Behind the Scenes of Starbucks's Latest Options Trends

Author: Benzinga Insights | December 01, 2025 02:01pm

Deep-pocketed investors have adopted a bearish approach towards Starbucks (NASDAQ:SBUX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SBUX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 25 extraordinary options activities for Starbucks. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 24% leaning bullish and 48% bearish. Among these notable options, 6 are puts, totaling $400,642, and 19 are calls, amounting to $961,040.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $90.0 for Starbucks over the recent three months.

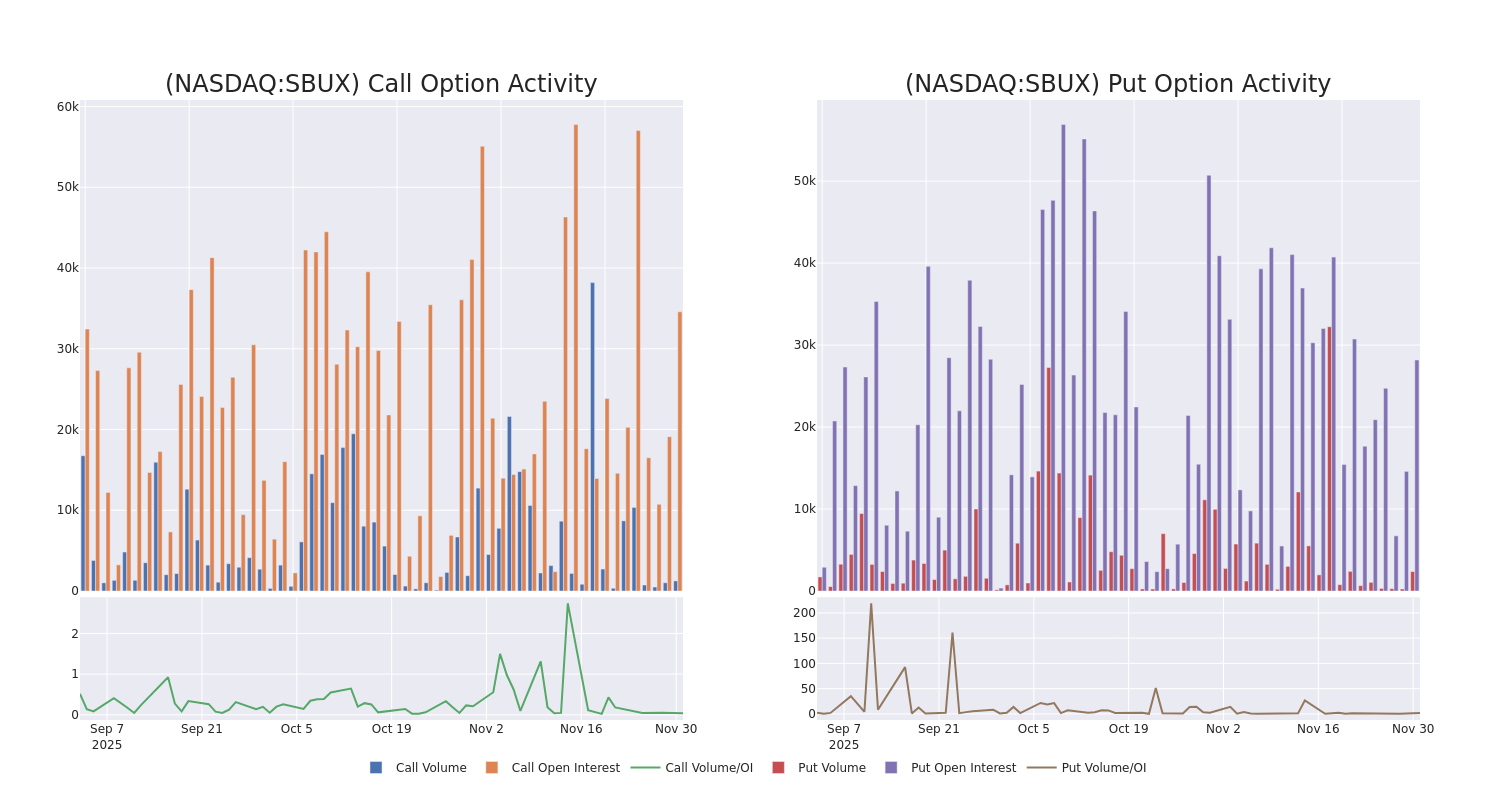

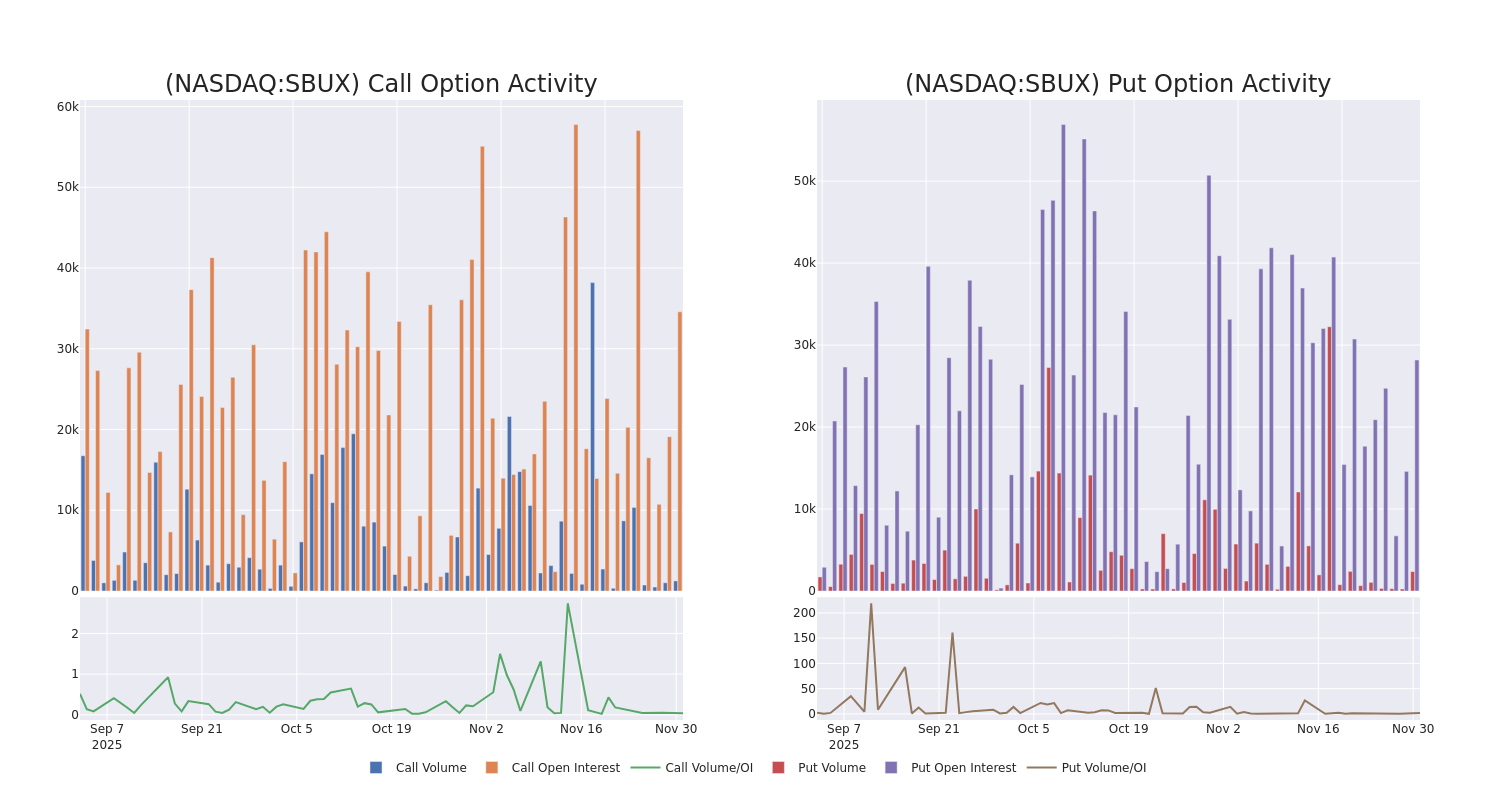

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Starbucks options trades today is 3923.06 with a total volume of 3,632.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Starbucks's big money trades within a strike price range of $45.0 to $90.0 over the last 30 days.

Starbucks Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SBUX |

PUT |

TRADE |

BEARISH |

06/18/26 |

$6.1 |

$5.1 |

$5.71 |

$80.00 |

$199.8K |

2.9K |

350 |

| SBUX |

CALL |

TRADE |

BEARISH |

12/18/26 |

$13.3 |

$12.3 |

$12.55 |

$85.00 |

$181.9K |

734 |

145 |

| SBUX |

CALL |

TRADE |

BEARISH |

12/18/26 |

$10.6 |

$10.1 |

$10.3 |

$90.00 |

$130.8K |

1.1K |

127 |

| SBUX |

CALL |

TRADE |

BULLISH |

01/16/26 |

$3.8 |

$3.7 |

$3.8 |

$85.00 |

$114.7K |

7.8K |

358 |

| SBUX |

PUT |

SWEEP |

BULLISH |

03/20/26 |

$8.65 |

$8.5 |

$8.5 |

$90.00 |

$85.0K |

1.3K |

115 |

About Starbucks

Starbucks stands out as the world's biggest and most recognizable coffee brand, powered by ultracustomizable beverages in-store and a sweeping footprint of nearly 41,000 cafes in over 80 countries. About 52% are company-operated, with the balance run by licensees. The company operates roasteries and sells across its North America (74% of revenue as of the end of fiscal 2025), international (21%), and channel development (5%) segments. The brand collects revenue from company-operated stores, licensee royalties, equipment and product sales, retail ready-to-drink beverages, and packaged coffee.

Following our analysis of the options activities associated with Starbucks, we pivot to a closer look at the company's own performance.

Where Is Starbucks Standing Right Now?

- Trading volume stands at 4,519,238, with SBUX's price down by -1.15%, positioned at $86.11.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 57 days.

Professional Analyst Ratings for Starbucks

In the last month, 2 experts released ratings on this stock with an average target price of $94.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from TD Cowen downgraded its rating to Hold, setting a price target of $84.

* Reflecting concerns, an analyst from BTIG lowers its rating to Buy with a new price target of $105.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Starbucks options trades with real-time alerts from Benzinga Pro.

Posted In: SBUX