |

12/19/25 |

$8.75 |

$8.7 |

$8.75 |

$260.00 |

$799.5K |

3.2K |

16 |

| MU |

CALL |

TRADE |

BEARISH |

04/17/26 |

$30.55 |

$29.55 |

$29.55 |

$260.00 |

$260.0K |

699 |

88 |

| MU |

PUT |

SWEEP |

BEARISH |

01/16/26 |

$84.65 |

$83.25 |

$84.65 |

$310.00 |

$228.5K |

9 |

53 |

| MU |

CALL |

TRADE |

BEARISH |

12/18/26 |

$58.7 |

$55.6 |

$56.77 |

$250.00 |

$227.0K |

1.2K |

40 |

| MU |

PUT |

SWEEP |

BEARISH |

11/28/25 |

$8.25 |

$7.5 |

$8.25 |

$222.50 |

$226.0K |

426 |

109 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Having examined the options trading patterns of Micron Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Micron Technology

- With a volume of 6,337,874, the price of MU is down -1.83% at $221.79.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 27 days.

What The Experts Say On Micron Technology

5 market experts have recently issued ratings for this stock, with a consensus target price of $293.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Micron Technology with a target price of $300.

* An analyst from Mizuho has decided to maintain their Outperform rating on Micron Technology, which currently sits at a price target of $265.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Micron Technology with a target price of $275.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Micron Technology, targeting a price of $325.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Micron Technology, targeting a price of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

Posted In: MU