Verizon Communications's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | November 20, 2025 03:02pm

Investors with a lot of money to spend have taken a bullish stance on Verizon Communications (NYSE:VZ).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VZ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 12 uncommon options trades for Verizon Communications.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 25%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $137,341, and 8 are calls, for a total amount of $503,860.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $32.0 to $50.0 for Verizon Communications over the last 3 months.

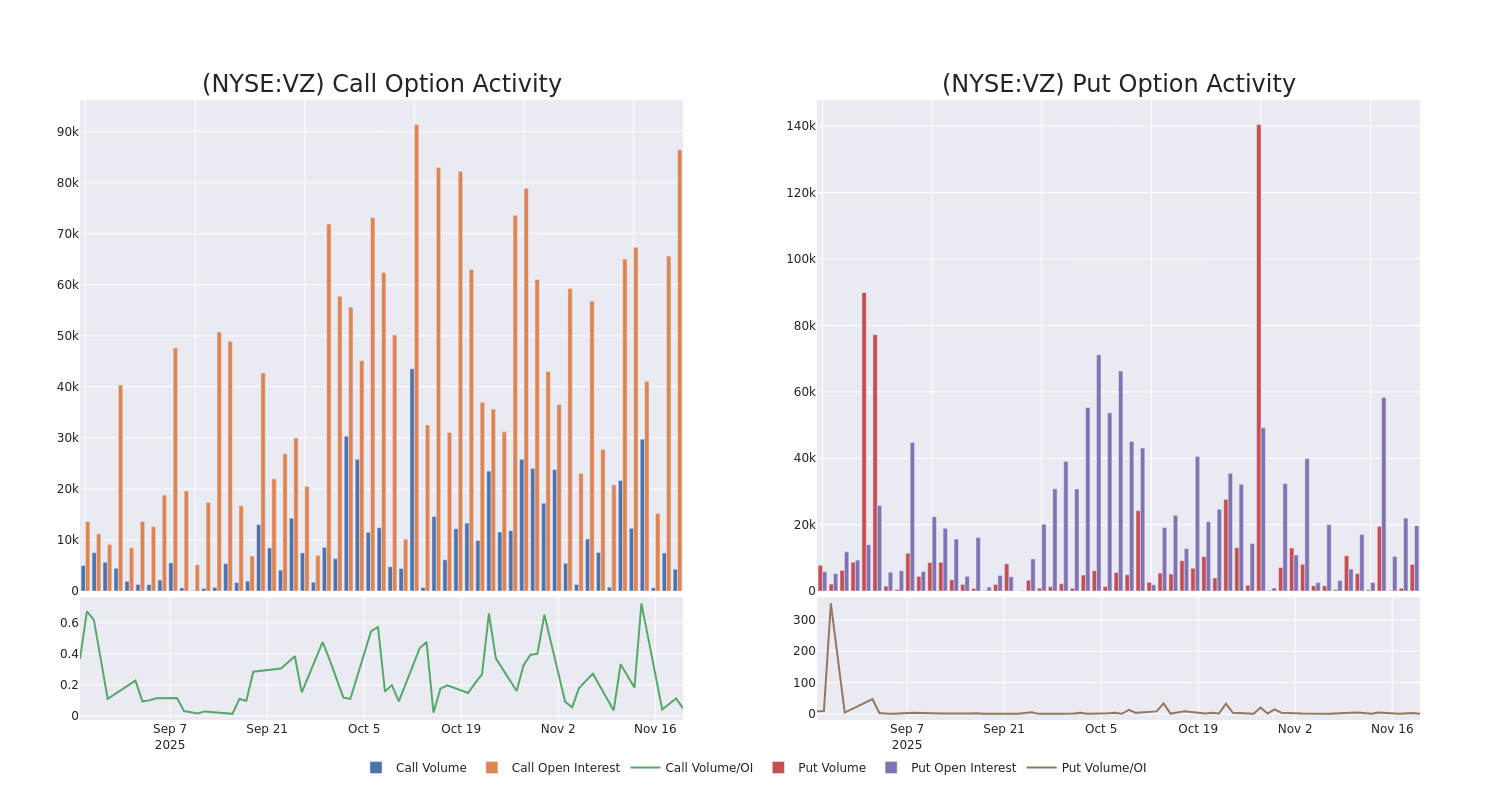

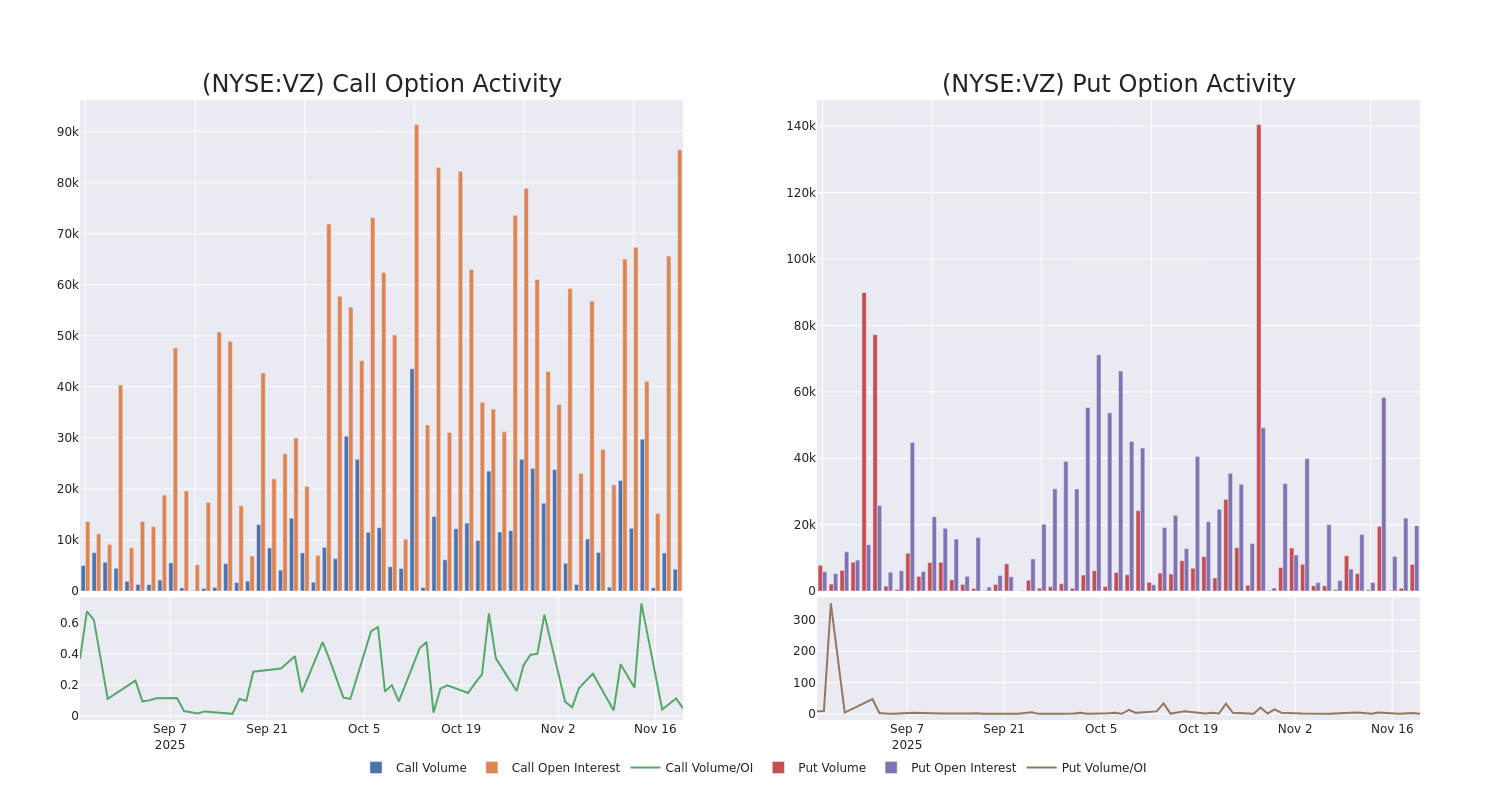

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Verizon Communications's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Verizon Communications's substantial trades, within a strike price spectrum from $32.0 to $50.0 over the preceding 30 days.

Verizon Communications Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VZ |

CALL |

TRADE |

BULLISH |

01/16/26 |

$2.19 |

$2.0 |

$2.15 |

$40.00 |

$215.0K |

17.8K |

142 |

| VZ |

CALL |

SWEEP |

BEARISH |

12/05/25 |

$9.55 |

$9.05 |

$9.24 |

$32.00 |

$54.2K |

161 |

113 |

| VZ |

CALL |

TRADE |

NEUTRAL |

01/15/27 |

$2.03 |

$1.87 |

$1.94 |

$45.00 |

$54.1K |

37.7K |

325 |

| VZ |

CALL |

TRADE |

BULLISH |

06/18/26 |

$0.39 |

$0.36 |

$0.38 |

$50.00 |

$44.7K |

10.0K |

1.2K |

| VZ |

PUT |

SWEEP |

BULLISH |

12/19/25 |

$0.25 |

$0.24 |

$0.24 |

$39.00 |

$44.4K |

15.9K |

111 |

About Verizon Communications

Wireless services account for 75% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast that reach about 30 million homes and businesses, including about 20 million with the Fios fiber optic network. These networks serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks. Verizon agreed to acquire Frontier Communications in September 2024.

Having examined the options trading patterns of Verizon Communications, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Verizon Communications Standing Right Now?

- Currently trading with a volume of 18,208,579, the VZ's price is down by -0.1%, now at $41.15.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 64 days.

What Analysts Are Saying About Verizon Communications

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $48.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Scotiabank has decided to maintain their Sector Perform rating on Verizon Communications, which currently sits at a price target of $51.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Verizon Communications with a target price of $44.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Verizon Communications with a target price of $47.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Verizon Communications with a target price of $51.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Verizon Communications with Benzinga Pro for real-time alerts.

Posted In: VZ