DoorDash's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | November 20, 2025 12:01pm

Financial giants have made a conspicuous bearish move on DoorDash. Our analysis of options history for DoorDash (NASDAQ:DASH) revealed 24 unusual trades.

Delving into the details, we found 29% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 19 were puts, with a value of $2,052,198, and 5 were calls, valued at $897,436.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $270.0 for DoorDash over the last 3 months.

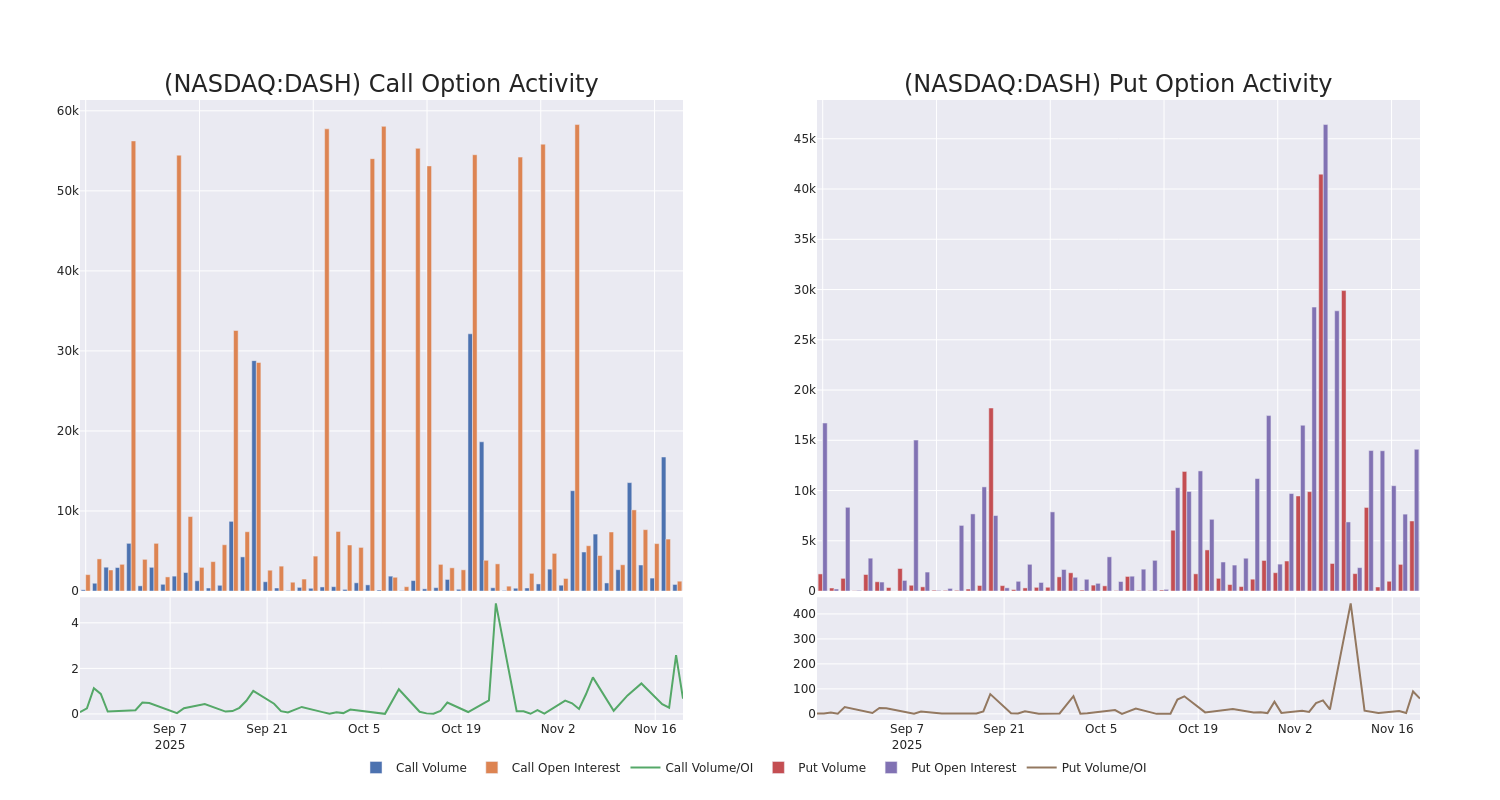

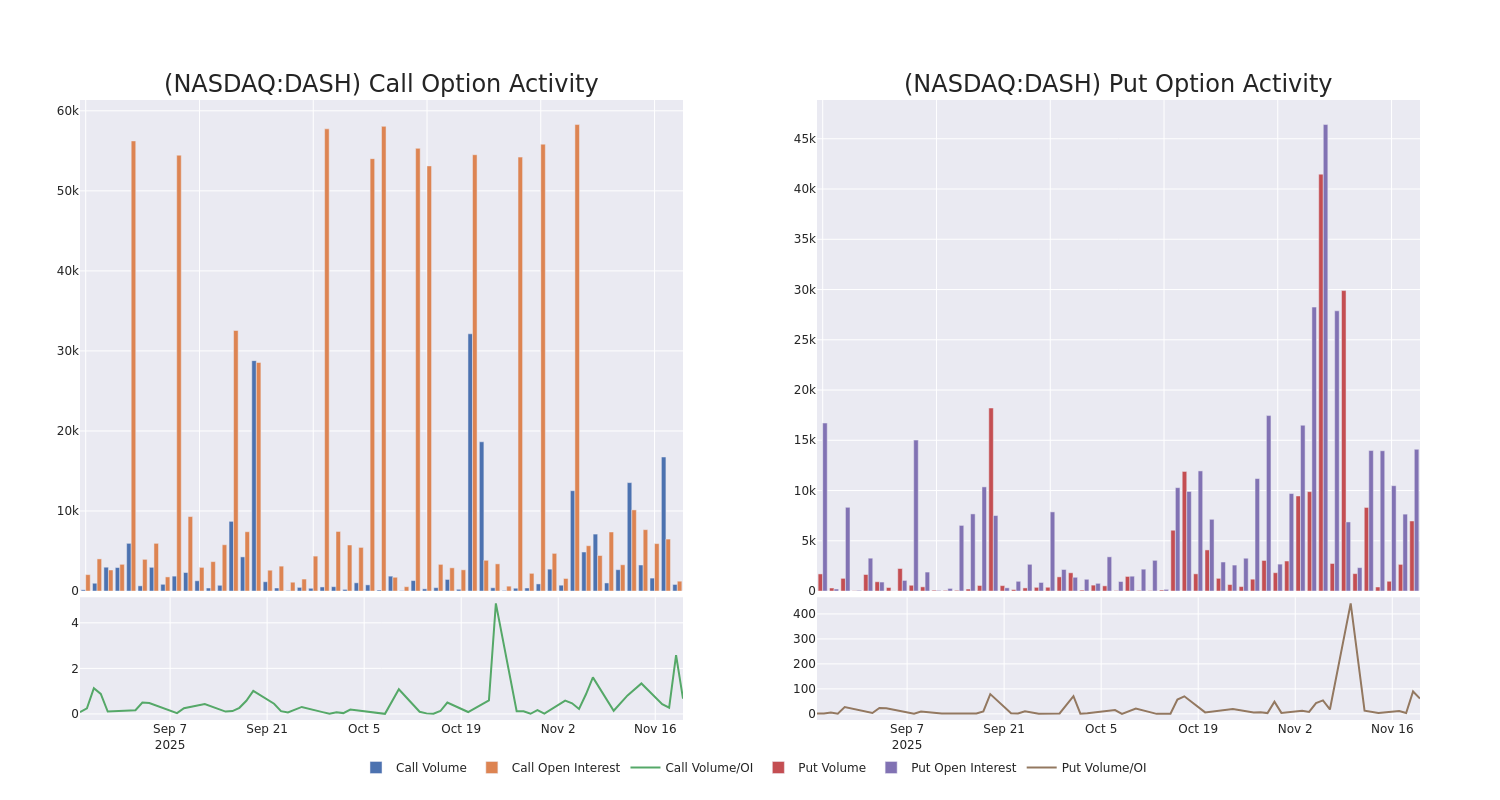

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for DoorDash's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across DoorDash's significant trades, within a strike price range of $180.0 to $270.0, over the past month.

DoorDash Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DASH |

CALL |

SWEEP |

NEUTRAL |

01/02/26 |

$13.2 |

$10.5 |

$11.84 |

$200.00 |

$528.7K |

2 |

450 |

| DASH |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$42.2 |

$39.35 |

$39.81 |

$240.00 |

$398.6K |

6.8K |

0 |

| DASH |

PUT |

SWEEP |

BEARISH |

12/05/25 |

$5.65 |

$5.1 |

$5.65 |

$190.00 |

$282.5K |

83 |

2.5K |

| DASH |

CALL |

TRADE |

BEARISH |

06/18/26 |

$9.6 |

$8.4 |

$8.7 |

$270.00 |

$261.0K |

144 |

300 |

| DASH |

PUT |

SWEEP |

BEARISH |

12/05/25 |

$5.0 |

$4.8 |

$5.0 |

$190.00 |

$250.0K |

83 |

1.5K |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online delivery demand aggregator. Consumers can use its app to order food items on-demand for delivery or in-store from merchants. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe and Asia. DoorDash creates a marketplace for merchants to establish a presence online, market their offerings, and meet demand through delivery. The firm provides similar service to nonrestaurant businesses, such as grocery, retail, and pet supplies. Dash is also rolling out nascent technology like drone delivery in an effort to continually innovate and provide the best possible service to supply-side and demand-side contingents of its marketplace.

Following our analysis of the options activities associated with DoorDash, we pivot to a closer look at the company's own performance.

DoorDash's Current Market Status

- Currently trading with a volume of 5,075,807, the DASH's price is down by -4.26%, now at $193.7.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 82 days.

What The Experts Say On DoorDash

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $269.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Barclays persists with their Equal-Weight rating on DoorDash, maintaining a target price of $238.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on DoorDash with a target price of $241.

* An analyst from Needham persists with their Buy rating on DoorDash, maintaining a target price of $275.

* An analyst from Stifel has decided to maintain their Hold rating on DoorDash, which currently sits at a price target of $253.

* An analyst from Truist Securities persists with their Buy rating on DoorDash, maintaining a target price of $340.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DoorDash options trades with real-time alerts from Benzinga Pro.

Posted In: DASH