Unpacking the Latest Options Trading Trends in Carvana

Author: Benzinga Insights | November 21, 2025 12:01pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Carvana.

Looking at options history for Carvana (NYSE:CVNA) we detected 44 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 28 are puts, for a total amount of $1,596,875 and 16, calls, for a total amount of $781,486.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $610.0 for Carvana over the recent three months.

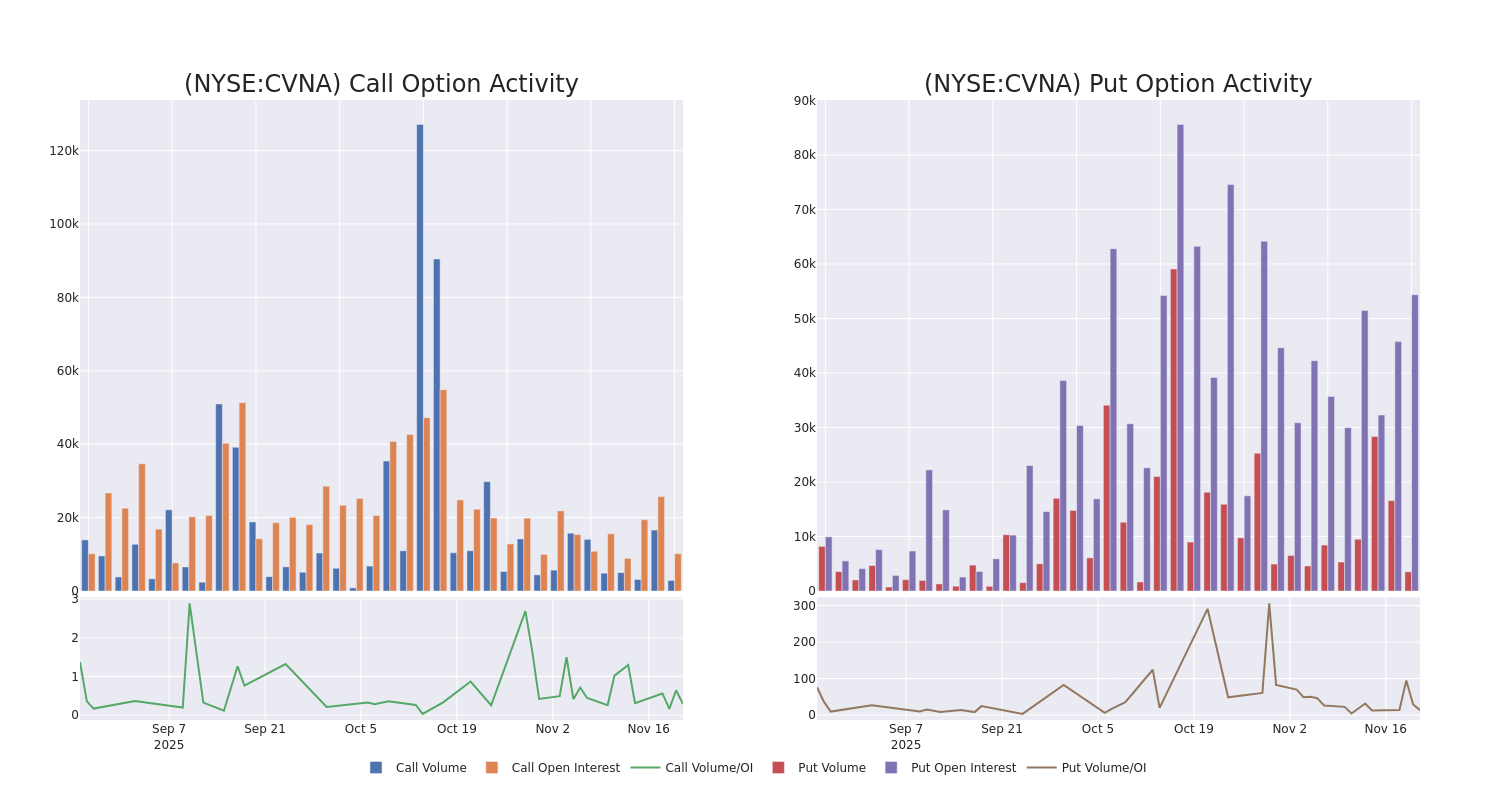

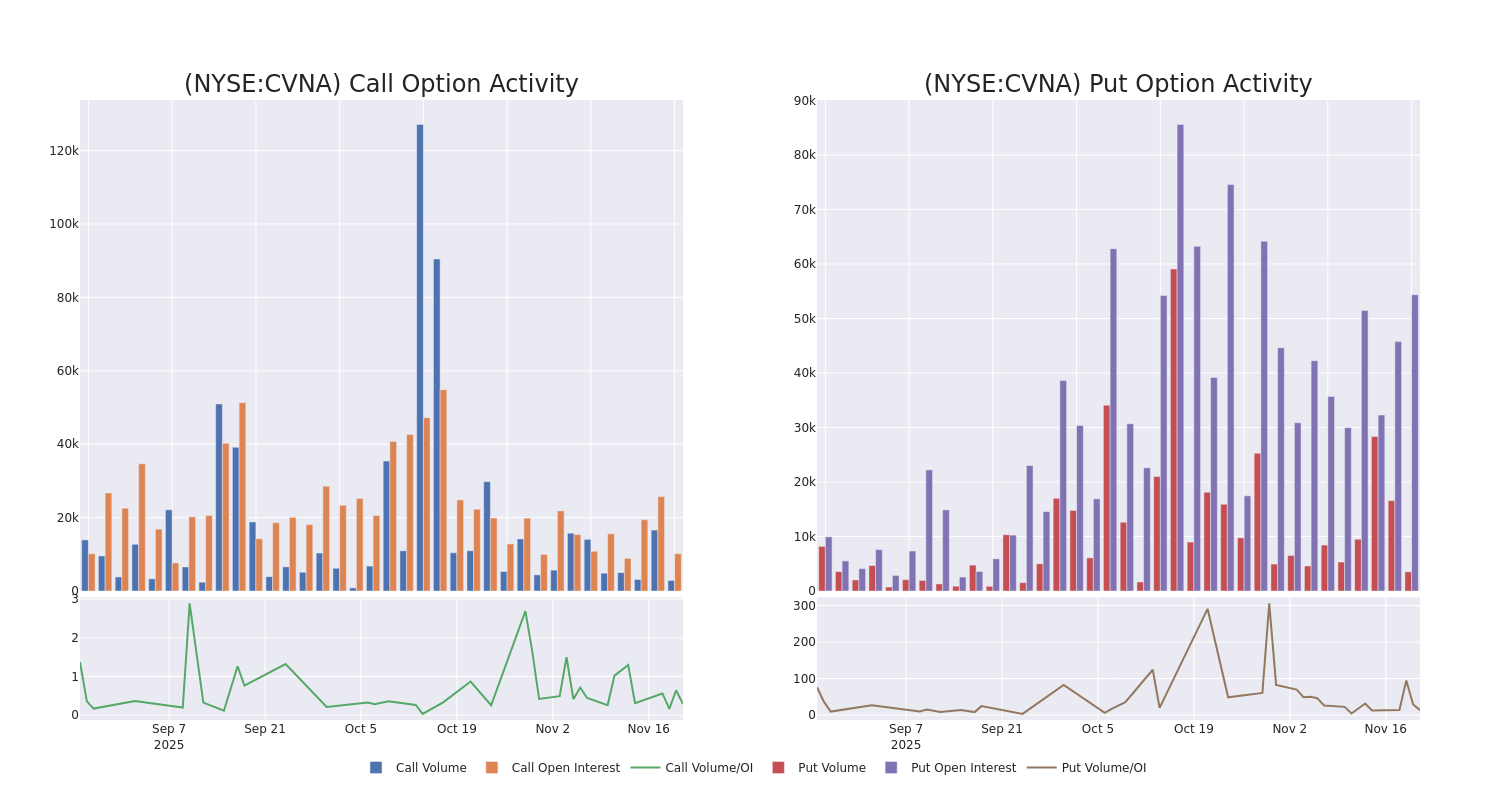

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Carvana's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Carvana's substantial trades, within a strike price spectrum from $200.0 to $610.0 over the preceding 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CVNA |

PUT |

TRADE |

BULLISH |

02/20/26 |

$48.0 |

$44.55 |

$45.8 |

$330.00 |

$229.0K |

89 |

50 |

| CVNA |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$14.85 |

$14.5 |

$14.85 |

$300.00 |

$147.0K |

3.1K |

591 |

| CVNA |

CALL |

TRADE |

BULLISH |

12/19/25 |

$1.37 |

$0.94 |

$1.2 |

$420.00 |

$120.0K |

3.1K |

1.0K |

| CVNA |

CALL |

SWEEP |

BULLISH |

06/17/27 |

$106.75 |

$104.95 |

$106.68 |

$310.00 |

$106.7K |

5 |

11 |

| CVNA |

PUT |

TRADE |

BULLISH |

01/16/26 |

$36.6 |

$35.45 |

$35.45 |

$320.00 |

$106.3K |

872 |

118 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

After a thorough review of the options trading surrounding Carvana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Carvana Standing Right Now?

- Trading volume stands at 928,973, with CVNA's price up by 1.68%, positioned at $318.5.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 89 days.

What The Experts Say On Carvana

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $424.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Carvana, targeting a price of $450.

* An analyst from Evercore ISI Group persists with their In-Line rating on Carvana, maintaining a target price of $395.

* In a cautious move, an analyst from Barclays downgraded its rating to Overweight, setting a price target of $390.

* An analyst from Needham downgraded its action to Buy with a price target of $500.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Carvana, targeting a price of $385.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carvana options trades with real-time alerts from Benzinga Pro.

Posted In: CVNA